A Sovereign Wealth Fund for the Prince

Economic Reforms and Power Consolidation in Saudi Arabia

SWP Research Paper 2019/RP 08, 10.07.2019, 32 Seitendoi:10.18449/2019RP08

ForschungsgebieteDr Stephan Roll is Head of the Middle East and Africa Division at SWP.

With the “Vision 2030” development plan, Saudi Arabia wants to diversify its economy and end its dependence on oil in the long term. The Public Investment Fund (PIF) is of particular importance here. By 2030, it is to become the world’s largest sovereign wealth fund (SWF) and manage financial assets worth $2 trillion. The PIF is not designed as a savings fund, but as a stabilisation and development fund: The fund capital is intended to cushion the state budget against price fluctuations on the commodities market, finance development projects, and attract investments and know-how from abroad to the kingdom.

The analysis shows, however, that the expansion of the PIF is primarily motivated by power politics. The SWF gives Crown Prince Muhammad Bin Salman direct access to the state’s substantial financial resources. He can use these resources according to his preferences and thus purchase the loyalty of politically important factions within the elite. In addition, Bin Salman could use the PIF to “buy” international support for his political goals. Through the SWF, the economic transformation in Saudi Arabia is closely linked to the consolidation of the crown prince’s rule. Decision-makers in Germany and Europe should be aware of these functions of the PIF. Economic cooperation with the kingdom involving the PIF or companies controlled by it has a political dimension that must not be ignored. In addition, a stronger involvement of the PIF in Europe could require a political impact assessment that would have to examine whether the SWF primarily acts as a profit-seeking investor or whether it is pursuing a foreign policy agenda.

Table of contents

2 Background: The Prince’s Vision

3 Restructuring and Expansion of the Public Investment Fund

3.1 Official Objectives and Mandate

3.2 Institutional and Personnel Structure

3.3.2 Transfer of Aramco Ownership Rights

4 Questionable Means-ends Relationship

4.1 Development of a New Public Source of Income

4.2 Development and Diversification of the Corporate Sector

4.3 Mobilising Direct Investment, Knowledge and Technology Transfer

5 The Political Calculation behind the Sovereign Wealth Fund

5.1 Effects on Domestic Power Relations

5.2 Effects on the Kingdom’s Foreign Policy

Issues and Recommendations

On 25 April 2016, then-Deputy Crown Prince Muhammad Bin Salman announced the outlines of a gigantic development plan: With “Vision 2030”, Saudi Arabia wants to diversify its economy and increase its competitiveness. By boosting the private sector, building futuristic cities, and tapping new natural resources, Saudi Arabia aims to end its dependence on oil. A central project of Vision 2030 is the establishment of a sovereign wealth fund (SWF). The kingdom is thus following the model of three neighbouring Gulf states – Qatar, Kuwait, and the United Arab Emirates – which have been pouring surplus oil revenues into SWFs for years. The plan is to expand the Public Investment Fund (PIF), a hitherto rather unknown public development fund, into the largest SWF in the world within a very short period of time. In fact, the fund’s assets have been more than doubled since 2016 to well over $300 billion through public financial transfers, more than 15 per cent of which is invested abroad. By transferring ownership of the state-owned oil company, Saudi Aramco, the PIF is also to gain a share of the kingdom’s oil revenues in the future.

This study examines the political motivation behind the expansion of the PIF. This question is all the more important since the Saudi government stated before 2015 that the establishment of an SWF would not be economically necessary. Now it explicitly cites economic reasons for the configuration and expansion of the PIF. According to its announcements, the PIF is to serve both as a stabilisation fund and as a development fund. It is intended to diversify government revenues, open up new economic sectors – especially for the private sector – and channel foreign direct investment (FDI) to Saudi Arabia, also to facilitate knowledge and technology transfer to the kingdom. The analysis shows, however, that the government’s approach is hardly suited to achieving these goals. This is evident through the lack of transparency, especially with regard to the integration of the PIF into government fiscal policy, and an investment behaviour of the SWF that impedes rather than promotes sustainable private-sector development.

The far greater effect will be that the expansion will give the PIF access to a substantial part of the country’s public finances and ensure economic supremacy in the country’s business sector. It is also driving forward the concentration of the kingdom’s foreign investment and procurement activities under its umbrella, particularly in the area of important defence procurement. As the fund is institutionally tailored to Muhammad Bin Salman, the PIF will contribute to a centralisation of power in favour of the crown prince, in line with the findings of recent SWF research. According to these studies, SWFs are an important instrument for securing power in authoritarian political contexts. In the Saudi case, the PIF can be used by the crown prince to align the country’s segmented patronage system to his person. Through direct investments and public contracts, Bin Salman can also try to “buy” the support of relevant foreign governments for his political goals.

In the context of Vision 2030, the SWF will thus serve less as a “growth engine”, as described by the state leadership, than as the crown prince’s central steering instrument to counter any loss of political control. Should Vision 2030 fail altogether and the announced development boost for the kingdom fail to materialise, Bin Salman would also have a resource at his disposal that would enable him to purchase the loyalty of important groups, such as in the security apparatus, through targeted transfer payments, despite the austerity policy that would then be necessary. However, the expansion of the PIF is far from complete. Bin Salman’s aggressive foreign policy and the murder of Saudi dissident Jamal Khashoggi in Istanbul in October 2018 have severely damaged Saudi Arabia’s image and that of the Saudi SWF, especially in Europe and the United States. In addition, the surprising postponement of Saudi Aramco’s initial public offering (IPO) in June 2018 and the delay in the transfer of Saudi Aramco’s ownership rights to the PIF indicate that there is resistance within the kingdom to the fund’s rise. From today’s point of view, however, opposition hardly seems strong enough to stop the government’s actions.

For German and European policy-makers, the expansion of the PIF is a challenge in two respects. On the one hand, the plan to make the SWF the most important steering instrument of the Saudi economy makes it clear that even a supposedly non-political cooperation between Germany and its European partners and the kingdom, for example in the implementation of Vision 2030, will have clear political implications. The PIF will closely link economic transformation in Saudi Arabia with the consolidation of Bin Salman’s rule. On the other hand, the SWF could also invest more in Europe in the future. European governments would then have to deal with the question of how to handle a state investor who is not primarily return-oriented, but who might also represent the foreign policy interests of his government – similar to other SWFs, such as those of China and Russia.

Background: The Prince’s Vision

At the beginning of 2015, there was a change of leadership in Saudi Arabia. After the death of King Abdullah, who had ruled the country for 10 years, his younger brother Salman ascended the throne. King Salman promoted his then 29-year-old son, Muhammad Bin Salman, to central positions of power. He first appointed him minister of defence, then deputy crown prince in April 2015, and crown prince in June 2017. Bin Salman thus effectively took over the leadership of the country in all areas. He used all his force against potential and actual political opponents. Competitors within the royal family were placed under house arrest, and critics outside the royal family were imprisoned or, as in the case of Saudi dissident Jamal Khashoggi, killed. The domestic political takeover was flanked by a new trend towards an aggressive Saudi foreign policy, which has been particularly striking in the Saudi military intervention in Yemen (since March 2015) and the blockade of the Emirate of Qatar (since June 2017).1

However, the young crown prince was initially noticed internationally not because of his harsh actions against competitors and critics or his foreign policy, but because of his economic and socio-political reform agenda, which he presented to the general public at the beginning of 2016 under the title “Vision 2030”.2 In his capacity as chairman of the newly created “Economic Cabinet”, the Council of Economic and Development Affairs (CEDA), he announced on 25 April 2016 a gigantic programme for the renewal and modernisation of the Saudi economy and society, the main features of which are based on a study by the consulting firm McKinsey.3 The aim of Vision 2030 is to diversify the economy and thus end the country’s long-term dependence on oil revenues.

This dependence had had an increasingly negative impact on public finances in previous years. Since the 1970s, the share of revenues from oil sales in total government revenue has averaged well over 80 per cent, and even over 90 per cent between 2010 and 2014.4 The collapse of international oil prices in 2014 had therefore led to a dramatic budget deficit, averaging well over 10 per cent of gross domestic product (GDP) in 2017. At its highest level in 2016, the state was lacking nearly $100 billion.5 For the reign of King Salman, who was already 79 years old at the time of his accession to the throne, this does not represent an acute threat. The kingdom does not have a high foreign debt and has considerable financial reserves, which it has earned over the years with rising oil prices (1973 to 1982 and 2003 to 2014).6 The Saudi Arabian Monetary Agency (SAMA) alone managed foreign exchange reserves worth $609 billion at the end of 2015.7 Even high budget deficits could be financed over years. For Salman’s probable successor, Crown Prince Muhammad, recent socio-economic developments pose a serious political challenge: The continuing high population growth of 2 per cent (2017),8 coupled with rising unemployment, especially among young people (38.8 per cent in the 20 to 24 age group9), and a possible decline in global demand for oil as a result of technological change could lead to a dramatic worsening of the situation of public finances in the coming decades.10 In the long run, budget deficits, such as in the period between 2015 and 2017, would no longer be offset by reserves and the raising of further public debt. Then the kingdom’s political leadership would come under considerable pressure.

“Vision 2030” aims to make public finances and living standards independent of oil export revenues.

The implementation of Vision 2030 is therefore intended to boost the growth of the Saudi economy (motto: “A Thriving Economy”), but above all to diversify it so that in the future, public finances, the living standard of the population, and the development of the private sector will no longer depend on oil export revenues.11 The share of the private sector in GDP is to rise from 40 to 65 per cent, that of FDI from 3.8 to 5.7 per cent of GDP, and that of non-oil exports from 16 to 50 per cent of total exports. At the same time, the unemployment rate is expected to fall from 11.6 to 7 per cent. This economic transformation is to be embedded in social reforms (“A Vibrant Society”) and a reorganisation of state structures (“An Ambitious Nation”). The aim is to increase the proportion of women in total employment and improve the effectiveness and transparency of state administration.

Crown Prince Bin Salman has put all his political capital into the reform programme. Vision 2030 is “his” vision and is linked to his person. Accordingly, the implementation of the agenda is also his responsibility. For this reason, the relevant decision-making processes have been centralised and tailored to the crown prince. By merging old and creating new state institutions, existing bureaucratic hurdles are to be overcome and implementation procedures made more efficient.12 The reforms announced in Vision 2030 were also concretised in “Vision Realisation” programmes – above all the National Transformation Program – which, in turn, are to be realised within the framework of initiatives by various state institutions.13 Vision 2030 is also to be continuously reviewed and adapted. It can also be supplemented with new projects. One example of this is the construction of Neom, a high-tech city on the Red Sea costing $500 billion, which was announced in 2017.14

Vision 2030 differs in several respects from previous, mostly less successful reform agendas of the Saudi government.15 On the one hand, the assessment on which the programme is based is comparatively ruthless and radical. In public statements, Bin Salman and other decision-makers, for example, denounced Saudi Arabia’s dependence on oil as dangerous for the country.16 On the other hand, Vision 2030 envisages socio-political liberalisation steps that for a long time seemed unthinkable in Saudi Arabia. The economic and social empowerment of women announced in the document was very quickly followed by concrete steps such as the lifting of the driving ban, the relaxation of clothing regulations, and the opening of certain occupations for female workers.17 The expansion of the entertainment sector in the kingdom, also envisaged in Vision 2030, includes the opening of cinemas – banned up until 2016 – and other leisure facilities, and thus the opening up of new public spaces.

Another key difference to previous development programmes is the financing of Vision 2030. The money will be raised from taxes that will be increased or newly introduced as well as from an SWF to be set up. Unlike the smaller neighbouring Gulf monarchies of Qatar, Kuwait, and the United Arab Emirates, which have been building huge SWFs with their oil and gas export revenues for decades and investing part of their accumulated funds in foreign companies, the Saudi kingdom had transferred most of the corresponding budget surpluses to the central bank, SAMA. Although SAMA was occasionally perceived as an SWF, both in its self-description18 and in its narrower definition,19 the institution was a central bank with monetary and currency policy functions first and foremost. In contrast to the much more profit- and thus risk-oriented SWFs of the three neighbouring countries, SAMA invested and continues to invest its foreign exchange reserves predominantly in fixed-interest investments (and US government bonds, in particular).20

Vision 2030 plans to develop the Public Investment Fund, a previously unknown financial vehicle, into the largest SWF in the world. By 2030, the PIF is to manage financial assets worth $2 trillion. It shall act as a “growth engine” for the Saudi economy as well as a new source of income for the kingdom. Indeed, in contrast to other projects such as Neom, which so far has only existed on paper,21 renewable energy projects that have been repeatedly modified,22 and postponed privatisation projects,23 the expansion of the PIF has been consistently pursued since 2016.

Restructuring and Expansion of the Public Investment Fund

The groundwork for the transformation of the PIF into an SWF was laid before the announcement of Vision 2030. Largely unnoticed by the public, the newly formed Saudi Economic Cabinet (CEDA) under Muhammad Bin Salman changed the institutional embedding of the PIF in March 2015, bringing the fund under direct control of the crown prince. In the spring of 2017, the government published the Public Investment Fund Program, which describes the restructuring and financing of the PIF as well as its mandate.24 The personnel changes that have taken place since then and the increase in the fund’s assets indicate that the Saudi leadership is serious about expanding the PIF.

Official Objectives and Mandate

Founded in 1971, the PIF was only one of several Saudi investment institutions until 2015. The fund’s task was to promote the activities of public enterprises in the domestic economy by granting loans. It was originally intended to act as an “Angel Investor”, providing financial support to companies in the startup phase, without staying invested over the long term. In fact, however, there were no such disinvestments, so that over the years the fund remained a silent partner in numerous Saudi state-owned companies, such as the chemicals and metals group Saudi Basic Industries Corporation (SABIC).25 In Vision 2030, the goals of the fund and its mandate were redefined: With the help of the PIF, state revenues are to be diversified, new economic sectors are to be opened up – especially for private-sector involvement – and FDI is to be directed to Saudi Arabia, which the Saudi leadership hopes will lead to knowledge and technology transfer.26 The PIF is not explicitly intended to be a savings fund with the aim of forming state reserves for the future.27 Rather, it has the character of a stabilisation and development fund with the tasks of shielding the state budget from fluctuations in commodity prices and external shocks, improving the competitiveness of the Saudi economy through planned investments, and attracting foreign companies and know-how to the kingdom.

In order to meet its new requirements, the fund will no longer function as a passive financing partner and lender.28 Rather, it is now to act much more actively and invest in (1) existing Saudi companies, (2) Saudi companies to be established, (3) real estate and infrastructure in Saudi Arabia, (4) “Giga” development projects, (5) international strategic partnerships with funds and companies, and (6) international capital investments with a long-term profit orientation.29 This explicitly gives the fund the mandate to operate abroad as well. By 2020 it should hold a quarter – and by 2030 even half – of its investments abroad,30 and thus be transformed into a “global investment powerhouse” and “the world’s most impactful investor”.31

Institutional and Personnel Structure

Until 2015, the PIF was subordinated to the Ministry of Finance, which in the past had acted rather technocratically and did not fall within the direct sphere of influence of a member of the ruling Saud family.32 Decree 270/2015 changed this competence.33 The fund was now directly subordinated to CEDA, and thus to the control of Crown Prince Bin Salman.34 Unlike, for example, the Norwegian SWF, which is managed by the Norwegian central bank on behalf of the Ministry of Finance, the PIF operates within the framework of an investment company model:35 It is both the owner and manager of the fund’s assets.

The special position of the PIF in the institutional framework of Saudi Arabia and the tailoring of the fund to the person of the crown prince are reflected in the composition of the Board of Directors (BoD). Whereas in the past the BoD was composed of state officials (representatives of various ministries and other administrative organisations and the governor of the central bank), Decree 270/2015 now merely stipulates that the chair of the BoD is to be held by the head of CEDA, Crown Prince Bin Salman. Other members of the BoD are appointed by the prime minister and thus, in effect, by the king, without having to be state officials. Since 2016, in addition to Crown Prince Bin Salman, the BoD has eight members, including six ministers.36 However, their appointment to the BoD is not due to their government positions, but rather to their personal proximity to the crown prince. This applies in particular to Khalid al-Falih (Energy) and Muhammad al-Jadaan (Finance) as well as Minister of State Muhammad al-Shaikh. It is striking that the Saudi central bank is no longer represented in the BoD. Its previous role as manager of the state’s assets has thus been noticeably curtailed.

Special powers have been granted to the managing director. Yasir al-Rumayyan, who is also a member of the fund’s BoD and one of the crown prince’s closest personal confidants, has held this position since September 2015. Al-Rumayyan has no political mandate but is part of the country’s more informal key command and control centres. The former investment banker has considerable political influence through his chairmanship of the Decision Support Center, which was founded in 2016.37 He is also a director of the Saudi Industrial Development Fund and the state-owned oil company, Saudi Aramco. In addition, Al‑Rumayyan represents the interests of the PIF on the Boards of Directors of the fund’s major holdings.38

Crown Prince Bin Salman exerts massive influence on the day-to-day business of the PIF through his offices.

After 2015, the internal governance structures of the PIF were also fundamentally redesigned and now largely follow the recommendations formulated by the International Monetary Fund (IMF) for SWFs.39 Individual internal responsibilities have been redefined to ensure that the expanding fund is managed as efficiently as possible. This became more urgent when the staff of the PIF was significantly increased from 2015 onwards. Initially, only around 40 people worked for the fund; by the end of 2018, the figure had already risen to 450.40 In addition, there was the task of coordinating the numerous international investment service providers who assisted the fund. In addition, efforts were made to fill important positions within the fund with international investment bankers. The fund’s close ties to the crown prince, however, meant that this undertaking proved to be not an easy one.41 Bin Salman exerts massive influence on the day-to-day business of the PIF within the BoD through his offices as chairman of the Executive and Remuneration Committees, which are also responsible for filling important management positions.42 Observers have therefore already described the fund as a “one-man investment vehicle”.43

Funding

The PIF’s programme states that the SWF should grow to $400 billion by 2020. In fact, between December 2015 and September 2017, the PIF’s assets had already increased by almost 50 per cent, from $152 billion to $224 billion.44 By November 2018 the fund assets were valued at $360 billion.45 The composition of this capital inflow of around $72 billion (between December 2015 and September 2017) and $208 billion (between December 2015 and November 2018) is not comprehensible in detail due to the lack of available statistics. In principle, the PIF’s programme describes four major sources of funding: These include capital injections by the government, the transfer of government assets to the PIF, borrowing, and earnings from investments.

Capital Transfers

In financial circles, there have been rumours since 2016 that part of the central bank’s reserves are transferred to the PIF. Indeed, between 2015 and 2017, the Saudi central bank, SAMA, recorded a significant decline in foreign exchange reserves. Only a part of these outflows, amounting to $120 billion, can be explained by the high budget deficits of those years, which had to be financed.46 A transfer of only $26 billion, ordered by King Salman in November 2016, was publicly announced.47 This was preceded by a replacement of the governor of SAMA as part of a comprehensive government reshuffle, apparently initiated by the crown prince. Market observers expect SAMA, under the new central bank governor, Ahmed al-Kholifey, to focus in the future more on its role as a guardian of the currency and its task of overseeing the financial sector, rather than the management of Saudi state assets, as was the case in the past.48

There are also rumours about another source of capital transfers for the PIF: the private wealth of members of the Saudi elite. In November 2017, hundreds of people – including members of the Saud family, prominent businessmen, and state officials – were arrested at the Ritz Carlton luxury hotel in Riyadh.49 Officially, this extensive internment, sometimes lasting months, was presented as a blow to corruption. According to that narrative, the kingdom wanted to create new “fair and very transparent” framework conditions for investors by taking action against princes, politicians, and businessmen who had illegally enriched themselves.50 In view of the lack of transparency of the corruption investigations, which were carried out without any procedures based on the rule of law, this was a hardly comprehensible reason. But even the explanation given by observers that Muhammad Bin Salman wanted to get rid of adversaries and potential competitors within the royal elite also falls short of the mark. The robust approach is more likely to have damaged the crown prince’s reputation within the elite, especially since among those arrested were also persons who could apparently hardly have become dangerous to Bin Salman.51

Apparently, the campaign aimed primarily at collecting money for the state treasury.52 A newly created anti-corruption agency was given extensive powers to investigate and prosecute corruption as well as reach out-of-court settlements. By transferring part of their assets to the state, the defendants were able to “buy” their freedom. Little is known about the details of the individual settlement agreements. Only in the case of Prince Miteb Bin Abdullah, a son of the former king, was a payment of about $1 billion reported.53 In January 2018, according to the attorney general, the sum of the settlement payments reached $100 billion, including the equivalent values for ceded shareholdings and transferred land holdings.54 Already during the wave of arrests at the end of 2017, Saudi dissident Jamal Khashoggi reported rumours that the confiscated companies would be subordinated to the PIF. On several occasions, however, the Saudi government underlined that the management of the confiscated assets would be taken over solely by the Ministry of Finance and not by the PIF. A link to the SWF could nevertheless exist: According to media reports, a separate holding company was set up to manage the confiscated assets; this company would be managed by a senior manager of the PIF’s subsidiary Sanabil Investments.55

Transfer of Aramco Ownership Rights

Vision 2030 already defined the most important source of financing for the PIF: the ownership rights to the state-owned oil company, Saudi Aramco.56 This company has the exclusive right to extract the country’s hydrocarbon resources. Because of this as well as numerous other business activities that now extend far beyond the oil and gas sector, Saudi Aramco is not only the most important employer in Saudi Arabia, but above all the most valuable company in the world, with an estimated market value of up to $2 trillion.57 Formally, Saudi Aramco reports to the “Aramco Supreme Council”, created in 2015 and headed by Crown Prince Bin Salman. The council acts as the representative of the sole shareholder, the Saudi state.58 A transfer of ownership would assign this role to the PIF. This would significantly increase the fund’s value. Vision 2030 also includes the plan for an IPO of Aramco, which could provide the SWF with enormous liquidity.59 The original plan was to convert Aramco into a listed company as early as 2018, sell around 5 per cent of the company’s shares on the stock market, and allocate the capital to the PIF.60 The possibility of a listing on an international stock exchange was also considered.

In June 2018, King Salman himself surprisingly stopped the IPO. Reportedly, the resistance was too strong.

Outside and inside Aramco, the attempt to shift ownership and control structures met considerable resistance. While prominent Saudi economist Essam al‑Zamil, who was arrested in September 2017, warned of the economic risks of an IPO,61 Aramco executives apparently feared above all that external actors could gain significantly better insight into the company’s activities.62

In June 2018, King Salman himself surprisingly stopped the IPO.63 Reportedly, resistance from the company – but also from members of the ruling family and the king’s leading advisors – was too strong. However, shortly after the royal family’s announcement of the temporary halt to the IPO, it became known that Aramco was negotiating with the PIF to acquire SABIC, a chemicals and metals company controlled by the SWF.64 The company, which is listed on the Saudi Stock Exchange, had a market capitalisation of more than $100 billion at that time.65 Instead of simply transferring the 70 per cent stake held by the PIF to Aramco, the oil company was urged to stem a costly acquisition – partially credit-financed66 – of Aramco. In March 2019, Saudi Aramco agreed to buy SABIC’s shares of the PIF for $69.1 billion.67 Above all, the crown prince announced at the end of 2018 that the IPO would be resumed after the successful takeover of SABIC. According to Bin Salman, the PIF would thus receive a total cash inflow of up to $180 billion between 2019 and 2021.68

Borrowing

Especially after the temporary postponement of the Aramco IPO, the PIF needed to borrow money in order to achieve its investment and growth objectives. In summer 2018, the SWF received an $11 billion loan from an international banking consortium. It was able to secure the same favourable conditions as the kingdom itself, which also had to increase its foreign debt due to the tight budget situation.69 Further loans are to be taken out in 2019.70 The procedure is quite unusual for an SWF, whose task, as a rule, is to increase its sovereign wealth in the long term. Therefore, this step once again illustrates the special role of the PIF: It should not only be managing government surpluses, but also begin operating as an “active investor” as soon as possible.71

Investment Returns

Compared to the three other sources of financing, the generation of own returns currently plays a comparatively minor role in building up the fund’s assets. By 2015, the PIF was expected to have generated revenues of SAR 20 billion ($5.3 billion).72 This means that the fund was still a long way from its self-imposed return targets, which ranged between 6.5 per cent and 9 per cent a year.

Questionable Means-ends Relationship

The pace at which the Saudi leadership is driving the expansion of the PIF into an SWF is remarkable in two respects. First, at the end of 2014, the Saudi government explicitly rejected the creation of an SWF. With reference to the successfully conservatively managed central bank reserves, the then–Saudi finance minister, Ibrahim al-Assaf – now himself a member of the BoD of the PIF, and since the end of 2018 foreign minister of the kingdom – had described the creation of an SWF as unnecessary.73 On the other hand, the idea of an SWF is not to be found in the McKinsey study, which represents the blueprint for Vision 2030. Against this backdrop, it is even more remarkable that the economic objectives now linked to the PIF remain also rather vague in Vision 2030 itself and the accompanying documents. In the following, it is therefore examined to what extent the PIF can actually achieve the three identified objectives, namely (1) the diversification of government revenues, (2) the development of new economic sectors, especially in order to strengthen private entrepreneurship, and (3) the promotion of FDI with the secondary objective of enabling knowledge and technology transfer to the kingdom.

Development of a New Public Source of Income

The declared goal of Vision 2030 is to diversify government revenues. The PIF should act as a stabilisation fund in the sense of the IMF typology: Through return-oriented investments, the fund shall provide Saudi Arabia with income from new sources that will enable it to reduce its dependence on oil exports.74 However, it has not yet been decided whether – and how – the fund will contribute to the financing of the state budget. At least for financial years 2018 and 2019, no revenue from the PIF will be transferred to the Ministry of Finance.75 Without mechanisms to ensure that the financial returns of the SWF benefit the budget of the kingdom, the expansion of the PIF will create a self-contained fiscal parallel structure that is, in addition, not subject to adequate state supervision. Legal amendments that were approved by the Shura council in 2018 largely guarantee the fund financial and administrative independence.76 It is therefore unlikely that the activities of the fund will be controlled by the Saudi Arabia General Auditing Bureau. Also, unlike almost all other state institutions, the PIF is not mentioned in the National Transformation Program.77 All of this indicates that the fund and its activities are separate from the general economic and budgetary planning.

The expansion of the PIF will create a self-contained fiscal parallel structure.

Such parallel structures are not new for the kingdom. In the 1990s, for example, billions of US dollars were administered in extra-budgetary programmes, to which only a few members of the royal family had access.78 What is also not new is that, in the course of the accession of a new king, new institutions were created or existing ones expanded.79 What is new, however, is the volume of the extra-budgetary administered funds. The annual income of the PIF could soon exceed even the budgets of individual ministries. In the long term, once the fund has been filled, it could not only receive returns from the investments it has made. According to the Saudi minister of economics and planning, oil revenues that are not needed to cover government expenditures could also be transferred to the PIF.80 Above all, however, according to the announcements in Vision 2030, the fund would gain direct access to part of the country’s oil revenues, even before they flow into the regular state budget, by transferring the ownership of Saudi Aramco to the PIF.

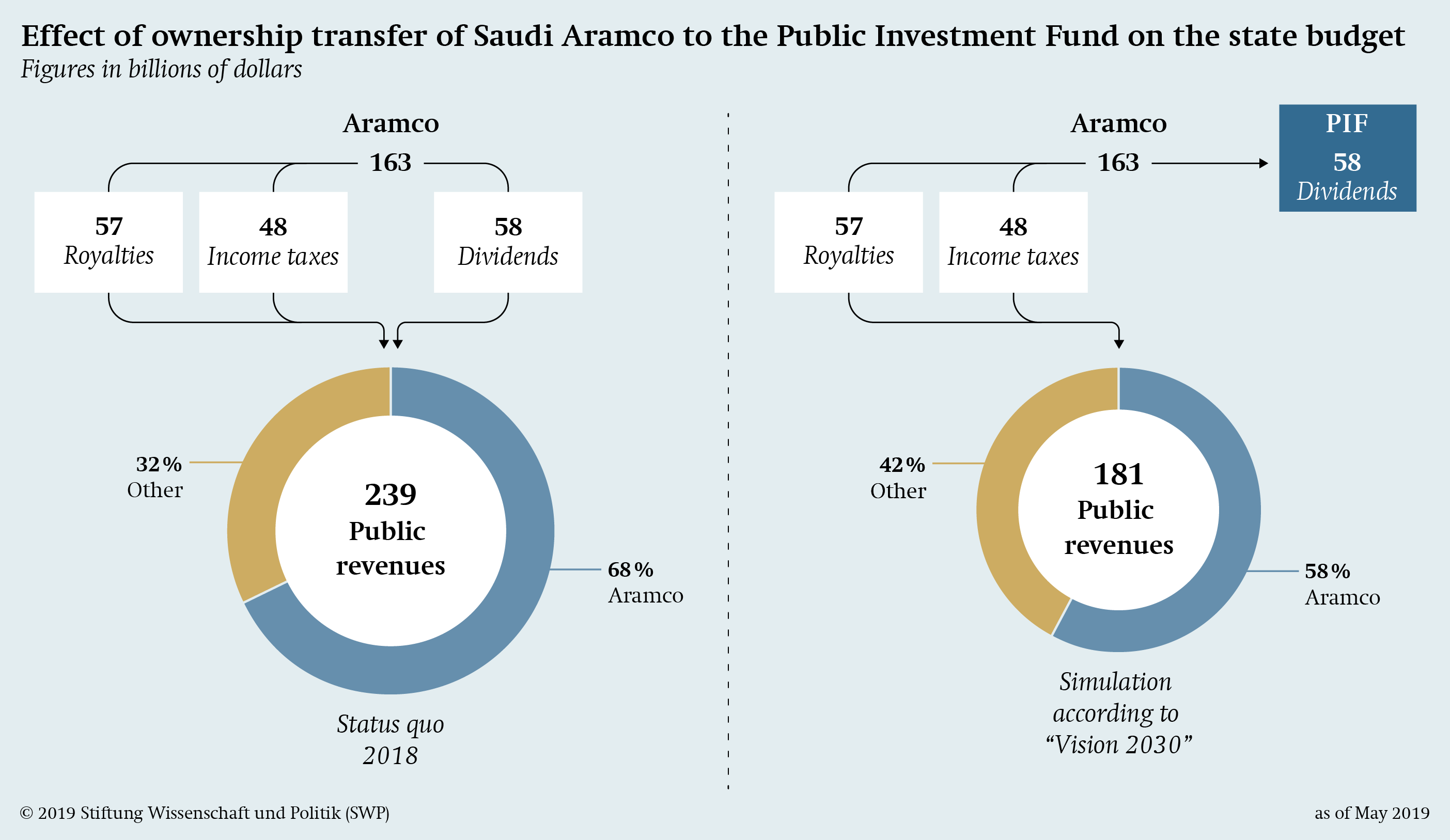

To date, Saudi Aramco transfers its earnings – which generate 68 per cent of public revenues – in the form of royalties, taxes, and dividends to the public budget. After a transfer of the ownership rights to the PIF, rent fees and taxes would continue to flow into the state treasury. However, the dividends would be paid to the shareholder, that is, the PIF (see Figure 1, p. 18). This change in state revenue flows would be all the more remarkable given that Saudi Aramco’s income tax was massively reduced by royal decree at the beginning of 2017. As a result, corporate profit after taxes has increased significantly, and the oil company was able to pay out dividends for 2017 and 2018 of $50 billion and $58 billion respectively, many times higher than in 2016 (around $3 billion).81 Should these dividend payments not – or only partially – be passed on to the state budget by the PIF, it would have a considerable loss of revenue.82 In 2018, for example, the dividend payment accounted for around a quarter of the total state revenue of the kingdom.83 Consequently, these dividends would build up a huge shadow budget under the umbrella of the PIF in the future. It remains completely uncertain what these funds will ultimately be used for, and whether they will actually benefit the Saudi state. Empirical studies of such extra-budgetary households in other contexts show that they not only potentially undermine the solidity of state fiscal policy and budgetary discipline, but are also a gateway for political and administrative corruption.84

Development and Diversification of the Corporate Sector

In addition to its fiscal stabilisation function, the PIF is to assume the role of a development fund. It should not only facilitate the major infrastructure and modernisation projects announced in the context of Vision 2030, such as the construction of the high-tech city of Neom, but above all also act as an “enabler of the private sector”85 and help to open up new capital-intensive economic sectors.86 Thus, the expansion of the private sector is the declared goal of Vision 2030. Its share of Saudi Arabia’s total economic output is to be increased from 40 to 65 per cent.87

The PIF plays a key role in the development of entirely new economic sectors such as tourism and the defence industry.

In fact, the PIF is the driving force behind the implementation of the numerous development and infrastructure projects under Vision 2030, which demonstrates once more how strongly the fund’s decision-making is influenced by politics.88 The PIF also plays a key role in the development of entirely new economic sectors such as tourism and the defence industry. The promotion of the entertainment sector announced in Vision 2030, for example, is being pursued decisively by the PIF subsidiary Saudi Entertainment Ventures Company (SEVEN, formerly Development and Investment Entertainment Company89). In spring 2018, the company was granted its first licence to operate cinemas in the kingdom.90 Over the next 12 years, SEVEN intends to invest $2.7 billion in Saudi Arabia.91 In addition, the SWF is financing a large part of the huge Qiddiya leisure complex south-west of Riyadh. Investments are also to be made in the tourism sector, which shall be expanded massively according to Vision 2030 guidelines. The Red Sea Development Company, wholly owned by the SWF, wants to build tourist resorts on the Red Sea.

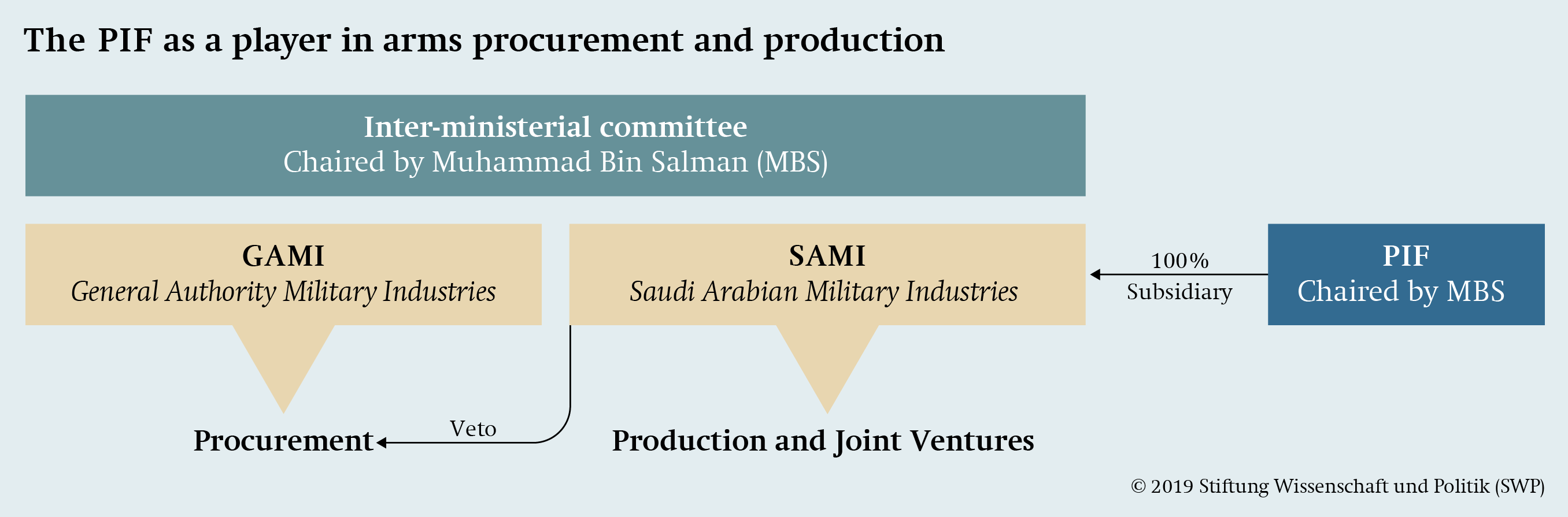

The Saudi Arabian Military Industries (SAMI) holding company – a PIF subsidiary founded in May 2017 – is responsible for establishing its own Saudi defence industry. In 2017, Saudi Arabia had the third-highest defence spending in the world ($69.4 billion92), with less than 5 per cent of the funds spent flowing into the national economy. The goal of Vision 2030 is to let domestic suppliers benefit from 50 per cent of Saudi arms expenditures and to make the country one of the world’s 25 largest arms producers by 2030. SAMI is to act as an “active holding company” for this purpose and, in particular, to promote national arms production through alliances with international companies.93 This is not only a matter of self-sufficiency in arms but also of exports – above all to friendly states in the region.94

The PIF already has a very extensive investment portfolio.

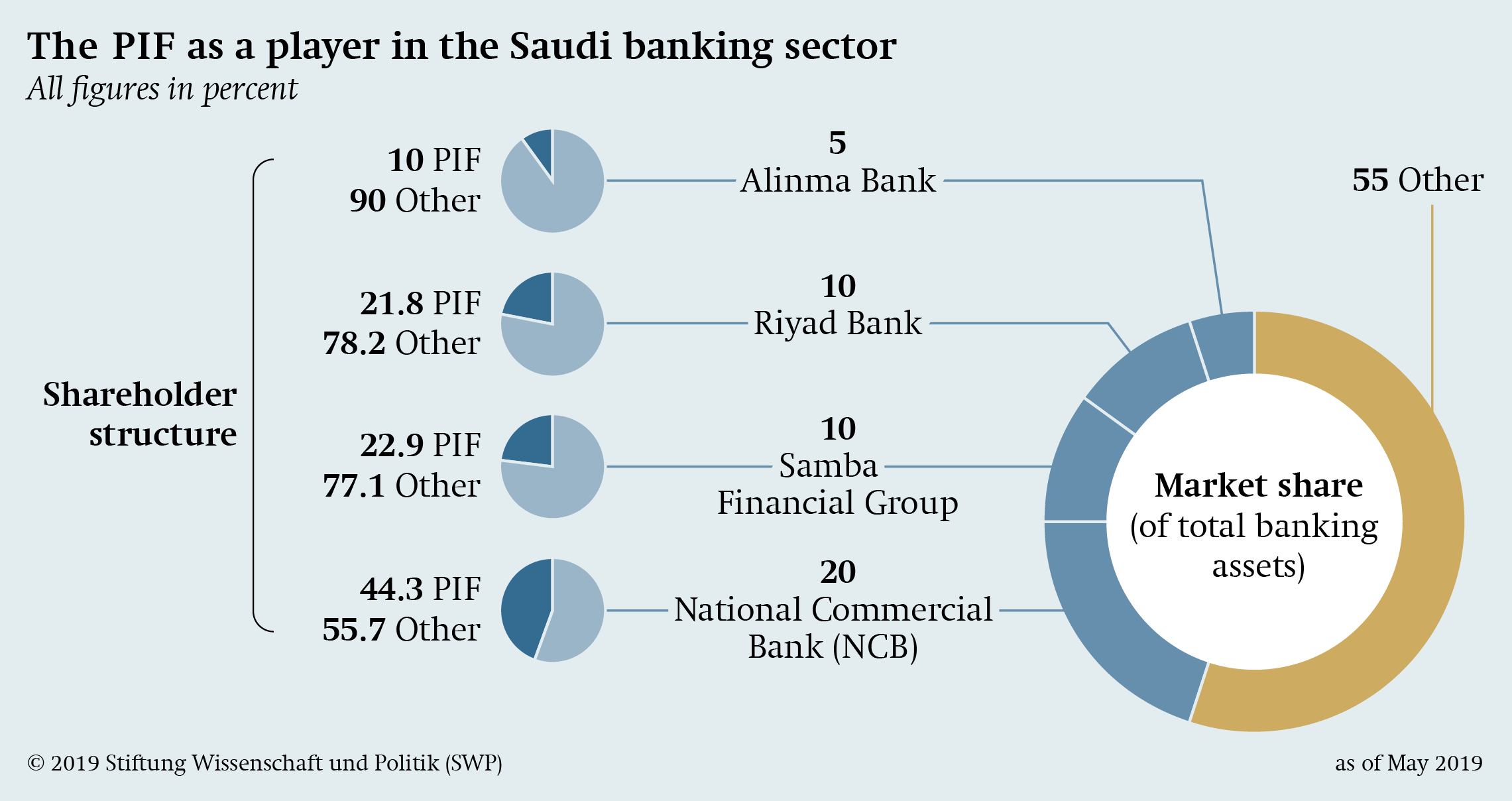

Besides new activities, the PIF already has a very extensive investment portfolio. Not least the sale of the chemicals and metals group SABIC illustrates the considerable role that the SWF plays in the domestic economy today. In the banking sector alone, the PIF is the most important shareholder in four financial institutions, which together have a market share (financial assets) of 45 per cent (see Figure 2, p. 20).95 In the cement industry, the market share of the companies in which the PIF is the largest shareholder is also over 40 per cent.96 In the mining sector, the PIF holds more than two-thirds of the shares in the market leader, Saudi Arabian Mining Company. In the food sector, companies such as Savola, Almarai, and Nadec, where the PIF is also one of the largest shareholders, are market leaders in a number of product segments.97

From an economic point of view, however, such investments by the PIF are only economically viable if they are actually intended as startup financing. Otherwise, the objective of private-sector development set out in Vision 2030 would be undermined.98 However, there is no sign that the PIF will withdraw from the lucrative sectors at a later stage. Accordingly, the IMF expressed fear in a recent analysis that “the increasing weight of the PIF could lead to a strengthening of the government’s role in the economy and push back the private sector”.99 The PIF would thus continue the state’s dominance in the economy, which was characteristic of Saudi Arabia before 2015. The oil rents that accrued to the Saudi state in the 1970s and early 1980s had fuelled state investment in almost all sectors of the economy and counteracted private-sector development. Though private economic activity had temporarily intensified when oil prices collapsed in the mid-1980s, the renewed rise in oil prices in the 2000s, the formation of speculative bubbles on the Arab capital markets (between 2004 and 2006), and the global financial crisis of 2008 led the state to reappear as a superior economic actor, to the detriment of the private sector.100 However, there is a central difference between the state interventionism of past years and the economic expansion of the PIF: The interventionism of earlier times was supported by a large number of ministries, downstream authorities, and state-owned enterprises, above all Saudi Aramco. By bundling state economic activities under the PIF’s umbrella, it is now largely centralised.

Mobilising Direct Investment, Knowledge and Technology Transfer

Also in its role as a development fund, the PIF should attract capital and cutting-edge technology to the kingdom through direct investment in foreign companies and “strategic partnerships” with other international investment funds. In addition, the SWF launched an international investor conference, the “Future Investment Initiative”, which has been held annually in Riyadh since 2017.101 Following the example of the World Economic Forum in Davos, the PIF is using this event to create a platform where decision-makers from politics and business can discuss global economic trends and, at the same time, gain an impression of the attractiveness of the kingdom as an investment location.

According to the PIF’s programme, the share of international assets in total assets under management should increase from 5 per cent (2017) to 25 per cent in 2020.102 This target could actually be achieved. Between 2015 and 2019, the fund has built up an extensive portfolio of international investments in various business sectors, ranging from agriculture and food to real estate and energy (see the overview of the largest investments in the Appendix, p. 30ff.). Until today, the PIF may have invested well over $45 billion abroad103 – together with committed and planned investments this amount could reach up to $100 billion. For this purpose, the SWF has entered into partnerships with private and state-owned investment companies, including the US asset manager Blackstone, the Japanese SoftBank Group, and the state-owned Russian Direct Investment Fund (RDIF).

In fact, thanks to the PIF’s foreign investments, new companies have emerged in Saudi Arabia, such as the Saudi-Korean joint venture PECSA, founded in 2015 with the aim to bring Korean construction know-how to the kingdom.104 However, it is more than questionable whether such joint ventures and the aggressive marketing strategy in the form of the Future Investment Initiative can attract SAR 20 billion ($5.3 billion) of FDI to the kingdom between 2018 and 2020, as announced in the PIF’s programme.105 Ultimately, the decisive factor for the inflow of FDI is not the investment policy of the SWF, but rather the general investment climate in Saudi Arabia, which international investors have rated as being less than positive in recent years. In the World Bank’s Ease of Doing Business Ranking, the kingdom has tended to deteriorate by international standards since 2016: In 2019, it ranked 92nd (2016: 83rd), by far the worst position in the G20 group of countries to which it belongs.106 The inflow of FDI is correspondingly low, having slumped 80 per cent to $1.4 billion between 2016 and 2017.107 In 2018, the country was able to record more FDI, with $3.5 billion.108 Compared to other economies with similarly high GDPs, however, the inflow is at an extremely low level.109

The expansion of the PIF is leading to a remarkable centralisation of Saudi Arabia’s foreign investment and arms procurement activities.

In any case, the expansion of the PIF is leading to a remarkable centralisation of Saudi Arabia’s foreign investment activity. Whereas in the past a number of ministries and other state institutions maintained their own funds for foreign investments whose activities were not coordinated by the government,110 the PIF is now the kingdom’s sole state investor internationally. Investments can thus be much more focussed on individual markets or industries. This is particularly evident in the SoftBank Vision Fund, which the Japanese SoftBank Group launched in 2017, and in which the PIF effectively holds a controlling majority of $45 billion. Through this investment, the SWF became the largest single investor in the US startup scene by October 2018.111 Another example is the $20 billion investment in the infrastructure fund of the Blackstone Group, providing the PIF considerable weight in infrastructure development projects in the United States.

In addition, the fund’s task to develop international strategic partnerships has given it a significant influence in the awarding of contracts to foreign companies. This is particularly evident in the defence sector. The PIF is indirectly involved in Saudi defence procurement through the SAMI holding company. Whereas in the past, procurement was decentralised and organised by the individual security bodies (Ministry of Defence, Ministry of the Interior, or Ministry for the National Guard), in 2017 it was centralised under the umbrella of a new authority: the General Authority for Military Industries. This authority organises arms procurement in principle, but SAMI seems to be highly involved in procurement decision-making because of its mandate to establish a national arms industry (see Figure 3).112

Whether this centralisation of foreign investment and public procurement really pays off for the kingdom is questionable. In the past, the welfare loss suffered by the Saudi state was caused less by a lack of centralisation than by an intermeshing of public and private interests in investment decisions and public procurement.113 The absence of public control and the associated lack of transparency of the PIF does nothing to counteract this problem.

The Political Calculation behind the Sovereign Wealth Fund

The previous analysis shows that the expansion of the PIF seems hardly suitable for achieving the economic goals set by the Saudi government. Rather, it shows that through the restructuring, the SWF gets access to a significant share of public revenues and takes a dominant position in much of the kingdom’s economy. Against the background of more recent research about SWFs, this result is by no means surprising.114 For a long time, SWFs have been analysed under the general assumption that the state, as the owner, tries to assert its economic interests or those of the domestic economy through the SWF. Recent work, however, has placed more emphasis on the interests of the “ruling elites”.115 The basic assumption is that ruling elites have discovered SWFs as an instrument “to secure their domestic political dominance against both internal and external threats”.116 By controlling an SWF, political leaders can increase their “autonomy”, both vis-à-vis their own population as well as other countries. Against this background, the question arises as to what effects the expansion of the PIF will have on Crown Prince Muhammad Bin Salman’s position of power within the kingdom and on his room for manoeuvre in foreign policy.

Effects on Domestic Power Relations

In Saudi Arabia itself, the upgrading of the PIF promotes a centralisation and concentration of power. Prior to 2015, Saudi Arabia’s ruling system was characterised by the existence of different centres of power, controlled by different factions within the ruling family.117 Supplied by the country’s oil rents, these centres of power, in turn, maintained patronage networks in the state apparatus and in the economy. This system of formal and informal rent-based relations can be described as “segmented clientelism”.118 In addition to the official institutions, the Saudi state was thus pervaded by downright parallel structures, each with a distinct life of its own.119 On the one hand, this system enabled the political integration of a large number of actors, and thus reduced the danger of resistance to the royal court. On the other hand, it encouraged the emergence of “bureaucratic fiefdoms”, which ultimately also acted as veto players, for example in implementing economic reforms.120

The patron–client relationships in Saudi Arabia are likely to become more centralised in the future.

The bundling of property rights and control powers in the form of the PIF changes this multipolar clientele system in favour of the crown prince. Through the fund, Muhammad Bin Salman gets direct access to a considerable part of the state’s financial resources and can distribute them according to his preferences, be it in the form of transfer payments to groups of strategic importance for the government – for example in the security apparatus – or targeted investments that promote personal dependencies on the crown prince in the business community. Moreover, through the SWF, Bin Salman gains a direct and great influence on the development of the economy that no member of the ruling family has had in the past. The patron–client relationships in Saudi Arabia are therefore likely to become even more centralised in the future and run towards one person, namely Bin Salman. His position of power vis-à-vis other influential members of the ruling Saud family, but also members of the Saudi business elite, will be massively strengthened.

The pending transfer of Saudi Aramco ownership rights to the SWF is likely to be the key milestone in power centralisation: Following the full nationalisation of Aramco in 1980, the company was run by technocrats instead of members of the ruling family. In this way, it was ensured that no member or faction of the Saud family had exclusive access to the country’s oil wealth.121 The “Saudisation” of Saudi Aramco’s management, which began in 1988 – during which Western managers were replaced by Saudi citizens – did not change this, nor did the formal subordination of the company to the Ministry of Petroleum and Mineral Resources.122 The assignment of the company to the PIF’s sphere of competence would, in fact, break with this principle. In particular, the described direct injection of the company’s dividend payment into the PIF’s budget would greatly strengthen the crown prince’s access to the state’s resources, and thus the establishment of a patronage system that can be described as “centralised clientelism”.

Effects on the Kingdom’s Foreign Policy

The expansion of the PIF counteracts the waning importance of the kingdom’s existing foreign policy instruments. So far, the Saudi leadership has attempted to exert foreign policy influence by playing off the country’s position as the world’s largest oil exporter and, with a view to US policy, buying American government bonds.123 In recent years, however, it has become clear that Riyadh has not been able to assert its interests as hoped, either through its oil policy or through the accumulation of US government bonds. The United States has made itself largely independent of oil imports through an increase in shale oil and gas production, which, according to government representatives, has also had an impact on its scope for foreign policy action, especially in the Middle East.124 In addition, the kingdom would damage itself in the medium and long term through politically motivated oil price increases, if such increases can be brought about at all in the short term by cuts in production, which some experts doubt.125 This would result in revenue losses due to falling oil demand, especially from East Asia, the loss of market share to other producers, and an acceleration in the expansion of alternative energies.126 Moreover, with regard to US government bonds, Saudi Arabia’s holdings have lost considerable international importance, not least because of the massive purchases by China.127 Market observers therefore assume that a disposal of government bonds would have hardly any impact on market activity, and thus on the price of the bonds.128 Should a Saudi “selloff” of government bonds and other US dollar-denominated assets nevertheless have negative consequences for the US currency, this would also be detrimental to the kingdom itself, as it has pegged its own currency to the US dollar and therefore had to devalue it proportionately against other currencies.129

Through the SWF, Bin Salman could “buy” international support for his political goals.

Against this backdrop, the abovementioned increase in Saudi foreign investment and its bundling under the PIF’s umbrella, but also the centralisation of public procurement – in the defence sector, for example – could serve to create a new foreign policy lever. Through the SWF, Bin Salman could “buy” international support for his political goals. The institutional cooperation of the PIF with the Russian SWF RDIF and the $2.5 billion trilateral partnership between the PIF, the RDIF, and the Chinese SWF China Investment Corporation bears witness to the fact that this is one of the functions associated with the fund.130 These deals are linked to an obvious political rapprochement between the three governments involved.131

The PIF’s investments in foreign companies could also be used by the crown prince as a foreign policy tool. This could play out especially in the case of the United States. Through the massive investment of venture capital via the SoftBank Vision Fund described above, the PIF has a considerable influence on the development of the startup scene in the United States. According to analysts, in the event of a capital withdrawal, the fund could cause massive damage to the entire venture capital market.132 Similarly, the PIF’s investments in US infrastructure – a sector that is a source of many jobs and a focal point of the current US administration’s economic policy – are likely to have similar political relevance. In addition, the PIF’s main business partner in that sector, the Blackstone Group, is backed by Stephen Schwarzman, one of the most politically influential business leaders in the United States.133 Finally, the PIF has considerable influence through SAMI on Saudi arms procurements, which are of central importance for the US arms industry: Between 2013 and 2017, 18 per cent of US arms exports went to the kingdom, making it by far the largest customer of the US defence industry.134 That this foreign policy lever is powerful became clear not least in the context of the murder of Saudi dissident Jamal Khashoggi. President Donald Trump openly rejected far-reaching sanctions against Saudi Arabia by pointing out its significance for the American economy.135 The US administration as well as other countries refrained from blaming the crown prince in particular.

Conclusions and Recommendations

Contrary to what is stated in Vision 2030, the new Saudi SWF, the PIF, serves less as a growth engine for the kingdom than as a central steering instrument for Crown Prince Bin Salman, who is consolidating and securing his own political power for the long term. Thus, the expansion of the SWF, which has been conducted in the shortest possible time, as well as its institutional redesign must be seen as prerequisites for the implementation of other measures announced in Vision 2030: Through the PIF, Bin Salman can carry out the planned reforms – at least in part – without losing political control. Exemplary here is the plan to allow more transparency, increase accountability, and generally establish good governance around public finances. These reforms could be carried out with regard to the formal public budget. The first signs of this are already visible: The implementation of the Fiscal Balance programme, for example, has significantly improved public access to information on state finances.136 However, the PIF itself is exempt from these reforms. Bin Salman could therefore ostensibly meet international demands, such as those of the IMF, and adapt the “official” government revenue and expenditure system more closely to international standards – as announced in Vision 2030 – and at the same time keep direct control over a large portion of public revenues as if it were his private fortune.

Another example is the support of private-sector development, also mentioned in Vision 2030. In fact, Bin Salman could, for example, significantly increase the share of the private sector formally in Saudi Arabia’s economic output through the (partial) privatisation of public enterprises, without having to fear that this sector will become economically independent of the centre of political power. Through the heavy economic involvement of the PIF, the entrepreneurial camp remains dependent on Bin Salman and will hardly be able to play any political role in the future.

Above all, however, the PIF offers the crown prince reinsurance in the event that the announced goals of Vision 2030 should fail to materialise. If the kingdom is unable to reduce its dependency on oil and channel foreign investments into productive areas, there will be massive budget cuts in the medium and long term and a further rise in the already high unemployment rate. With the SWF, Bin Salman has an instrument at his disposal to counter social tensions through transfer payments to groups that are strategically important for the government. Personal loyalty relations, for example with members of the security organs, could thus be maintained, even in an economic situation in which there is no alternative to a comprehensive austerity policy. Through the PIF’s strategic investments abroad, the crown prince could also hope for international support, even in a situation where domestic political pressure on the royal court is growing.

However, the development of the PIF is not yet complete. For example, despite its remarkable expansion over the past four years, the SWF has by no means achieved its stated goal of becoming the “preferred and most impactful partner globally”.137 At the end of 2018 in particular, the fund’s development suffered a severe setback. The murder of Saudi dissident Jamal Khashoggi has damaged Saudi Arabia’s image, especially in the United States and Europe. Accordingly, investors have also distanced themselves from the Saudi SWF. This became evident at the second Future Investment Initiative Conference in Riyadh, held three weeks after Khashoggi’s death. Numerous high-ranking international business representatives cancelled their participation apparently for fear of damaging their companies’ image. Some investors even cancelled their existing business relationships with the PIF.138 However, this setback is unlikely to slow the expansion of the PIF in the long term. Multinational companies such as Siemens declared their willingness to continue doing business with Saudi Arabia shortly after the murder.

However, a much greater hurdle to the further development of the SWF has arisen within the kingdom. The extent of the resistance to the expansion of the PIF can hardly be assessed from the outside. The fact that Saudi Aramco’s planned IPO has been postponed and the ownership of the company has not yet been transferred to the PIF can, however, be seen as an indication of such resistance. Should Saudi Aramco’s IPO and the associated transfer of ownership rights to the PIF not take place in 2020/21, the fund will hardly be able to achieve the specified growth targets – this would not only dampen the PIF itself, but also Muhammad Bin Salman’s efforts to consolidate his power. From today’s perspective, however, it is hardly conceivable that critics of the expansion of the PIF could prevail in the kingdom.

For Germany and its European partners, the expansion of the PIF poses two challenges: On the one hand, the example of the SWF makes it abundantly clear how closely economic and political developments in Saudi Arabia are linked. In light of Bin Salman’s aggressive regional policy, there is an intense debate in Germany and Europe as to whether – and to what extent – arms exports to the kingdom are politically justifiable, whereas economic cooperation in other areas has so far been regarded as completely harmless. However, the instrumentalisation of the PIF as the crown prince’s tool of political power described above may well give cooperation with the SWF itself or with companies under its control a political dimension that should not be ignored.

On the other hand, there is the question of how European governments should react to investments by the PIF in Europe. In contrast to the SWFs of other Gulf monarchies, above all the Abu Dhabi Investment Authority, the Kuwait Investment Authority, and the Qatar Investment Authority – which, as return-oriented investors, have built up stakes in large European companies over decades – the PIF currently has a minimal presence in Europe. In Germany, for example, only a minority stake in the logistics company Hapag-Lloyd is known to the public. However, the Vision Fund of the Japanese SoftBank Group, which is largely financed by the PIF, has made significant investments in German technology companies since 2018.139 Should the PIF expand its investment activities in Europe, a political impact assessment could become necessary in view of the close link between the fund and the Saudi government. An assessment would have to be made as to whether the PIF exclusively acts as a profit-seeking investor or whether it pursues a foreign policy agenda. In the latter case, European decision-makers would have to consider very carefully whether such an investment is actually in the political interest of the recipient country, similar to the way they deal with SWFs and state-owned enterprises from China and Russia.140

Appendix

Abbreviations

|

BoD |

Board of Directors |

|

CEDA |

Council of Economic and Development Affairs |

|

FDI |

Foreign Direct Investment |

|

GDP |

Gross Domestic Product |

|

IMF |

International Monetary Fund |

|

IPO |

Initial Public Offering |

|

PIF |

Public Investment Fund |

|

RDIF |

Russian Direct Investment Fund |

|

RSIF |

Russia-Saudi Investment Fund |

|

SABIC |

Saudi Basic Industries Corporation |

|

SAMA |

Saudi Arabian Monetary Agency |

|

SAMI |

Saudi Arabian Military Industries |

|

SAR |

Saudi Riyal |

|

SEVEN |

Saudi Entertainment Ventures Company |

|

SME |

Small and Medium-Sized Enterprises |

|

SWF |

Sovereign Wealth Fund |

|

UAE |

United Arab Emirates |

|

UK |

United Kingdom |

|

US |

United States |

|

PIF/subsidiary |

|

|

|

|

|

|---|---|---|---|---|---|

|

SoftBank Group “Vision Fund” and “Vision Fund 2”. |

|||||

|

$1.2 bn |

May 2019 |

■ Cruise |

Mobility |

USA |

17 |

|

$1 bn |

May 2019 |

■ Rappi |

Tech/Startup |

Columbia |

17 |

|

$20 bn |

May 2017 |

Blackstone (MoU) |

Infrastructure |

US |

1&18 |

|

n.a. |

December 2017 |

AMC Entertainment Holdings |

Films |

US |

1&19 |

|

$50 m |

2018 |

TriLinc Global Impact Fund |

All sectors |

US |

5 |

|

$200 m |

March 2018 |

Penske Media Corporation |

Media |

US |

6 |

|

$461 m |

March 2018 |

Magic Leap (investment) |

Tech/Startup |

US |

1 |

|

n.a. |

April 2018 |

Six Flags |

Entertainment |

US/Saudi Arabia |

1 |

|

$100 m |

June 2018 |

Tushino Airfield Development/Project (with RDIF) |

Infrastructure |

Russia |

8 |

|

$300 m |

July 2018 |

Arcelor Mittal Tubular Products Jubail (AMTPJ) |

Steel |

Luxembourg/UK |

4 |

|

$5.33 bn |

May 2018 |

AccorInvest |

Hotel and real estate |

France |

1 |

|

$2 bn |

August 2018 |

Tesla (5% share) |

Mobility |

US |

1&9 |

|

$1 bn |

September 2018 |

Lucid Motors (investment) |

Mobility |

US |

1 |

|

n.a. |

September 2018 |

Mriya Agro Holding |

Agro-products |

Ukraine |

7 |

The selection does not claim to be exhaustive.

n.a. = not available; MoU = memorandum of understanding.

Sources: See next page.

Endnotes

- 1

-

See also Guido Steinberg, Muhammad Bin Salman Al Saud an der Macht. Der Kronprinz und die saudi-arabische Außenpolitik seit 2015, SWP-Aktuell 71/2018 (Berlin: Stiftung Wissenschaft und Politik, December 2018).

- 2

-

See Vision 2030 – Kingdom of Saudi Arabia, April 2016, https://vision2030.gov.sa/sites/default/files/report/Saudi_

Vision2030_EN_2017.pdf (accessed 4 February 2019). - 3

-

McKinsey Global Institute, Saudi Arabia beyond Oil: The Investment and Productivity Transformation (New York, December 2015), https://mck.co/2QfRI6M (accessed 4 February 2019).

- 4

-

See Saudi Arabian Monetary Agency (SAMA), ed., Yearly Statistics, http://www.sama.gov.sa/en-US/EconomicReports/ Pages/YearlyStatistics.aspx (accessed 4 February 2019).

- 5

-

Angus McDowall and Andrew Torchia, “Saudi Plans Spending Cuts, Reforms to Shrink Budget Deficit”, Reuters, 28 December 2015, https://www.reuters.com/article/us-saudi-budget-idUSKBN0UB10D20151228 (accessed 5 February 2019).

- 6

-

See Daniel Moshashai, Andrew M. Leber and James D. Savage, “Saudi Arabia Plans for Its Economic Future: Vision 2030, the National Transformation Plan and Saudi Fiscal Reform”, British Journal of Middle Eastern Studies (online), 20 August 2018, 5ff., https://www.tandfonline.com/doi/abs/ 10.1080/13530194.2018.1500269 (accessed 5 February 2019).

- 7

-

International Monetary Fund (IMF), ed., Saudi Arabia: 2018 Article IV Consultation – Press Release and Staff Report, IMF Country Report no. 18/263 (Washington, D.C., 24 August 2018), 71, http://bit.ly/2VRmDaY (accessed 5 February 2019).

- 8

-

The World Bank, ed., World Development Indicators – Population Growth, https://data.worldbank.org/indicator/ SP.POP.GROW (accessed 5 February 2019).

- 9

-

See General Authority for Statistics, Kingdom of Saudi Arabia, Labour Force Survey, Labour Market 2018 Third Quarter, https://www.stats.gov.sa/en/818-0. Total unemployment in the 3rd quarter of 2018 amounted to 12.8 per cent.

- 10

-

Other factors that could have a negative impact on public finances include climate change and local political unrest.

- 11

-

See Moshashai et al., “Saudi Arabia Plans for Its Economic Future” (see note 6), 9.

- 12

-

The Decision Support Center, which was established directly at the royal court and prepares decisions for the crown prince, deserves special mention here.

- 13

-

For the implementation process, see KSA Vision 2030 – Strategic Objectives and Vision Realization Programs, 25 April 2016, https://www.vision2030.gov.sa/download/file/fid/1319 (accessed 5 February 2019).

- 14

-

Alaa Shahine, Glen Carey and Vivian Nereim, “Saudi Arabia Just Announced Plans to Build a Mega City That Will Cost $500 Billion”, Bloomberg, 24 October 2017, https:// bloom.bg/2JHb2cF; see also Adel Abdel Ghafar, “A New Kingdom of Saud?”, The Cairo Review of Global Affairs 28 (2018): 72–81 (79ff.), https://cdn.thecairoreview.com/wp-content/ uploads/2018/02/cr28-ghafar.pdf (both accessed 9 May 2019).

- 15

-

See also Jane Kinninmont, Vision 2030 and Saudi Arabia’s Social Contract: Austerity and Transformation (London: Chatham House, July 2017), 10, http://www.chathamhouse.org/sites/ default/files/publications/research/2017-07-20-vision-2030-saudi-kinninmont.pdf (accessed 5 February 2019).

- 16

-

See Hazel Sheffield, “Saudi Arabia Sets out Sweeping Reforms to Wean Itself off ‘Dangerous Addiction’ to Oil by 2020”, The Independent, 25 April 2016, https://ind.pn/2WrsurF (accessed 5 February 2019).

- 17

-

See Martin Hvidt, The New Role of Women in the New Saudi Arabian Economy (Odense: Syddansk Universitet, Center for Mellemøststudier, April 2018), https://portal.findresearcher. sdu.dk/en/publications/the-new-role-of-women-in-the-new-saudi-arabian-economy. Special public attention was given to the announcement that, in the future, women will also be able to apply for (selected) positions in the military and at the public prosecutor’s office, see “12 Criteria for Saudi Women to Join Army As Soldiers”, Saudi Gazette, 26 February 2018, http://saudigazette.com.sa/article/529295/SAUDI-ARABIA/12-criteria-for-Saudi-women-to-join-army-as-soldiers (each accessed 5 February 2019).

- 18

-

See Ahmed Banafe and Rory Macleod, The Saudi Arabian Monetary Agency, 1952–2016: Central Bank of Oil (Cham, 2017), 194.

- 19

-

See Li Yang and Jin Zhang, “Political and Economic Analysis on SWFs of Saudi Arabia”, Journal of Middle Eastern and Islamic Studies (in Asia) 6, no. 3 (2012): 28–57 (37).

- 20

-

See Sara Bazoobandi, The Political Economy of the Gulf Sovereign Wealth Funds (Abingdon and New York, 2013), 26ff.

- 21

-

Saeed Azhar, Katie Paul and Hadeel Al Sayegh, “Saudi Investment Ambitions Impress but Foreign Money May Be Slow to Come”, Reuters, 26 October 2017, https://reut.rs/30H9 Rzd; Simeon Kerr and Anjli Raval, “Saudi Prince’s Flagship Plan Beset by Doubts after Khashoggi Death”, Financial Times, 12 December 2018, https://www.ft.com/content/c24ab1d4-f8a7-11e8-8b7c-6fa24bd5409c (both accessed 5 February 2019).

- 22

-

“Saudi Arabia Resets Renewable Energy Goals”, Power Technology (online), 22 January 2019, https://www.power-technology.com/comment/saudi-renewable-energy-targets/ (accessed 5 February 2019).

- 23

-

Sarah Algethami, “Saudis Set for $11 Billion Asset-Sale Blitz after Slow Start”, Bloomberg, 13 January 2019, https:// bloom.bg/2YMWUlP (accessed 5 February 2019).

- 24

-

Kingdom of Saudi Arabia, The Public Investment Fund Program (2018–2020), 2017, https://www.pif.gov.sa/style%20 library/pifprograms/PIF%20Program_EN.pdf (accessed 8 May 2019).

- 25

-

Jean-Francois Seznec, “Saudi Arabia’s Sell Off of Aramco: Risk or Opportunity?”, Bulletin of the Atomic Scientists 72, no. 6 (2016): 378–83 (379).

- 26

-

The responsibilities of the PIF in implementing “Vision 2030” are set out in the key document itself (Vision 2030 [see note 2], 42) and the four objectives defined in the Public Investment Fund Program (see note 24), 12–15.

- 27

-

For a typology of the organisational models of SWFs, see Abdullah Al-Hassan, Michael Papaioannou, Martin Skancke and Cheng Chih Sung, Sovereign Wealth Funds: Aspects of Governance Structures and Investment Management, IMF Working Paper WP/13/231 (Washington, D.C.: International Monetary Fund [IMF], 2013), 10ff.

- 28

-

Matthew Martin, “Saudi Wealth Fund to Cut Back on Lending in Transformation Plan”, Bloomberg Quint Business News (online), 11 October 2016, http://www.bloombergquint. com/business/saudi-wealth-fund-to-cut-back-on-lending-in-transformation-plan#gs.jh5UT6Fn (accessed 14 February 2019).

- 29

-

See Kingdom of Saudi Arabia, The Public Investment Fund Program (2018–2020) (see note 24), 22f.

- 30

-

Andrew Torchia, Stephen Kalin and Marwa Rashad, “Saudi’s PIF Invested in 50–60 Firms via SoftBank Fund”, Reuters, 23 October 2018, https://www.reuters.com/article/us-saudi-investment-pif/saudis-pif-invested-in-50-60-firms-via-softbank-fund-director-idUSKCN1MX12X (accessed 15 January 2019).

- 31

-

See Kingdom of Saudi Arabia, The Public Investment Fund Program (2018–2020) (see note 24), 21.

- 32

-

With the exception of the period between 1962 and 1975, the Ministry was not run by members of the ruling family, but by technocrats, see Stig Stenslie, Regime Stability in Saudi Arabia. The Challenge of Succession (Abingdon and New York, 2012).

- 33

-

See decree 270/2015 (in Arabic), with the author.

- 34

-

Further administrative and financial independence was granted to the fund by an amendment to the law in December 2018, which does not appear to have yet entered into force, see Robert Anderson, “Saudi’s Shoura Council Approves Law Granting the PIF Greater Independence”, Gulf Business (online), 6 December 2018, https://gulfbusiness.com/ saudis-shoura-council-approves-law-granting-the-public-investment-fund-greater-independence/ (accessed 15 January 2019).

- 35

-

Al-Hassan et al., Sovereign Wealth Funds (see note 27), 10ff.

- 36

-

See “Public Investment Fund – Board Members”, Public Investment Fund (online), https://www.pif.gov.sa/en/Pages/ Leadership.aspx (accessed 15 January 2019).

- 37

-

The founding of the Decision Support Center was announced in the “Vision 2030”, see Vision 2030 (see note 2), 83. The Center, which is barely visible from the outside, is located directly at the royal court and apparently serves as the crown prince’s central advisory body. In the operative implementation of the “Vision 2030”, the Center therefore plays a decisive role; see interviews by the author with Saudi analysts, Berlin and Riyadh, June and July 2018.

- 38

-

See also “Biography: Yasir O. Al-Rumayyan”, SoftBank Group, https://group.softbank/en/corp/about/officer/

al-rumayyan/ (accessed 15 January 2019). - 39

-

For the IMF recommendation, see Al-Hassan et al., Sovereign Wealth Funds (see note 27); for the governance structure of the PIF, see Kingdom of Saudi Arabia, The Public Investment Fund Program (2018–2020) (see note 24), 25ff.

- 40

-

“Saudi Arabia’s PIF Hires Former IFC Official As Chief Economist”, Reuters, 17 March 2019, https://www.reuters.com/ article/saudi-pif/saudi-arabias-pif-hires-former-ifc-official-as-chief-economist-idUSL8N2140BF (accessed 9 May 2019).

- 41

-

Rory Jones, “Expats Flee Saudi Fund, Bemoan Crown Prince Control”, The Wall Street Journal, 31 December 2018, https://www.wsj.com/articles/expats-flee-saudi-fund-bemoan-crown-prince-control-11546257600 (accessed 15 January 2019).

- 42

-

See Kingdom of Saudi Arabia, The Public Investment Fund Program (2018–2020) (see note 24), 25.

- 43

-

Andrew England and Simeon Kerr, “How the Kashoggi Killing Threatens the Prince’s Project”, Financial Times, 22 October 2018, https://www.ft.com/content/227c99dc-d2b5-11e8-a9f2-7574db66bcd5 (accessed 8 May 2018).

- 44

-

See Kingdom of Saudi Arabia, The Public Investment Fund Program (2018–2020) (see note 24), 12.

- 45

-

See Sovereign Wealth Fund Institute, “Sovereign Wealth Fund Rankings by Total Assets”, updated November 2018, SWFI (online), https://www.swfinstitute.org/sovereign-wealth-fund-rankings/ (accessed 15 January 2019).

- 46

-

Andrew Torchia, “The Mysterious (and Continuing) Fall in Saudi Foreign Reserves”, Reuters, 27 June 2017, https://reut. rs/2JBxRyt (accessed 15 January 2019).

- 47

-

“Custodian of the Two Holy Mosques Directs to Allocate SR 100 Billion from Kingdom’s Reserves for PIF Account”, Saudi Press Agency, 30 November 2016, https://www.spa.gov.sa/ 1564833?lang=ar&newsid=1564833 (accessed 15 January 2019).

- 48

-

Simeon Kerr, “The Saudi Reshuffle: Five Key Reforms in Riyadh”, Financial Times, 9 May 2016, https://www.ft.com/ content/0a8bd756-15c6-11e6-b197-a4af20d5575e (accessed 15 January 2019).

- 49

-

Ben Hubbard, David D. Kirkpatrick, Kate Kelly and Mark Mazzetti, “Saudis Said to Use Coercion and Abuse to Seize Billions”, New York Times, 11 March 2018, http://www. nytimes.com/2018/03/11/world/middleeast/saudi-arabia-corruption-mohammed-bin-salman.html (accessed 15 January 2019).

- 50

-

Holly Ellyatt and Hadley Gamble, “‘Saudi Arabia Is Different Today’: Kingdom Seeks to Reassure Investors after Corruption Crackdown”, CNBC, 24 January 2018, http://www. cnbc.com/2018/01/24/saudi-arabia-seeks-to-reassure-investors-after-corruption-crackdown.html (accessed 15 January 2019).

- 51

-

Andrew Leber and Christopher Carothers, “Is the Saudi Purge Really About Corruption?”, Foreign Affairs, 15 November 2017, https://www.foreignaffairs.com/articles/china/2017-11-15/saudi-purge-really-about-corruption (accessed 15 January 2019).

- 52

-

“Cash Settlements from Saudi Purge to Continue in 2019”, Arabian Business (online), 20 December 2018, http:// bit.ly/2VYdBOk (accessed 15 January 2019).

- 53

-

“Saudi Anti-corruption Drive: Prince Miteb Freed ‘after $1bn Deal’”, BBC News, 29 November 2017, https://www.bbc. com/news/world-middle-east-42161552 (accessed 15 January 2019).

- 54

-

“Attorney General: Total Number of Subpoenaed Individuals Reached 381”, Saudi Press Agency, 30 January 2018, https://www.spa.gov.sa/viewfullstory.php?lang=en&newsid=

1714970 (accessed 15 January 2019). - 55

-

Hani Halawani, a member of the management of Sanabil Investments, an investment arm of the PIF, has been appointed head of this new institution, see Matthew Martin, Patrick Winters and Jan-Henrik Foerster, “Saudi Arabia to Set Up Entity for Assets Taken in Crackdown”, Bloomberg, 12 December 2017, http://www.bloomberg.com/news/articles/2017-12-12/saudi-arabia-said-to-set-up-entity-for-assets-taken-in-crackdown (accessed 15 January 2019).

- 56

-

Vision 2030 (see note 2), 42.

- 57

-