A New Hydrogen World

Geotechnological, Economic, and Political Implications for Europe

SWP Comment 2021/C 58, 16.12.2021, 8 Seitendoi:10.18449/2021C58

ForschungsgebieteThe global implications of a switch to hydrogen (H2) are far-reaching, as hydrogen will, at least in part, gradually replace the oil and gas trade, and new international trade flows will emerge. In addition, hydrogen will transform the industry, and its use will have disruptive effects that reshape the economic geography. Policymakers are being called upon to make far-reaching, fundamental decisions that will decisively shape the contours of the hydrogen world. Germany and the European Union (EU) should consider the geo-economic and political consequences when setting the course.

H2 is not an end in itself – it primarily serves the goal of climate protection, and climate-neutral H2 will play an important role in the transformation. According to studies, a large part of the demand in Germany will have to be covered by imports. The raw numbers for current energy consumption in Germany of around 2,500 terawatt hours (TWh) – of which only around 560 TWh are accounted for by electricity – also speak for themselves. Thus, a significant amount of chemical energy is kept “in stock” in infrastructures such as gas grids, storage facilities, refineries, and filling stations. This flexible availability stabilises and secures the delivery of electricity, heat, and energy supply and must largely be replaced with electrons. System stability will require new climate-neutral solutions.

Energy efficiency, the expansion of renewables, and electrification must be prioritised, but not necessarily in that time sequence. More importantly, climate-neutral H2 must be adopted as quickly as possible in order to achieve a rapid reversal in greenhouse gas emissions.

Hydrogen is also considered indispensable as a storage medium for a deep and rapid decarbonisation as well as for sector-coupling. H2 will be used primarily in hard-to-electrify sectors such as chemicals, steel, aluminium, and cement, as well as in oil-refining, petrochemicals, and the production of fertilisers. In the medium term, there will also be no alternative to the utilisation of hydrogen derivatives in aviation, shipping, and heavy-goods transport.

In 2019, the International Renewable Energy Agency (IRENA) described how the energy transformation is creating a new world. Given the dynamics of H2, a new hydrogen world is emerging, and how Europe positions itself for this transformation is an urgent matter.

Trendsetting Political Decisions

According to the International Energy Agency (IEA), there are major political decision-making and regulatory gaps when it comes to hydrogen. In order to successively use hydrogen and its derivatives, the scale-up of production and a cost degression similar to that for renewable energies are also necessary for electrolysers. The cost differences to fossil fuels and the H2 that is generated from them are still too high. The technologies are largely available, but they need to be scaled up, and supply chains and business models need to be built.

Therefore, during these early stages of a hydrogen economy, political decisions are needed to tackle the “chicken or egg” dilemma: Supply and demand must be aligned, and the logistics in between, that is, transport and storage, should be free of bottlenecks.

Politicians will have to decide whether the type of production, that is, the “colours”, or the “greenhouse gas content” is the decisive factor. Along with Japan and Korea, the United States (US) is promoting a technology-open approach. For the ramp-up over the next five years, the US is defining clean hydrogen as a level of carbon intensity that is equal to or less than 2 kilogrammes of CO2 equivalent per kilogramme of H2 produced at the production site, and it is granting tax credits for its production. The focus in Germany, on the other hand, is on green hydrogen from renewables, which is the only option allowed as part of the sustainable energy mix to be achieved by 2050.

Politics also set the framework for where H2 and its derivatives can be used. In the “merit order” of climate protection, H2 should primarily be used in sectors that are difficult to decarbonise, such as the steel industry. From this perspective, the extent to which it is used in the heating sector and passenger transport is highly controversial. On the one hand, the speed in emissions savings should not be ignored when considering a deep decarbonisation. There is an obvious trade-off between depth and speed of decarbonisation in many cases. On the other hand, technological “leap-frogging” is difficult to realise without intermediate steps. For instance, the steel industry requires substantive quantities to be ready for delivery at an early stage. In order to achieve that, it is not only necessary to establish production facilities at home and abroad, but also to quickly purchase small and increasingly greater quantities to build up the logistics chain in between.

Whether climate-neutral H2, ammonia, methanol, or synthetic Fischer-Tropsch products are used will also depend on their application. Once established, supply and logistics chains create market hurdles. At the same time, assets are at risk of being stranded if other utilisation pathways, logistics chains, or transport vectors are developed. In this context, the costs now assumed are an important – but only one – yardstick, in addition to speed and volume. Those who quickly establish an entire route will shape the contours of the market.

The central issue here is certification. Technical norms and standards are used to define leading markets and technology pathways as well as project designs, business models, and opportunities for partner countries.

In addition, there is a political balance to be struck on how much state intervention in the market is necessary or desirable. Other countries rely on mercantilist measures and have semi-state-owned enterprises as vehicles for bilateral hydrogen projects along the entire value chain in order to quickly establish supply and logistics chains.

For Germany and the EU, the challenge is to match supply and demand under existing internal market regulations and unbundling requirements. This raises the question of how, in this initial phase, the principles and modes of operation of the European internal market can be swiftly implemented in an EU hydrogen market and union, and how at the same time imports can be secured.

H2 Value Chains

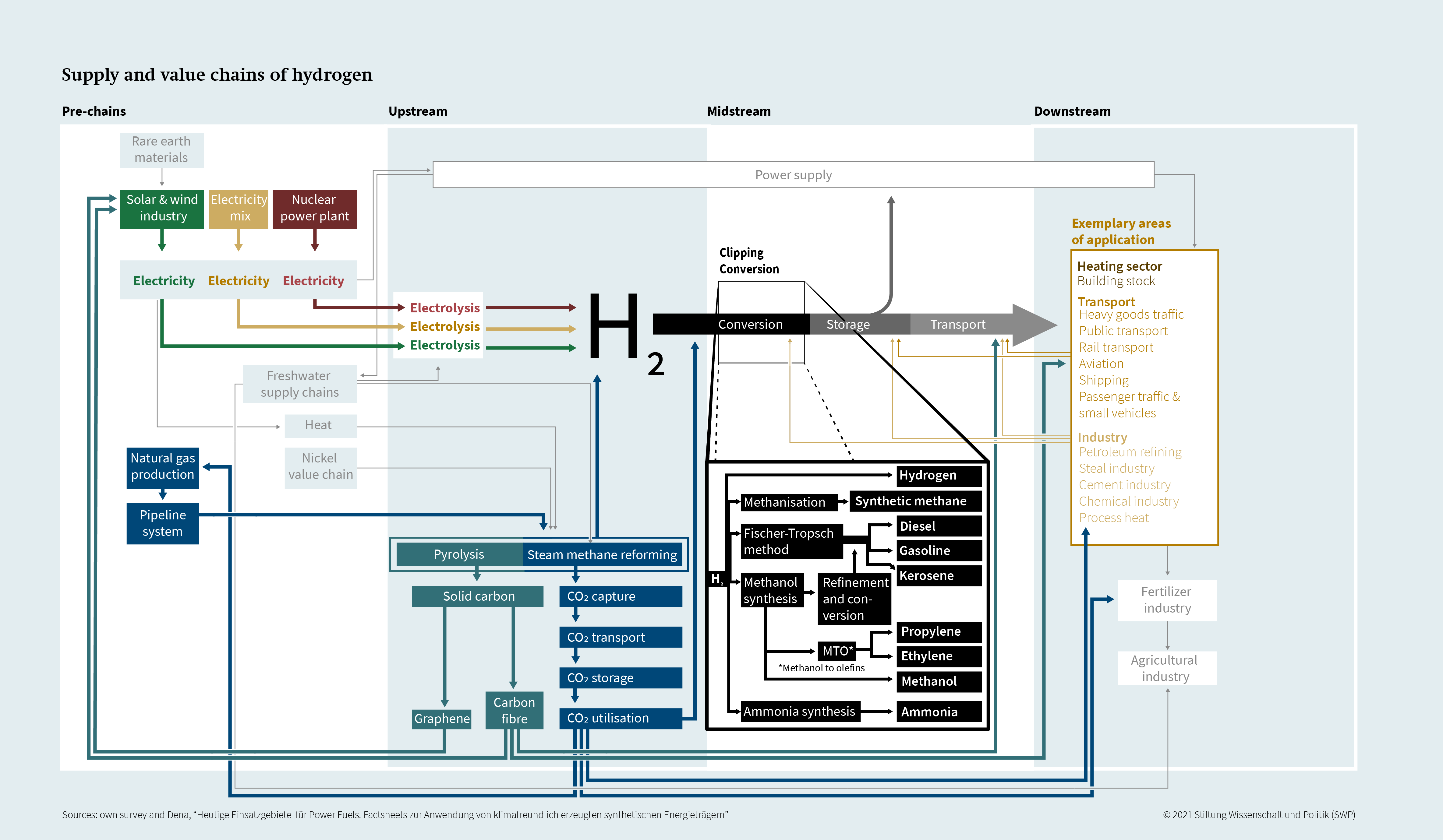

As the diagram shows, H2 can be distinguished along a colour spectrum: Grey hydrogen is produced using fossil fuels; yellow hydrogen relies on a country’s electricity mix; red or pink uses nuclear power. Green hydrogen is also produced using the electrolysis process, but with electricity from renewable sources.

The supply chain of green hydrogen begins in the mining sites for rare metals and earths that are needed to build solar and wind power plants. In Germany and the EU, electricity demand could double by 2050, with electrolysers accounting for 30–40 per cent of total demand. Ramping up the market for green hydrogen thus crucially depends on a low-cost and stable electricity supply as well as enormous capacity growth rates for wind and solar energy. The total wind and solar capacity currently installed worldwide would be required to replace the grey hydrogen produced globally today with green hydrogen.

Blue hydrogen is produced from natural gas, and the CO2 released in the process is captured, stored, or used for other purposes. Turquoise hydrogen is also produced from natural gas with the help of pyrolysis, but it has a low level of technological maturity. The gas industry and supply chains for copper and palladium, which are used for nickel catalysts, are part of the preceding supply chain for blue and turquoise hydrogen. In the case of blue hydrogen, the separated CO2 must be transported and stored, or it can be used in a CO2 cycle. The pyrolysis process, on the other hand, produces solid carbon that can be used as a co-product, for example in the renewable energy chain.

In addition, 9 kg of fresh water are needed for each kilogram of hydrogen, and as much as 13 to 18 kg are needed for blue hydrogen. In arid regions, this can lead to competing uses and/or require the energy-intensive desalination of seawater (though without significantly increasing the overall costs). Food prices also depend on the cheap availability of ammonia-based fertiliser, which is a hydrogen derivative.

Only after the hydrogen has been produced are the supply and value chains of the individual technology routes identical, but they split up again during conversion into derivatives (see Figure, p. 4).

The chemical industry in particular plays a role in the upstream sector, for example in the production of catalysts, electrodes, and membranes for electrolysers, as well as polymers, coatings, carbon fibres, and absorption agents for storage and transport. At the same time, the chemical industry needs hydrogen as a raw material. The steel industry supplies hydrogen pipelines, pressure vessels, as well as green steel, for example for the automotive industry.

These examples display the close interconnection of key European industries and its landscape of small and medium-sized suppliers with the hydrogen value chain, which makes the complexity and economic scope of H2 visible. Thus, H2 is part of industry and innovation policies. Synthetic crude oils can be processed into co-products in refineries. If only co-products are imported, then this also impacts the product range and ultimately refinery sites.

The individual H2 routes create multiple and varied risks and opportunities. Some of the leading industrial nations, such as Germany, the United Kingdom, and Japan, but also oil exporters such as Saudi Arabia, already see themselves as future leaders in the hydrogen market, whether by providing key technologies or producing climate-neutral H2 and derivatives for export.

On the one hand, hydrogen use allows the importing country to shape new energy trade flows and importer-exporter coalitions in a way that rebalances energy security. Renewable energies, as the most important input, are geographically available worldwide, and electrolysers can be used both for large-scale and decentralised plants in the future. This means that many countries can be largely self-sufficient if land and water are available and the necessary technology and social acceptance are provided. On the other hand, energy-rich countries can deepen and diversify their value creation, which can translate into chain

reactions and tipping points. High-emission and easily transportable (upstream) products can be relocated to sun- and wind-rich countries. The steel and chemical industries are not only extremely energy-intensive, but are also subject to strong international competition and have closely integrated production steps. The “renewables pull” effect can lead to relocation, especially for high-emission and easily tradable products. Competition for upstream products such as ponge iron or green ammonia as well as concerns about security of supply in the various upstream chains could trigger new dynamics.

Ultimately, the world is not only facing an energy transformation, but also an industrial revolution.

Space, Market and Technology – Hydrogen As a Power Factor

Geopolitics is traditionally defined as the space-related nature of foreign policy processes. When the geographical settings (location, space, resources) “are included in a political calculation, they gain geopolitical significance” (Otto Maul).

Geo-economics differ from this in that the space-relatedness of (foreign) economic policy and energy policy processes is understood. Thus, it is about the interplay between state and non-state action on the one hand, and the reorganisation of economic and energy spaces along production networks and industrial clusters on the other.

In a world of growing confrontation between power blocs, geo-economics complement classical military power projection and define the competition over industrial production processes and their value creation. Research and development, but also logistics chains and production networks, play a central role. In addition, today’s geo-economics are characterised by competition between different political-economic systems: liberal Western systems on the one hand, mercantilist-state capitalist authoritarian systems on the other.

With regard to H2, it is significant that the market ramp-up can benefit from measures that have mercantilist features. This applies, for example, to the redirection of public investment and state aid as well as to the securing of imports through bilateral purchase agreements. The interplay of market forces and institutional frameworks is far more complex than implementing state-directed measures.

The production of H2 and its derivatives is a technology-intensive process. This has repercussions on value chains, supply chains, and production networks. States, state-owned enterprises, and private companies are no longer just competing with each other for access to raw materials and their transport routes, but also over leading markets, key components, production processes, the preservation of production sites, optimal supply-chain management, market shares and access, as well as for financial and investment flows.

“Geotechnology” focusses on the world organising itself along technology pathways. This is immanent with H2 because there are different technology routes but also downstream products. Value chains and clusters as well as transport vectors are established along these routes. The example of shipping can be used to illustrate this – engines can potentially run on ammonia or methanol. However, the decision about a supply and application chain then has an exclusive effect in terms of fleets and routes. This effect becomes even more pronounced when quality standards, norms, and leading markets are also defined in this way. This shapes internationally interlinked production networks, which also have an exclusive effect.

Differentiation effects can also result from certification systems and sustainability standards. Whether H2 production routes or CO2 content serve as a reference for certification or whether sustainability criteria set high standards for realising projects affects their feasibility and cost structures as well as market characteristics and the potential participants. There may very well be conflicting goals here between industrial and development policy, but also between diversification and the rapid implementation of large-scale projects. One may have good arguments in favour of green hydrogen with a view to climate neutrality, but the downside is the early confinement to a “playing field”, which primarily affects quantities, the establishment of transport logistics, and the partners involved. The latter must be willing to commit exclusively to this limited playing field.

Spatial and Temporal Diversity

There is a disparity in the energy transformations of individual countries in terms of the envisaged “end dates” for the respective climate targets. The EU and the US name 2050, China and Russia 2060, India 2070. This significantly determines the speed and depth of decarbonisation. In the case of H2, “first movers” will have to play a central role. Countries with the technological know-how and the necessary market size for economies of scale are in particular demand here. But the time factor is also important – not only in the race against the climate crisis, but also in the race for technologies, markets, and investments. Pioneers are taking risks here, but if they succeed, they also have every chance of exporting technologies and shaping leading markets.

A crucial question for the location of production sites and for competitiveness at present seems to be how quickly climate-neutral H2 can be made available for industry. Ultimately, the energy transformation is linked to the restructuring – or even disruption – of economic structures.

This raises the question of the necessary intermediate steps during the ramp-up. On the one hand, it is widely discussed whether blue H2 carries “lock-in” risks or whether mixing it with grey H2 is a “waste” of a precious commodity. On the other hand, it is often ignored that a “phase-in” is also needed. In the early stages, sufficient quantities will hardly be available, nor will H2 clusters be immediately connected via pipelines.

The temporal dimension is intertwined and amplified with the process of spatial differentiation and a changed map of value creation. Initially, hydrogen islands (“hydrogen valleys”) will form around industry clusters. Only the expansion of the hydrogen infrastructure (“hydrogen backbone”) will create the conditions for a networked regional market. The Important Projects of Common European Interest (IPCEI) address the “chicken or egg” dilemma at various locations across different stages of the value chain.

A regional focus is emerging in north-western Europe, geographically defined by the ports of Rostock, Hamburg, Rotterdam, and Antwerp and the inland port of Duisburg. Here there is a vast industrial cluster, the electricity and pipeline network is closely linked, and the ports are central bridgeheads in the logistics chain, which is well-connected with the hinterland. This already reveals a geographic and temporal differentiation in hydrogen development, for example between north and south in Germany, and east and west in the EU. H2 is thus also a topic for the cohesion of societies and national economies.

At the global level, new hydrogen spaces are emerging in which transactions are condensing, especially where production and consumption can be close to each other: The Americas will form a strong – largely self-sufficient – pole, having locations, land, technology openness, and know-how as well as the required industries. The same applies to China. For importers, it seems essential to establish logistics chains early on and to work on the emergence of a “commodity” market.

Fragmentation and Connectivity

From a climate policy angle, there is a clear imperative for global cooperation to advance technologies, know-how, and production quickly and globally. But spatial and temporal diversity is in the nature of a technology and market ramp-up. So in the early stages, the hydrogen world will be highly fragmented.

The strategic rivalry between the US and China, but also the increasing geo-economic competition, may cause this fragmentation to perpetuate and harden. Added to this is the end of the liberal hegemony of the West and the competition between economic systems. There is neither a level playing field worldwide, nor is there cooperation on creating a functioning marketplace according to universally valid rules as a “global good”.

H2 is increasingly playing a role in the diverse and competing connectivity initiatives: the US Blue Dot Network and Build Back Better World, China’s Silk Road, and Japan’s High Quality Infrastructure. These create techno-political and geo-economic spheres of influence. Particularly in the development phase of a global hydrogen market, these can lead to physical, infrastructural, regulatory, and financial fragmentation at an early stage. Participation and trade are determined by technical standardisation as well as by standards concerning quality, social responsibility, sustainability, and governance. This “software” of connectivity shapes the remapping of energy flows, industries, transport corridors, and pipelines.

The connectivity of hydrogen, that is, its versatility and tradability, depends on the universality of the standards on the one hand, and on their implementability on the other. In the absence of clear international standards, there are spatial and temporal uncertainties about how the fields of application and standards will develop.

This new regulatory competition manifests itself in particular between the largest power and market blocks: the US, the EU, China, and Japan. These are better positioned than others to act as technical and financial standard-setters in a global hydrogen economy. The more internationally applicable these standards are, the more positive it is for trade, transport, and planning, and the faster economies of scale will be achieved. A “technological dialogue” – for example between the EU and the US as a like-minded partner – is difficult due to different approaches to technological standards or in dealing with systemic rivals such as China or Russia.

Different competing standards could lead to fragmentation, and thus to an inefficient global hydrogen economy, which would also fuel competition. Countries that are able to enforce standards that are tailored to their economies gain advantages in their competitiveness. Countries that fail with their standards risk negative consequences for domestic companies.

Increasingly, the growing geopolitical confrontation between major powers could lead to protectionist countries sealing themselves off, pursuing reshoring for security reasons, and setting themselves the goal of technological sovereignty, which would further undermine the emergence of a global hydrogen market.

Europe in the Hydrogen World

Germany and the EU must quickly set the course for Europe to help shape the hydrogen industry as an important market.

Hydrogen Union and Green Deal. Internally, cohesion in the EU, and thus the guiding principle of a hydrogen union, is purposeful. Accordingly, infrastructure planning that integrates H2, gas, and electricity as well as the development of market and trade mechanisms is important.

The great challenge for the EU is to achieve the market ramp-up against the backdrop of its market regime with a similar speed and focus as China, Japan, or the US are providing via mercantilist and industrial policy instruments. The trick is to establish market and trade mechanisms early on and to create a business model across the value chain.

The climate protection targets and higher CO2 prices in the EU intensify the pressure on energy-intensive industries that are difficult to decarbonise in order to adapt. The extent to which the EU can put a stop to the offshoring of these industries will depend, on the one hand, on the effectiveness of a CO2 border adjustment mechanism or whether the other countries introduce CO2 prices and an emissions trading system in a timely manner. On the other hand, it will play a role as to whether and how quickly climate-neutral hydrogen becomes available and how effectively the price gap to today’s input energy is absorbed.

Resilience and sovereignty. Supply-chain resilience and technological sovereignty must also be considered. The “triad of goals” – climate protection, industrial policy, and development cooperation – present trade-offs between securing German industrial competitiveness and deepening economic cooperation with other countries. In view of the conceivable consequences, policymakers face a sensitive trade-off between strategic and socio-economic considerations. In this respect, on the one hand, technological sovereignty and strategic integration with important partner countries must be carefully balanced, and on the other hand, a global market must be established at an early stage.

In geopolitical terms, it is significant that the issue of hydrogen transport also requires supply-chain security, which in the Indian Ocean and Pacific, for example, is increasingly facing classic hard security issues such as free shipping lanes.

Compatibility and leading the market. Europe is currently a leader in key technologies such as electrolysis. China, however, could make up for this through a combination of more favourable production conditions and aggressive practices to establish its own standards. Europe’s position will therefore depend on the extent to which Brussels manages to align the wider neighbourhood with the EU via hydrogen imports, short supply chains, and climate-neutral transport and logistics corridors, while exporting stability and sustainable prosperity to the neighbourhood as well.

In summary, the EU has already formulated important instruments, but there is a need for swift implementation also within the framework of the “Fit for 55” package. Firstly, the Global Gateway Initiative should be more focussed on the EU and H2. Secondly, “H2 Global” should be international and European in scope as envisaged, as it addresses the time-critical issue of market mechanisms and business models and can offer valuable “lessons to learn”. Thirdly, certification is urgently needed for the first trade agreements, but also to set European standards internationally, or at least to ensure compatibility. Fourthly, Germany and the EU need an “external hydrogen policy” in order to bring their own climate policy and economic interests into line with the various decarbonisation pathways in partner countries and developments on international energy markets.

Julian Grinschgl is Research Assistant, Dr Jacopo Maria Pepe is Associate, and Dr Kirsten Westphal is Senior Associate in the Global Issues Research Division at SWP. This paper was produced as part of the project “Geopolitics of the Energy Transition – Hydrogen”, which is funded by the German Federal Foreign Office.

© Stiftung Wissenschaft und Politik, 2021

All rights reserved

This Comment reflects the authors’ views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

doi: 10.18449/2021C58

(revised and updated English version of SWP‑Aktuell 78/2021)