Economic Relations between the Western Balkans and Non-EU Countries

How the EU can respond to challenges concerning direct investment, trade and energy security

SWP Comment 2023/C 36, 07.07.2023, 8 Seitendoi:10.18449/2023C36

ForschungsgebieteThe economic and financial crisis of 2008 disrupted the European Union’s (EU) enlargement policy for the Western Balkans. At least since that time, the region has seen greater involvement by economic actors from non-EU countries such as China, Russia, Turkey and the United Arab Emirates (UAE). Their engagement has been most evident in the areas of direct investment, trade and energy security. Investments from these countries can increase the risk of “corrosive capital”, which could have a negative impact on the development of the rule of law and democracy in the Western Balkans. In view of a visibly intensifying rivalry between the EU on the one hand and Russia and China on the other, the question therefore arises as to how the EU can react to and strategically counteract the intensified economic interconnectedness of the Western Balkans with these actors.

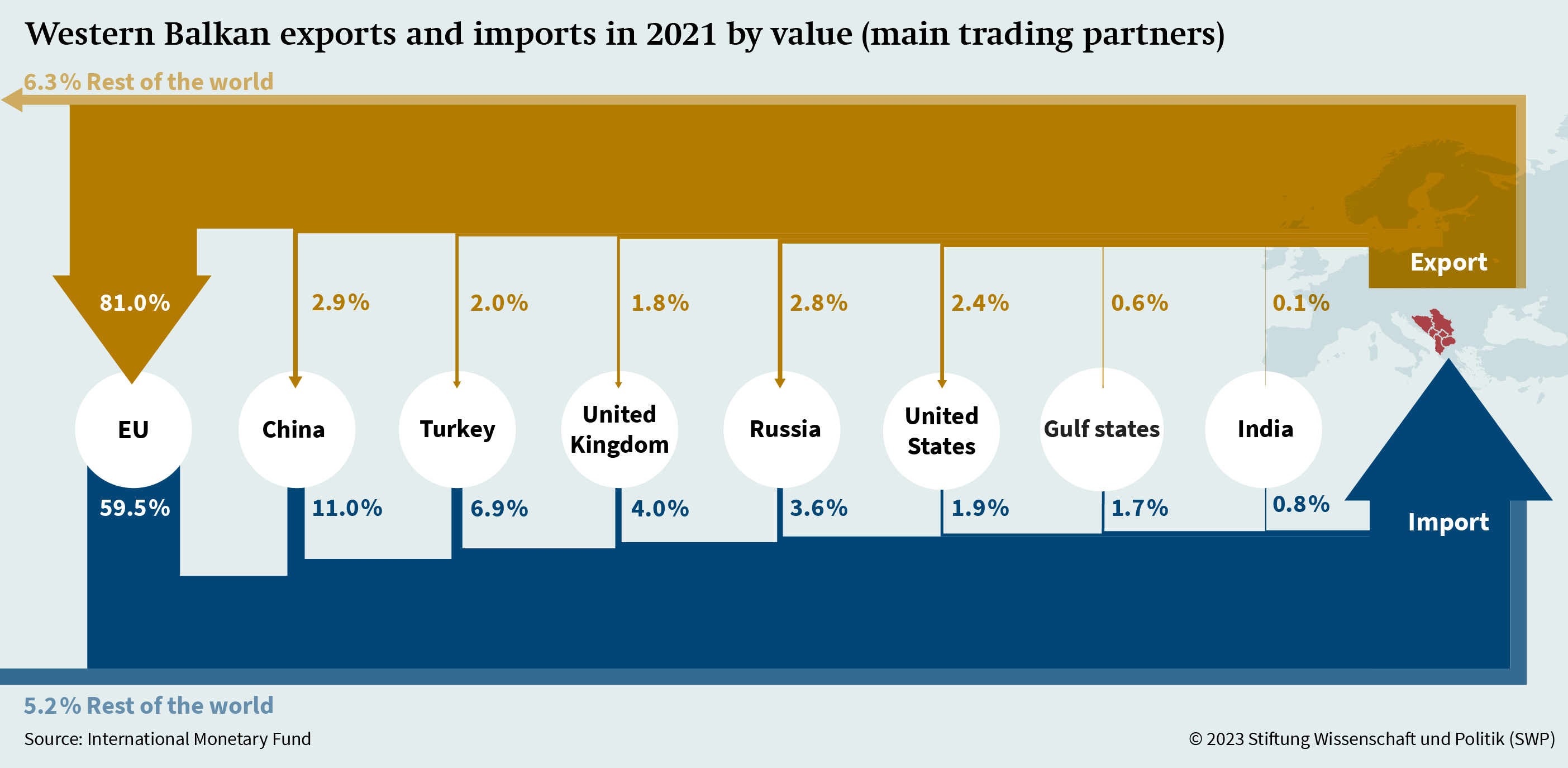

Within the framework of its Belt and Road Initiative (BRI), China is primarily active in the Western Balkans in the areas of infrastructure development, mining and the energy sector. Cooperation with the Western Balkans already takes place within the 17+1 format (after the withdrawal of the Baltic states, now only 14+1), which promotes China’s regional cooperation with Central and Eastern European countries. Russia’s investments tend to be directed towards the strategic energy sector, for example in Serbia and Bosnia-Herzegovina. Other economic partners, such as Turkey, are involved in infrastructure development or invest in the banking sector, while the UAE mainly invests in real estate. However, the economic activities of all these countries are dwarfed by those of the EU, which is the most important trading partner for the Western Balkans: For example, 81% of all exports from the Western Balkans went to the EU in 2021; conversely, the Western Balkans imported 59.5% of its goods from the EU. Similar values were also registered in the four years prior to that. In terms of foreign direct investments, companies from the EU are leading, with a share of 61% of the region’s investment stock in 2021.

However, investments from China have grown significantly over the last 12 years. More than 50% of the project budget invested by China in the countries of the former 17+1 initiative goes to the Western Balkans. Around four-fifths of infrastructure investments also go there. Between 75 and 85% of this funding consists of loans, which creates dependencies on China. Russia, in turn, is the largest single investor in Montenegro (based on volume between 2012 and 2022). The United States and Turkey also play a role in road and infrastructure investments in the region.

That the EU perceives these countries as rivals is shown, for example, by the fact that it adopted an Economic and Investment Plan (EIP) for the Western Balkans in 2020. Within the framework of its 10 flagship projects, green energy and infrastructure measures worth €9 billion as grants are to be financed from funds of the Instrument for Pre-Accession Assistance (IPA III). In addition, investments of up to €20 billion are to be secured from other international financial institutions and private investors. This is a direct response to China’s and Russia’s economic activities in the Western Balkans, as well as the Global Gateway initiative at the global level.

The fact that these countries have been able to establish themselves in the Western Balkans to this extent can be explained on the one hand by a decline in the EU’s commitment to the region. Since 2009 at the latest, the EU has been in a permanent crisis and has therefore had to focus on other issues. This is also reflected in the fact that the IPA II funds (2014–2020) have increased by just over €1 billion – from €11.5 to €12.8 billion – compared to the IPA I funds (2007–2013).

On the other hand, this is also a consequence of the increasingly authoritarian tendencies in the Western Balkans. In the case of economic cooperation, preference is often given to partners who neither demand reforms nor compliance with rule of law and environmental standards linked to EU procurement law. When Western Balkan countries cooperate with non-EU countries, it is also to show that they have alternatives to the EU. Local elites also use the choice of partners as political leverage to accelerate the EU enlargement process, even without making the necessary reforms. However, this strategy has only worked to a limited extent, because the enlargement process is still not moving forward, while the funds earmarked for the EIP have already been planned under IPA III and are subject to strict conditionality. However, this could change in light of Russia’s invasion of Ukraine if the EU pushes for enlargement out of geostrategic considerations and neglects the status of the reforms achieved in the Western Balkans as a criterion.

Last but not least, the political elites also derive economic benefits from this cooperation, for example those in Serbia, which even during the energy crisis in early 2022 was able to secure gas that was three times cheaper – for US$31 per kilowatt hour from Russia – whereas gas on the spot market cost US$99. In view of these developments, the EU needs to re-establish a realistic prospect of EU membership based on reforms in the Western Balkans. This would be necessary above all as a geostrategic investment in its own security and future.

But what are the political and economic effects of the economic activities of the above-mentioned non-EU countries in the Western Balkans, and what can the EU do to counteract their growing influence? To answer these questions, three important domains of cooperation need to be examined in more detail: foreign direct investment, trade relations and energy dependencies.

Foreign direct investment

Although foreign direct investment in the Western Balkans has increased significantly since the break-up of Yugoslavia, especially in Serbia and Albania, this does not seem to have contributed significantly to economic development. One possible explanation for this is the phenomenon of “state capture”: the appropriation of the state for private interests. As a consequence, profits end up in the hands of a small group of elites, but not in the state coffers. The deficient rule of law in the Western Balkans enables investments that exacerbate “state capture”. Such funds are called “corrosive capital” (which can be either in the form of equity or loans), which exploits and potentially reinforces weaknesses in the system. Close relationships among elites who circumvent the competition rules applicable to public procurement procedures contribute to the non-transparency of investment practices. The increase in investment from non-Western countries such as Russia and China exacerbates the risk for the emergence of corrosive capital.

This does not mean that such capital cannot also come from the West. This has been shown, for example, by the “Jadar” project in Serbia, initiated by the Anglo-Australian company Rio Tinto for the purpose of extracting lithium. When the project was agreed, the regular legal procedures for a project with the potential to greatly damage the environment were disregarded. The result was mass protests, and the project was eventually cancelled. A similar situation applies to the activities of the US-Turkish company Bechtel-Enka in the context of the project to build a motorway connecting Kosovo and Albania. Lobbying by the US Embassy on behalf of the company, poor planning, the lack of competitive tendering and the failure to set cost ceilings have cost Albanian and Kosovar taxpayers €2 billion for the construction of 137 km of motorway – funds that could have otherwise been invested in schools and healthcare. However, the risk of corrosive capital is greater when investments come from countries that themselves follow clientelist investment practices and do deals behind closed doors without public oversight.

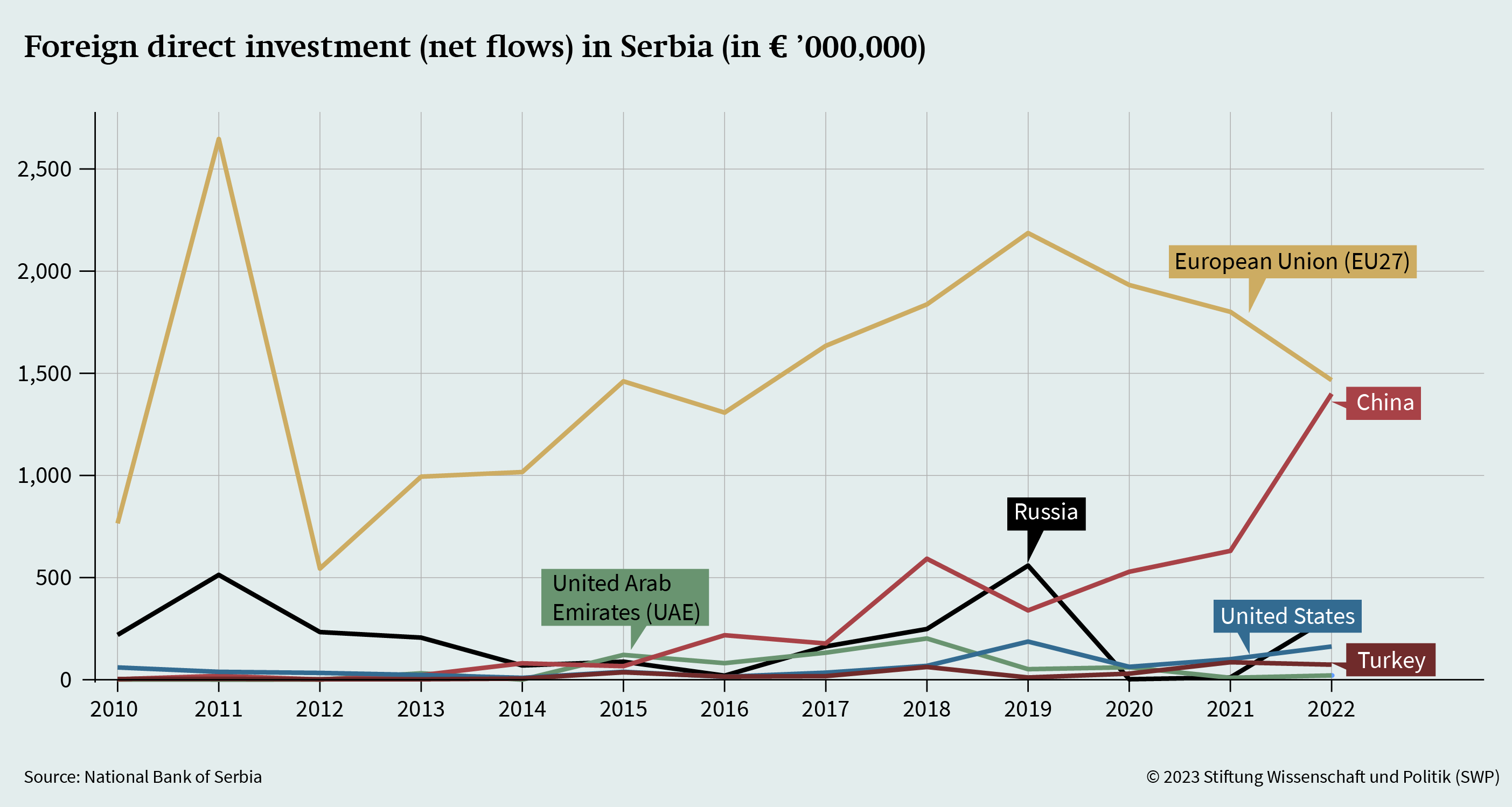

One example is investment from China, which has increased significantly in the Western Balkans over the last 12 years. In Serbia, the largest economy of the Western Balkans, the value (net inflows) of investments from China increased from €2.4 million in 2010 to almost €1.4 billion in 2022, according to the data from the Central Bank of Serbia. China was the largest single investor in 2022, with only the EU as a whole ranking just ahead of China at €1.46 billion. Investments from Russia and the EU, on the other hand, have been decreasing since 2019 (Figure 2). In Montenegro, Russia was the largest single investor in the period between 2012 and 2022 with 20.9% of foreign direct investment inflows. However, the combined inflows from EU countries surpassed that. Investment from the EU has been growing since 2021 and declining from Russian sources since the invasion of Ukraine as a consequence of sanctions and a geostrategic re-orientation of Montenegro away from Russia. In North Macedonia, Turkey stood out as the third-largest investor in 2022, with an increase of more than 100% from 2021, but still below the EU27 and the United Kingdom. For other Western Balkan countries, the picture looks more EU- and “Western”-oriented. In Kosovo in 2022, Germany, Switzerland and the United States were the largest investors, and in Albania in 2022 the largest investment inflows came from the Netherlands, Italy and Germany. In 2021, the main investors in Bosnia-Herzegovina were also countries from the EU. Hence, mainly Montenegro with its Russian investments and Serbia with its Chinese investments stand out.

Out of a total of 136 projects led by China in the Western Balkans between 2013 and 2021, 61 were implemented or agreed upon in Serbia – with a value of €18.77 billion. Bosnia-Herzegovina is in second place (29 projects worth more than €5.2 billion). Additionally, looking at China’s activities in 2020 in the countries of the former 17+1 initiative, it is clear that the total value of Chinese projects in the Western Balkans is more than half of all allocated funds (€1.4 billion in the Western Balkans, €1.38 billion in the remaining 17+1 countries). As mentioned, the majority of these investments are loans, which can reach the value of 18% of the gross domestic product (GDP) in Montenegro, 12% in Serbia, 10% in Bosnia-Herzegovina and 7% in North Macedonia.

All this data points to the growth of China’s economic engagement in the Western Balkans, especially in Serbia, which benefits the most from the investments in absolute terms. As the investments are mostly loans, countries have to provide state guarantees for the projects, which can create dependencies in strategic sectors such as energy and infrastructure.

These investments can further undermine the already fragile rule of law and also create environmental problems. The controversial Bar-Boljare highway project in Montenegro – financed by the Chinese Exim Bank and implemented by Chinese construction companies – had plunged Montenegro into a debt crisis. As a result, it needed help from the European Commission and a group of Western banks to protect itself from currency fluctuations and to be able to meet the repayment schedule. However, the project has also had negative consequences for the environment: The river Tara (a gorge of the Tara is a UNESCO World Heritage Site) had to be diverted, resulting in the deposition of sediments, which has consequences for the fish population.

Other negative examples are the Chinese investments in the Smederevo steel plant and the Bor copper mine in Serbia. In these two cities, fine particle pollution from cancer-causing air pollutants such as arsenic, cadmium, nickel, lead and cobalt is far above the permitted level. According to activists from Smederevo and Bor, the productivity of the copper mine has increased by 150% since the Chinese company Zijin took over. But they claim that the law on fine particle limits is not being respected. The Serbian government does not oblige the Zijin company to install costly pollution-reducing filters.

According to a study by the Belgrade Centre for Security Policy, the incentive for continuous economic growth in Serbia has produced an economic and political model that has led to social and economic inequalities and contributed to environmental degradation. Besides the investments from China, concrete examples also include investments from a UAE investor in the real estate project “Belgrade Waterfront” and in the Serbian airline Air Serbia. The deal for the first project was made behind closed doors in 2015 without a public tender. The Serbian government made many concessions to the UAE investor, including a 68% share in the ownership of the real estate, 99-year extraterritoriality rights over the construction land located in the centre of the capital and laws were also changed in favour of the investor. The consequences were mass protests in Serbia and the establishment of green-liberal movements. The “Air Serbia” investment, which was also agreed behind closed doors in 2013, was similar. Even though it was hailed as a significant investment, the subsidies paid in the process cost the Serbian state €88 million more than was contractually agreed just to make the company profitable.

What is the ultimate reason for the economic exploitation and environmental damage associated with these investments? It is primarily the weak legal and political structures of the Western Balkan countries rather than an investor acting “corrosively” in principle. Chinese state-owned enterprises have proven that they can build according to EU standards and win tenders, as the construction of the Pelješac Bridge in Croatia has shown. Therefore, one should take a closer look at the local legal situations in the Western Balkans instead of demonising one investor per se.

Trade relations

In contrast to foreign direct investment, trade relations of non-EU countries with the Western Balkans are not very pronounced, especially when compared to those of the EU (see Figure 1). In the period from 2017 to 2021, between 81 and 83.1% of Western Balkan exports went to the EU, but only between 2.8 and 4.2% to Russia, 0.8 and 2.9% to China, and 2 and 2.6% to Turkey. The Western Balkan countries exported between 1.4 and 2.4% of their goods to the United States, while the Gulf states hardly figure in the statistics (0.6 to 1.3%).

It is similar for the data on imports: In the period from 2017 to 2021, Western Balkan countries imported between 50.9 and 63.9% of their goods from the EU. More was imported from China (8.3–11%) than the Western Balkans exported to the People’s Republic. Imports from Russia (3.3–5.7%), the United States (1.8–2.6%), Turkey (5.3–6.9%) and the Gulf states (1–1.7%) were very low by comparison.

All Western Balkan countries have concluded free trade agreements with the EU. Serbia has also concluded such an agreement with Russia and is planning one with China. Serbia also has a free trade agreement with the United States and Turkey, although trade quotas apply in some places. All other Western Balkan countries also have free trade agreements with Turkey. Notwithstanding these agreements with external partners, the EU is both the largest import and export partner for each individual Western Balkan country (with the exception of Kosovo and Montenegro).

There is no doubt that trade relations between the EU and the Western Balkans are significant. However, a recent study by the Vienna Institute for International Economic Studies and the Bertelsmann Foundation draws attention to two important facts: 1) The Western Balkan countries do not sufficiently benefit from trade integration with the EU, since all countries – except North Macedonia – clearly run trade deficits with the EU; 2) the current model of trade integration with the EU does not contribute to the competitiveness of the Western Balkan countries. Better trade integration could be achieved by reducing non-tariff barriers (in the agricultural sector, e. g., by lifting certain import quotas) and promoting competitiveness by helping countries modernise their institutions and develop infrastructure. In addition, investing in a green and digital transition could help the Western Balkan countries to emerge as more robust economic hotspots. The large potential for renewable energy that exists in the Western Balkans is well documented. If this potential was properly exploited, the region could even export clean electricity.

Energy security

Although the region has great potential for the generation of renewable energy, the Western Balkan countries rely predominantly on lignite and crude oil for their energy supply, according to 2020 data from the International Energy Agency. The share of coal is the lowest in Albania, while that of oil is 53% (mostly from own production) and that of hydro energy 23.1% (again from own production). Albania is therefore largely self-sufficient in terms of energy resources. Hydro energy from own production has a share of 12.3% of the energy supply in Montenegro. However, a mix of coal and oil has a share of at least 60.7% of the energy supply in every Western Balkan country. In Kosovo, this share is the highest at 85%. Consequently, energy dependence on fossil fuels is very high in the Western Balkans, with most of the coal used coming from regional production in addition to being heavily subsidised.

Natural gas has a share of 11.7 and 12.5% of the energy supply in North Macedonia and Serbia, respectively. The former imports 97.5% and the latter imports 92.3% of their gas from Russia. Montenegro and Kosovo do not need gas for their energy supply, according to the statistics of the International Energy Agency. Albania and Bosnia-Herzegovina, which cover 2.1 and 2.3% of their energy needs with natural gas, import 100% of their gas from the Netherlands (statistics for Albania are from 2015) and 98.7% from Russia (statistics for Bosnia-Herzegovina are from 2021).

Energy dependencies on Russia exist above all in Serbia, North Macedonia and Bosnia-Herzegovina. Russia operates the Lukoil petrol station network in the region and controls Bosnia-Herzegovina’s oil industry. The Russian company Gazprom also still owns the majority of shares in the Serbian oil company NIS. But since the shares of natural gas in the energy supplies of these countries are not so large, the dependencies can be reduced with political will. Serbia, for example, started to diversify its gas suppliers after Russia’s attack on Ukraine and being put under pressure by the EU. For example, it is also trying to import gas from Azerbaijan, whose reserves are expected to cover the entire region’s import needs. Serbia has also reduced its dependence on Russian oil in the last eight years: In 2015, 84% of imported oil came from Russia, while in 2021 it was only 24.5%.

Not only strategic dependencies on Russia, but also a strong focus on fossil fuels are characteristic of the energy supply in the Western Balkans. In combination with increased energy prices in Europe and a higher inflation rate, this will make a green energy transition in the region more difficult. If such a transition were to happen, dependencies on Russia would be reduced. The six Western Balkan countries committed to the Green Agenda for the Western Balkans at a summit in Sofia in November 2020. The agenda includes decarbonisation and reducing the impacts of climate change, among other things, but it is unclear how effectively it can be implemented.

Political impact

The political impact of the Western Balkan states’ economic cooperation with Russia and China can be evaluated by looking at the foreign policy relations of the six states. Although most of the states are completely aligned with the EU’s Common Foreign and Security Policy (CFSP), Serbia has for years refused to support declarations that are critical of China, as the annual monitoring of Serbian foreign policy by the International and Security Affairs Centre (ISAC) makes clear. This also applies predominantly to declarations directed against Russia. The reasons for this are not only Serbia’s economic dependence on Russia and China, but also their support for Serbia’s Kosovo policy.

Recommendations for the EU

In view of the dependencies of the Western Balkan countries in strategic sectors that have been highlighted and China’s increasing, environmentally hazardous investments in the region, the question arises as to how the EU can respond to these challenges.

1. Strengthening the rule of law in the Western Balkans through gradual EU accession with a focus on the internal market.

The causes of the negative political and environmental effects of the above-mentioned economic activities are largely not to be found in the countries of origin of these investments, but in problems that exist in the Western Balkans themselves, such as weak rule of law, fragile and corrupt structures, and the maxim of “economic growth at any price”. It is therefore necessary to strengthen the principles and mechanisms of democracy and the rule of law in the Western Balkans.

However, the reform process in the Western Balkans has not progressed for years, and this has two main reasons. On the one hand, there are the intensifying anti-democratic tendencies of the elites of some countries, who see no advantages in making reforms that could endanger their power. On the other hand, there is the unwillingness of the EU to accept new members (the so-called enlargement fatigue). There is a strong interplay between both factors. In order to provide new momentum for reform in the Western Balkans, the enlargement process should offer the accession countries advantages not only at the end of the process, but also along the way. One option would be gradual EU accession.

There are at least two proposals for this: 1) the so-called staged accession model, which provides for four stages of membership, whereby the state in question would receive more money from the European Structural and Investment Funds at each stage after reforms have been completed; 2) the model of opening up the internal market before full membership, as in the cases of Finland, Sweden and Austria in 1994 in the course of their membership of the European Economic Area. The staged accession model also provides for membership in the Single Market in Stage 3. In order to join the Single Market, Western Balkan countries have to implement significant reforms in the rule of law (public procurement law, anti-corruption measures, etc.) anyway. Those Western Balkan countries that lag behind reform-minded countries due to authoritarian tendencies can also be held accountable by their own citizens. A new dynamic in the accession process based on credible and gradual economic integration with the EU would offer the prospect of tangible goals being achieved before full membership. The gradual increase in funding from the Structural Funds would also serve as an incentive for reform. In doing so, however, the EU should also apply the 2020 revised enlargement methodology and define concrete measures in case of non-compliance with EU standards (e. g. in the case of regression or stagnation in the reform process). The ultimate goal should always be full EU membership.

Finally, this change in dynamics in the accession process would not significantly burden the state coffers of EU countries. The GDP of the entire Western Balkans is comparable to that of Slovakia. If the region were to be treated financially in the same way as other member states benefiting from EU funds, this would only burden the state coffers of the member states between €1.60 and €10.80 more per capita per year.

2. Using investments in solar and wind energy as a strategic tool to counter investments from China or Russia.

The competitiveness of the six Western Balkan countries can be increased not only through deeper trade integration (which is linked to gradual accession to the EU), but also through more investment in sustainable infrastructure and renewable energy.

In the EU’s EIP, there is only one project under “Flagship 4: Renewable energy” that promotes solar or wind energy. Yet, the Western Balkans has the greatest potential in these two energy fields. An additional floating solar power plant in Albania was only added to the planning in 2022. However, the majority of the projects under Flagship 4 concern investments in hydro energy. This carries a risk in that hydropower can not only cause damage to local ecosystems, but will probably also no longer be a reliable source of energy in the future due to climate change. In Albania, it could already be noticed in 2022 that hydropower could not cover up to 85% of domestic energy production as in previous years as a result of droughts.

In the EIP’s “Flagship 5: Transition from coal”, mainly projects financing the construction of gas pipelines are supported. This will not contribute towards a transition away from fossil fuels. Although the platform for gas purchases to be made jointly by the EU and the Western Balkans has been established, a phase-out of fossil fuels must be the ultimate strategic goal. The newly announced EU-US plan to invest €3.5 billion in gas infrastructure in the Western Balkans does not serve this long-term strategy.

If it wants to counter the “dirty” Chinese and Russian investments in the mining and energy sectors, the EU should rethink its strategic priorities for green investments. Instead of promoting gas or hydropower – which should only be seen as transitional solutions – the EU should finance wind and solar energy projects in the Western Balkans. This can reduce the strategic dependencies on Russia in the long run. However, such a transition also requires – especially in the case of decentralised solar energy – the expansion of transmission and distribution grid capacities in the Western Balkans.

3. Strengthening strategic communication on the EU’s economic activities.

Green investments should also be accompanied by strategic communication. The EU should not miss the opportunity to use these investments also as a narrative tool against “dirty” investments (e. g. from Russia or China). Since the environmental movements in the Western Balkans are popular and gaining traction, this issue also resonates with the population at large. Every EU project in the Western Balkans (especially the EIP projects) should be followed by a communication strategy in order to also narratively counteract investments from China and Russia. For example, already now the majority of respondents in Serbia believe that the EU is the main economic pillar for the future; at the same time they see Russia as the most important foreign policy partner. This discrepancy in perceptions could be reduced with a broadly conceived communication strategy.

Dr Marina Vulović is a Researcher in the project “Geostrategic Competition for the EU in the Western Balkans” at SWP.

© Stiftung Wissenschaft und Politik, 2023

All rights reserved

This Comment reflects the author’s views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

DOI: 10.18449/2023C36

(English version of SWP‑Aktuell 41/2023)