Security of Supply in Times of Geo-economic Fragmentation

Enhancing the External Dimension of the EU’s Raw Materials Policy

SWP Comment 2024/C 15, 17.04.2024, 8 Seitendoi:10.18449/2024C15

ForschungsgebieteThe recent political consensus on the European Critical Raw Materials Act (CRMA) marks a significant step towards a common raw materials policy within the European Union (EU). Against the backdrop of increasing geopolitical tensions, the EU aims to bolster its “strategic autonomy” within its raw material supply chains. To achieve this goal, it is essential for the EU and its member states to enhance collaboration with mineral-rich third countries. The current geopolitical environment will require a concerted effort on the part of the EU with respect to its raw material diplomacy, as only through such effective engagement will the EU be able to diplomatically and programmatically implement raw material partnerships that appeal to third countries.

Minerals are the basis of almost all industrial value chains, and therefore, they are of great strategic importance to the European economy. As the EU needs to import the vast majority of these raw materials, it currently faces tremendous challenges stemming from, on the one hand, increasing demand driven by the need to produce green and digital technologies, and on the other hand, limited non-EU suppliers of these raw materials, which has resulted in pronounced dependencies on a select few, particularly China.

In Europe, the Russian invasion of Ukraine and the resultant disruption to Russian gas supply has sharpened awareness of risks associated with supply chain dependencies. There is growing concern that trade may increasingly be used as political leverage. Against this backdrop, the EU is aiming to strengthen its economic “strategic autonomy”. Consequently, the European Green Deal, which was implemented in 2021, foresees a dual transformation, in that the EU will become a green and digital economic hub while simultaneously improving its economic resilience through the reduction of critical (import) dependencies in strategic sectors, including the raw materials sector.

The EU’s CRMA: creating resilient mineral supply chains

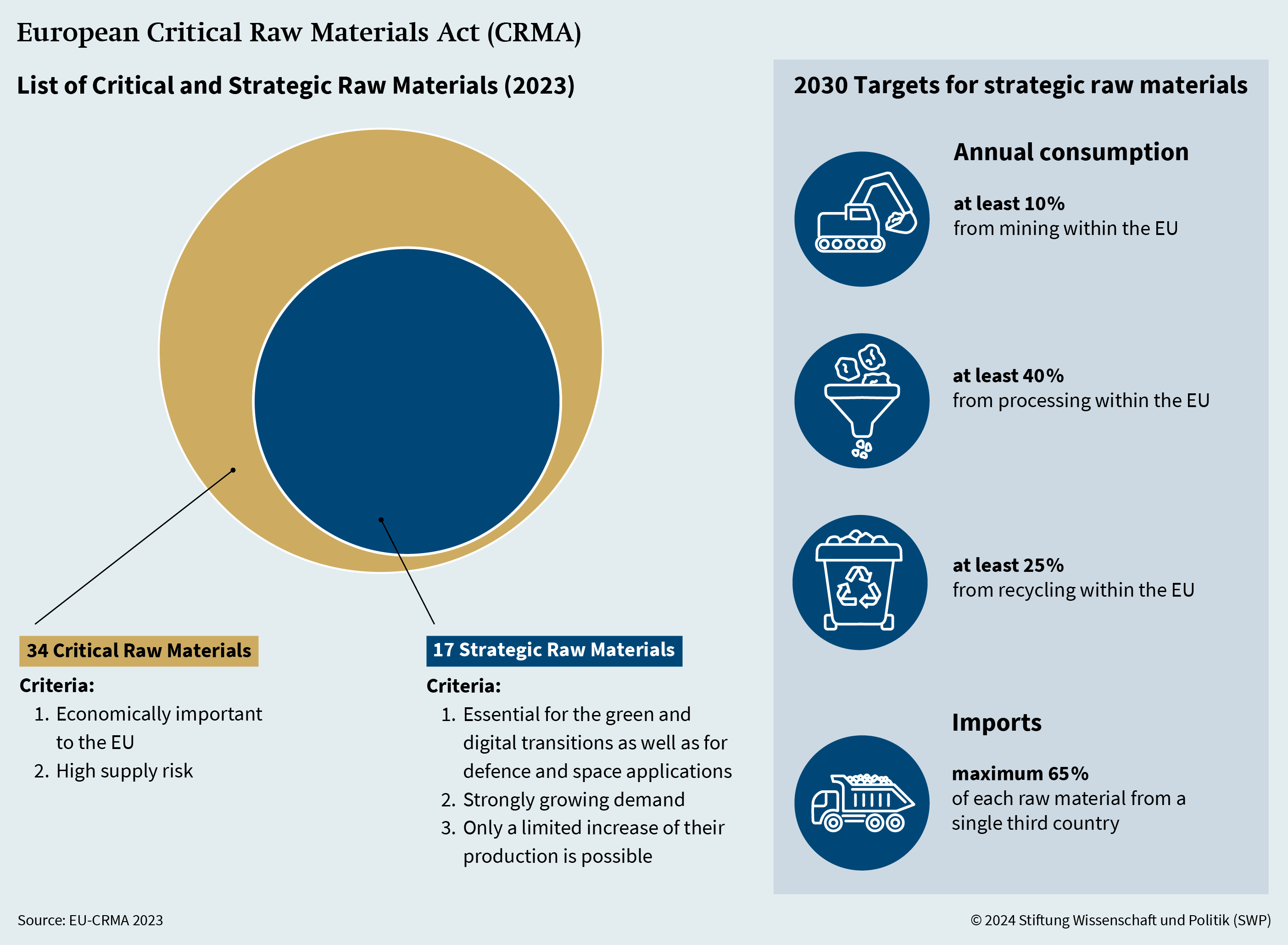

In March 2023, the European Commission introduced a proposal for the Critical Raw Materials Act (CRMA), which aims to ensure that European industries have a resilient and sustainable supply of critical raw materials. The Act received broad political backing and will soon come into force. The introduction of the CRMA strengthens the EU’s role in raw material policy – a domain that had previously primarily fallen under the purview of member states. Under the Act, the European Commission will now lead the European Critical Raw Materials Board (CRM-Board), which will oversee and coordinate the implementation of the CRMA in cooperation with member state representatives. Engagement will be based on the list of critical raw materials that is set to be updated every three years. The last update in 2023 identified 34 critical raw materials. The Act focuses on a subgroup of strategic raw materials (currently numbering 17) that are of significant importance for the EU and exhibit very high supply risks. Concrete targets for 2030 include firstly, increasing Europe’s capacity to mine, process, and recycle these strategic raw materials, and secondly, diversifying the sources from which they are imported (see Figure 1).

Expanding European capacities: The 2030 target is tight, as the time between exploration to operation of mining projects averages over 15 years. The creation and expansion of processing and recycling capacities will also require enormous effort. In this context, the promotion of strategic projects will be all the more important; they will be selected by the CRM-Board and are planned to benefit from accelerated approvals as well as financing opportunities. It should be noted that the CRMA itself does not contain any new direct investments, therefore industry representatives have expressed concerns about the feasibility of implementing a sufficient number of new projects. Still, even if European capacities are rapidly expanded, the EU will never achieve complete autonomy because many critical raw material deposits are absent or insufficient in the EU, such as nickel and cobalt – which are essential for the production of batteries.

Diversifying imports: Third countries will remain the EU’s primary source of minerals for the foreseeable future. Therefore, diversifying sources of supply is a central objective of the EU’s raw material strategy. The CRMA stipulates that no more than 65 percent of any one strategic raw material should be imported from any single third country. This is particularly significant in view of China’s dominant position in transnational supply chains. China is the EU’s main supplier of most raw mineral materials, including over 90 percent of its rare earths, gallium, and magnesium. When it comes to processing, European dependency is particularly pronounced. For example, China currently controls over 50 percent of the global capacity to produce refined lithium and cobalt.

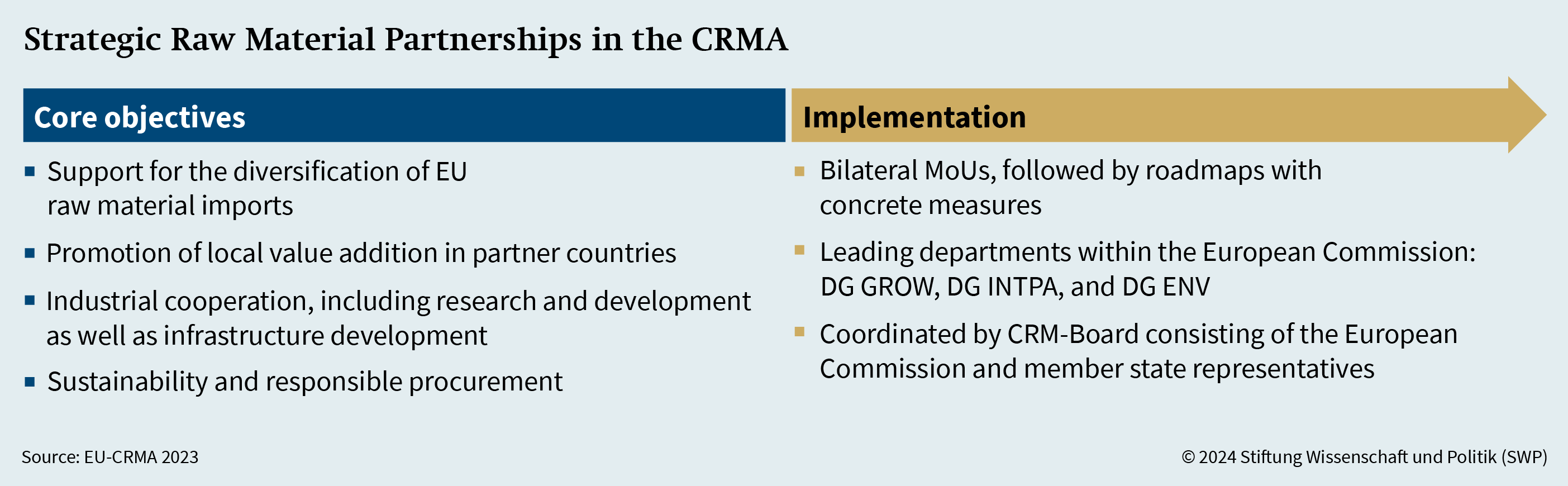

To achieve its diversification goals, the EU must intensify its cooperation with mineral-rich countries. To this end, the CRMA envisages the establishment of strategic partnerships related to raw materials. Since 2021, the European Commission has already initiated twelve such partnerships and counting. In addition to industrialised mining countries such as Canada, these partners also include numerous countries from the so-called “Global South”.

Most of these partnerships are laid out in concise Memoranda of Understanding (MoUs) founded on the mutual interest to cooperate in the raw material sector. Nonetheless, these collaborations now require further concrete delineation. To this end, the EU plans to develop joint roadmaps that provide partner countries the opportunity to contribute their own priorities and to actively participate in shaping the agenda, thus creating a win-win situation. This will be quite ambitious considering that resource-rich countries are making concrete demands for domestic value creation.

Core objectives and key implementing elements within the strategic raw material partnership framework can be found in Figure 2.

Geo-economic context of the EU’s raw material strategy

In order to be perceived as a credible partner in the raw materials sector, the EU and its member states must adapt their offers to be in line with a coherent raw material foreign policy. So far, the EU has been unable to effectively position its offers to resource-rich countries vis-à-vis established actors such as China. If anything, the EU is perceived as a part of US-led initiatives.

Furthermore, many partner countries remain sceptical of Europe’s promises to cooperate. This is due in part to the earlier reluctance of European companies to invest in the raw materials sector and also because of significant power asymmetries in the value chain. This scepticism is reinforced by European policies on subsidising domestic industry and the introduction of unilateral sustainability standards such as the Carbon Border Adjustment Mechanism (CBAM), which are often perceived as a form of European protectionism.

Mineral-rich countries demand added value

Local value addition is a core concern for mineral-rich countries. Amidst the increasing global demand for mineral resources, these countries are looking for partners that address the risks of resource extraction and support local industrial policy goals.

Indonesia’s strategic approach serves as a model for many mineral-rich countries. Beginning in 2014, the Indonesian government implemented export bans on unprocessed raw materials, including nickel, a key component in the steel and battery industries. Undergoing a trade conflict with the EU, Indonesia succeeded in promoting local processing and achieved higher profits from its exports. Currently, international investors are working with Indonesia to localise battery production.

Many mineral-rich countries in the Global South either have, or are pursuing industrial policy interventions aimed at increasing local value addition. The strategies and measures vary significantly depending on the raw material at hand and the local and regional context. Many states are striving to link resource extraction with various steps in upstream and downstream production, but this is contingent on certain requirements such as the country’s energy and transport infrastructure or the availability of qualified workers. Governments’ capabilities for industrial policy planning vary widely, as do capacities for implementation.

Essentially, there are two groups of mineral-rich countries demanding to be integrated into supply chains and add value to local production: The first group can be seen as the so-called “Middle Powers” comprising mineral-rich emerging countries such as Indonesia, Argentina, Chile, Brazil, and South Africa. These countries have not only established themselves as raw material producers but also play a significant role in the global raw materials market because they are (potential) centres for the processing of raw materials from neighbouring countries. This is facilitated by the fact that they host a handful of transnationally operating mining companies, including state-owned ventures such as Codelco (Chile) and private corporations such as Anglo American (South Africa). They present themselves confidently on the international stage and link raw material cooperation with other foreign and trade policy issues. Some of these countries openly question Western dominance in the global economy while simultaneously seeking to reduce their own dependencies – including on China. Therefore, they often find greater access to the European internal market attractive. However, they demand more involvement in shaping the future of cooperation, trade, and investment formats.

The second group consists of various smaller economies with strategic mineral resources, such as Zambia, the Democratic Republic of Congo (DRC), Namibia, and Uzbekistan. For these states, the export of unprocessed raw materials is often the primary source of government revenue. Many of these countries are unilaterally dependent on the activities of a limited number of powerful foreign mining companies or certain export destinations (mostly China), and thus are subject to a high degree of economic vulnerability. Structural impediments, including inadequate infrastructure and limited administrative capacities, pose additional challenges to the effective implementation of industrial policy strategies. Nevertheless, these countries are actively seeking to shape their international relations and leverage the current high demand for metals to enter into profitable partnerships.

Both groups share the aspiration to avoid being caught in the middle of the geopolitical game of economic superpowers. They strive to keep all of their options open and avoid compromising existing trade relations.

A diplomatic balancing act

Most mineral-rich states have an interest in maintaining undisturbed economic relations with China. Over the past decade, China has built close political and economic relationships with governments in resource-rich countries through the Belt and Road Initiative (BRI); the resulting transport and logistics infrastructure enables connectivity with Chinese industries.

However, Chinese lending, often backed by the delivery of raw material, has frequently come under scrutiny. Some governments, including that of the DRC, have come to question Chinese companies’ contractual compliance, even seeking to renegotiate terms. Nevertheless, China remains a significant development partner for many governments and will continue to be involved in the raw materials sector in the long term. Since the Covid-19 pandemic, the Chinese government has indeed shifted focus towards its domestic economy, and Chinese foreign direct investment has declined in many areas, but not in the raw material sector. On the contrary, Chinese investments and new contracts in the field of raw materials reached a new peak in 2023. Furthermore, China has pledged to support the industrialisation efforts of mineral exporting countries and to promote local industrial projects. The EU cannot compete with the levels of investment, scope, and attractiveness of the comprehensive packages that China offers its partners.

The US, on the other hand, has firmly committed to this endeavour. Due to its intensifying trade conflict with China, securing a reliable supply of raw materials has become a political priority in the US. With its flagship programme, the Inflation Reduction Act (IRA), the Biden administration has introduced a comprehensive initiative aimed at strengthening domestic industries. In the form of subsidies and tax incentives, the US is investing a significant amount of money, not least to motivate the private sector to explore new import sources for raw materials. However, the US is still exercising restraint in its foreign direct investment in the minerals sector. To advance supply chain diversification, the US also relies on international cooperation, especially the Mineral Security Partnership (MSP) established in 2022. Through this initiative, it seeks to collaborate with allies in creating financial synergies and minimising risks for investments in raw material projects. Currently, the initiative comprises 14 mostly highly-industrialised states (including Germany) and the EU, and it is actively seeking to expand membership to mineral-rich states in the Global South.

While the US’s desire to reduce risky dependencies on China within supply chains resonates within Europe, the EU has demonstrated a more cautious diplomatic stance compared to that of the US. At the EU-China summit in December 2023, for example, President of the European Commission Ursula von der Leyen emphasised that decoupling from China was not in Europe’s interest.

Europe is thus caught in a diplomatic balancing act between China and the US. At the same time, it needs to carefully consider how to deal with new, emerging actors. Here, Saudi Arabia, which has the potential to establish itself as a middle power in the raw materials sector, deserves special attention. Seeking to diversify its economy beyond fossil fuel exports, Saudi Arabia is coming to focus on mineral resources, among other industries. The country provides significant capital for investments in both domestic and international mining projects. For example, it has announced plans to invest around $10 billion in African mining projects over the next five years. Europe’s closer cooperation with the Gulf state, on the hand, has potential but also risks, namely concerning significant differences in values and regarding transparency and standards in supply chains.

Sharpening Europe’s profile

In the global competition for a resilient supply of raw materials, the EU will need to develop its own independent foreign policy on the topic if it is to strengthen its “strategic autonomy”. Similar to mineral-rich states, it should carefully consider its international partnerships. While coordination through the MSP is a useful way to pool resources, the EU should be careful to avoid becoming overly reliant on US initiatives. The US’s introduction of the IRA demonstrates its significant determination to promote its domestic economy and secure its own raw material supply. From the outset, the EU has sharply criticised the IRA for creating unequal competitive conditions. To date, attempts to negotiate comprehensive access for European companies to IRA funding have failed. Europeans should prepare for the continued existence of such industrial policy interventions, regardless of the outcome of the US presidential elections in November.

Furthermore, while the US government expects its allies to support its stance towards China, the EU must develop and clearly articulate its own position by way of its raw material policy. It should adopt a more open approach towards cooperation with China in the raw materials sector compared to the US. Indeed, China will indefinitely remain a significant supplier of raw materials and is also pertinent in terms of standard-setting and transparency. Moreover, it is clear that China will continue to be an important development and trading partner for many mineral-rich countries. Consequently, the EU must refrain from offering preferential deals to these countries. Instead, it should strive to effectively coordinate donors in key areas such as energy and infrastructure planning, which would be beneficial for all parties involved.

To foster an independent approach, the EU must intensify its efforts to effectively implement raw material partnerships. It faces two challenges in this regard:

Firstly, there is a lack of public funding, as there was no political will to stipulate in the CRMA that EU funds could be used to directly finance raw material projects. Given the high level of investment that is needed for strategic raw material projects and their accompanying measures, implementation of the CRMA will be very difficult. The CRMA envisages using the European Global Gateway infrastructure initiative, launched in 2021, for the raw material sector, but the capacity of this initiative should not be overestimated. Its financial framework of €300 billion until 2027 is already largely committed, and its planned investments are mostly tied up; so there are no new funds available. Nevertheless, the initiative could make already planned projects, in the energy sector for example, applicable to the raw material sector. In comparison to China, the EU also has a unique selling point in this regard: It not only provides loans but also generous grants. It also places higher emphasis on transparency.

Secondly, the EU’s strategic approach to raw material supply chains is not feasible without the participation of Europe’s private sector. However, many industry representatives are disappointed by the absence of an EU raw material fund. Without such a European financing instrument, the main responsibility to financially support strategic projects lies with the member states. Nonetheless, positive developments are unfolding here: Germany, Italy, and France are planning to introduce national raw material funds that are already coordinating at the working level. It is crucial to bundle this commitment up to the European level and to minimise intra-European competition.

As with Global Gateway, these raw material funds rely on the participation of private sector actors to achieve so-called “crowding-in” effects. This means that state investments and guarantees are intended to attract additional private capital. However, European companies are very cautious when it comes to high-risk sectors such as mining and large infrastructure. This is partly due to their typical position as end-users who are far removed from resource extraction. European mining companies are scarce. If public financiers do not counteract, crucial investments in structurally weaker raw material partner countries will not be made.

It remains to be seen whether industry representatives will follow through on increasing their engagement. The Federation of German Industries (BDI) emphasises that German companies are already operating more assertively as investors and offtakers in the minerals sector. Moreover, industry alliances such as the European Raw Materials Alliance (ERMA) can assist in identifying projects. These groups could also support the formation of business consortia that cover projects along the entire value chain from extraction through processing to the manufacture of semi-finished products.

Recommendation: only unified, will the EU be an attractive partner

The CRMA has created a solid foundation for the establishment of a coherent European raw material policy. To ensure a resilient and sustainable supply of mineral resources, the EU’s own industrial policy ambitions must now be aligned with its diversification efforts. The state of the current geopolitical landscape underscores the need for an independent and autonomous European approach. Given the quantitative superiority of resource superpowers such as China and the US, the EU should refrain from entering into direct competition with them. Instead, it should focus on targeted collaborations with select partner countries, directing efforts towards their design.

Coordination and coherence

Strict internal coordination is required if the EU wants to be perceived as an attractive competitor and partner at the international level. This task primarily falls to the EU Commission, whose capacities must be expanded for this purpose. Appointing an EU Raw Materials Commissioner would be a good start.

The EU should systematically consider raw material issues when devising its trade and climate policies, in part, to be able to address potential conflicts in a timely manner. It is also the responsibility of the European Commission to coordinate member states, on whose shoulders much of the burden of implementation falls. Important European industrial nations such as France and Germany must transfer their level of ambition in the raw material sector to the EU level. The German government can contribute to the establishment of raw material partnerships by contributing its broad expertise and by leveraging its multitude of programs in the realms of foreign trade promotion, research, and development cooperation.

Given the limited resources at hand and the need to avoid losing credibility due to inadequate implementation, the EU should concentrate its efforts on key countries. It is advisable to establish country-specific working groups that consist of representatives from member states and non-state actors, including the private sector and civil society. Implementation of these structures in partner countries, under the leadership of the European External Action Service (EEAS), would be effective.

Attractive offers for cooperation

Offers to partner countries must be context-specific and tailored, considering both the strategic importance of the raw materials to the EU, as well as the (industrial) policy goals of partner countries and local conditions.

Many mineral-rich emerging countries (“Middle Powers”) such as Chile, South Africa, and Indonesia are important to the EU. Fruitful cooperation with these states will require a strategic approach that acknowledges the willingness and desire of their governments to shape policy and terms of cooperation. The EU should therefore take into account these countries’ demands to further process raw materials domestically and establish local supply chains. Collaborations should focus on concrete projects that are economically feasible and in line with the strategic interests of both sides. Technology transfer will also be an important factor in the field, therefore, accompanying measures that identify and promote public-private partnerships and investment in research cooperation would be a step in the right direction.

Smaller economies with structural challenges and limited implementation capacities, such as Zambia and the DRC, should form the core of the EU’s cooperation efforts. Due to the current high demand for minerals, many governments are very interested in increasing their countries’ capacities to explore and produce. The EU should strengthen institutional cooperation: For example, by expanding its support for geological services that explore joint project opportunities. In addition, it should strengthen cooperation and financial support for technical organisations such as the African Minerals Development Centre (AMDC), which supports mineral-rich countries in the development of industrial policy strategies.

In all cases, it is advisable that the EU collaborates more closely with partners to expand the infrastructure required for renewable energies. Already existent bilateral partnerships can be built upon, and investments can be realised through the Global Gateway program in cooperation with international partners. In addition, the EU should provide targeted support for the implementation of other sustainability standards. Partner governments are often interested in this, as it increases the population’s acceptance of new mining and infrastructure projects and draws in investors.

Better financing

More financial resources will need to be made available if the EU wishes to effectively implement raw material cooperation abroad. On the one hand, at the EU level, the next Multiannual Financial Framework (MFF) should provide for a significant increase in funds for the Global Gateway initiative from 2028 onwards. This will allow it to be better equipped to promote infrastructure projects. Furthermore, the establishment of an EU raw material fund located at the European Investment Bank (EIB), similar to the fund for green hydrogen, would substantially strengthen the EU’s room for strategic manoeuvre.

On the other hand, the German government should expedite the development of its own national raw material fund while also allocating additional financial support to measures that foster raw material cooperation and partnerships. This would not only signal Germany’s commitment to a strategic approach under a common EU framework, but it would also encourage German companies to actively engage in international raw material cooperation.

Meike Schulze is an Associate in the Africa and Middle East Research Division at the German Institute for International and Security Affairs (SWP). This SWP Comment was produced as part of the “Research Network Sustainable Global Supply Chains”, a project funded by the Federal Ministry for Economic Cooperation and Development (BMZ).

© Stiftung Wissenschaft und Politik, 2024

All rights reserved

This Comment reflects the author’s views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

DOI: 10.18449/2024C15

(English version of SWP‑Aktuell 22/2024)