Omani Hydrogen for Germany and the EU

Not just a matter of energy policy

SWP Comment 2023/C 18, 21.03.2023, 8 Seitendoi:10.18449/2023C18

ForschungsgebieteGermany and the EU plan to import hydrogen and its derivatives from the Arab Gulf states. Although Germany has signed a joint declaration of intent with the Sultanate of Oman to this end, its efforts focus primarily on Oman’s larger neighbours. However, it would be a mistake to overlook Oman’s potential role within German and European energy policy, geostrategy, and climate diplomacy. Oman’s ambitious hydrogen plans can provide Germany and the EU with affordable clean energy; and enhanced (trade) relations with the Sultanate align with a value-based approach to trade, support global climate action, and stabilise regional power balances – thus preventing the potential of dangerous conflict.

The Arab Gulf states – Saudi Arabia, Kuwait, Bahrain, Qatar, the United Arab Emirates (UAE), and Oman – have entered the spotlight of German and European energy policy in 2022. While Germany and the EU still urgently need liquefied natural gas (LNG) in the short-term, hydrogen imports will allow for the long-term decarbonisation of their industry and aviation. The Gulf states boast excellent conditions for the production of hydrogen from renewable energies thus placing them at the lower end of the global supply curve. The Gulf states can provide these resources at a lower cost and diversify the EU’s import sources, but just as important, turning to these states will also help to support the necessarily rapid development of the hydrogen market. The Gulf states offer strong financing capacities, pre-existing (export) infrastructure, short construction times, and advanced know-how in the hydrogen sector, thus allowing them to implement pilot projects quickly and reliably. For these reasons, they are also able to get exports to Europe faster than other regions.

Within this context, the Gulf states have adopted ambitious hydrogen plans and they are keen on teaming up with partners to develop technology, investment, and trade in this sector. Here, Germany has signed declarations of intent with Saudi Arabia, the UAE, Qatar, and Oman. However, throughout 2022, the German government failed to visit Oman during its trips to the region. Also, other institutions and companies seem to neglect Oman as they direct most of their attention to Saudi Arabia and the UAE. After all, when compared to Oman, these countries tend to have stronger representation in Europe and produce more oil and gas.

Nonetheless, it would be a strategic mistake to overlook Oman. The Sultanate is deeply committed to its plans – partially because its economic situation urgently requires the government to develop new sectors. Moreover, Germany’s hydrogen ambitions should consider geostrategic implications and climate diplomacy in the case of Oman. Indeed, so far, it represents an example of weakness in Germany’s management of the hydrogen sector that needs to be resolved.

Oman’s hydrogen policy: Framework and background

Oman’s hydrogen policy is embedded in the country’s overall development goals and is connected to its economy and efforts to fight climate change.

A general framework for the country’s approach to hydrogen is provided by Vision 2040 – an overarching sustainable development agenda for 2021–2040 period. This is the country’s primary strategy document, and it defines various goals as well as ways to harmonise and monitor how they are being achieved. Among those goals are economic leadership and diversification. To this end, future industries and key sectors that complement the petroleum business are being identified and developed. Within this context, Vision 2040 aims to have the contribution of non-oil sectors grow from 61 to 91.6 per cent of Oman’s economic output; it also envisions their share of the public budget doubles to 18 per cent. Oman’s green economy, especially clean energy, is to be expanded to increase the country’s competitiveness. By 2030, Vision 2040 foresees 20 per cent of Oman’s energy demand being met by renewable energy, and 35 to 39 per cent by 2040.

While this plan is not unusual for a Gulf state, its context certainly is. After 50 years in office, Oman’s Sultan Qaboos bin Said passed away in 2020. Concerns over political destabilisation did not materialise. Instead, the new ruler, Sultan Haitham bin Tariq, was able to quickly consolidate his power, and he continues to largely pursue the policies set by his predecessor. Nonetheless, he did inherit economic and social challenges. For example, in 2021, youth unemployment and the rising cost of living led to otherwise rare protests. The demonstrators’ demands included the creation of new (public sector) jobs, the removal of recently introduced taxes, and the reinstatement of previously cut subsidies; the calls for change continue to this day. However, the public’s demands for (much needed) expansionary fiscal policy is at odds with the country’s budget. Oman’s public debt is unusually high for an oil exporter; it amounts to about 50 per cent of the country’s economic output and has steadily grown since the collapse of oil prices in 2014 and the 2019 outbreak of the Coronavirus pandemic. It may continue to rise if the budget is not cut. With an annual per capita income of about €19,000, Oman is wealthy, although to a lesser extent than its neighbours. At around €39 billion, Oman’s sovereign wealth fund is relatively small, limiting its scope to engage in any game-changing investments.

Oman’s current strategic approach to the energy sector and the wider economy is therefore to limit current spending while creating mid-term prospects in promising areas. It does so through capital structure management – especially by way of leveraging – and through targeted support for future industries. First, (partial) privatisation and debt leverage provide additional liquidity and reduce current liabilities, which eases the burden on the fiscal state. For example, in 2021, concessions for developing central oil fields were transferred to a newly founded company that is state-owned albeit debt-financed. Shares in various public (energy) companies are scheduled to be sold and traded in the future. Oman sees foreign and borrowed capital as the main source of funds for hydrogen, as the Sultanate considers itself a natural resource provider first and foremost. Secondly, Oman is targeting structural unemployment by onshoring jobs, reserving positions for nationals, and by identifying key sectors for investment in the future. Alongside Vision 2040, an “In-Country Value” framework stipulates that the Omani (energy) economy must demonstrate a substantial contribution to the socio-economic development of the Sultanate. The country is pinning its hopes on the hydrogen sector, where it expects to generate 70,000 new domestic jobs.

The creation of jobs in sectors of the future is also a key element of the country’s strategy to achieve climate neutrality, which was published in November 2022. The document outlines the complete decarbonisation of Oman by 2050 along a pragmatic though ambitious path of transformation. The hydrogen economy’s central role in this vision is twofold. First, the plans intend for hydrogen to drive domestic decarbonisation in industry and transportation. Second, hydrogen is the main vehicle for the creation of the green economy and green jobs. According to the strategy, 55 per cent of the jobs created during the transformation and two-thirds of the economic growth are to come from the hydrogen economy.

The beginning of an Omani hydrogen economy

In October 2022, Oman quantified and published its national hydrogen plans. Accordingly, it aims to produce 1 to 1.25 million tonnes (Mt) of hydrogen by 2030; and 3.5 and 8 Mt by 2040 and 2050, respectively. These are colossal goals for the rather small Gulf state. As an illustration, neighbouring Saudi Arabia, which is about eight times larger in terms of its area and population, plans to produce 4 Mt of hydrogen annually by 2030; the EU-wide production target by 2030 is “only” 10 Mt per year. The Sultanate projects that achieving its goals will necessitate electrolyser capacities of 8–10 gigawatts (GW) and additional renewable power generation of 16–20 GW by 2030, while increasing these requirements to 100 GW and 185 GW, respectively, by 2050. Oman’s energy ministry estimates that €132 billion worth of investments will be required, including by way of infrastructure.

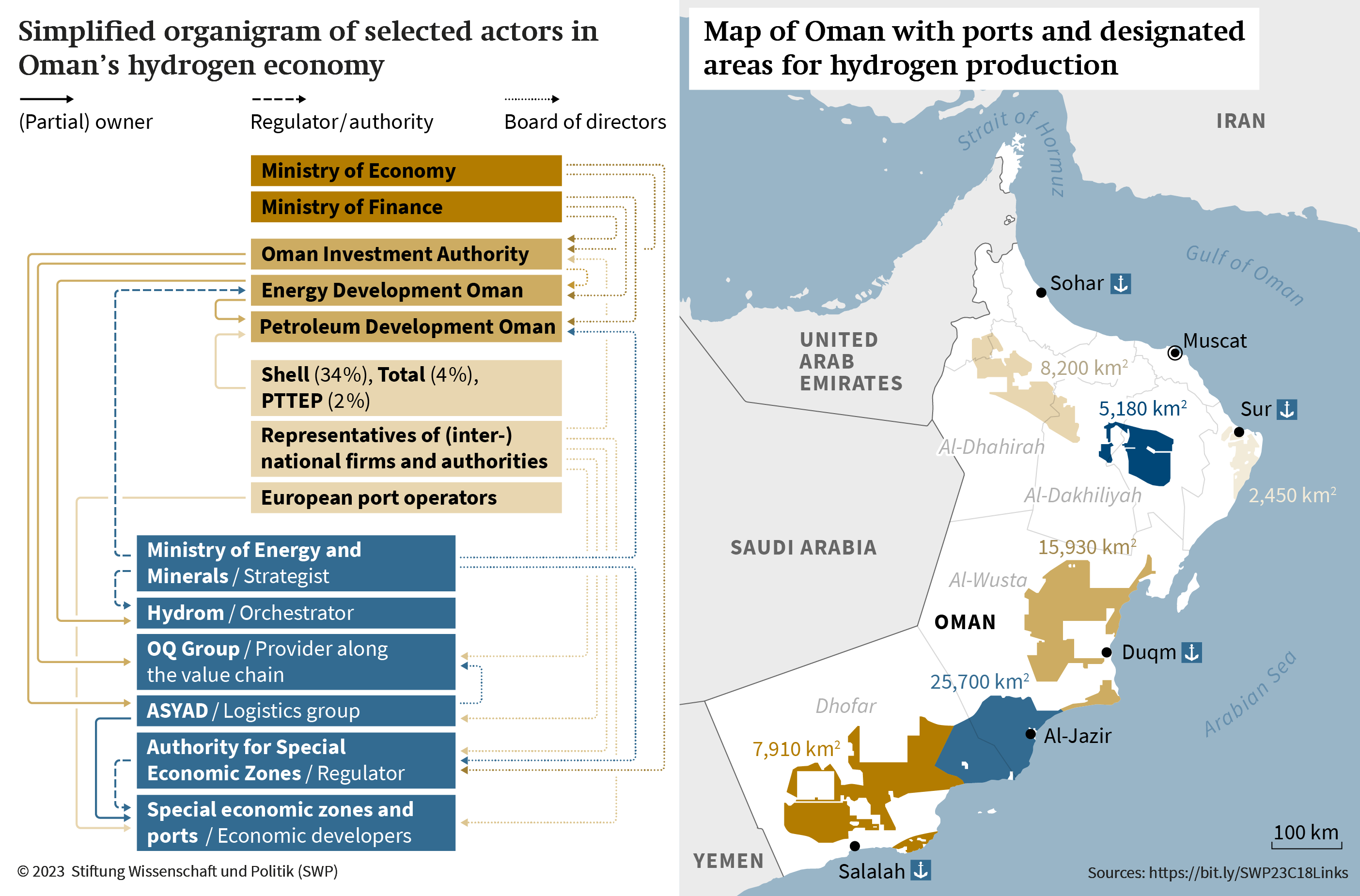

Regions suitable for hydrogen production are dispersed across the country and linked to (deep water) ports (see figure). Duqm, Salalah, and Sohar are developed industrial ports and special economic zones, while Sur is home to the Sultanate’s LNG terminals. Currently, the Omani energy ministry has pinpointed the regions around Salalah in the Dhofar governorate as well as Duqm and Al-Jazir in the Al-Wusta governorate as the sites most suitable for sustainable hydrogen production. They have favourable sun and wind conditions and are located near the coast – an important consideration as the water needed for electrolysis will be obtained from desalinated seawater. Also, their location near the coast eliminates the need for expensive transport pipelines to reach ports. Salalah (like Sohar) is an urban centre, which allows for better access to human resources.

While the construction of hydrogen infrastructure will be the responsibility of various state-owned actors and will be tendered separately, Oman calls on private international consortia to implement hydrogen production. This approach matches Oman’s general approach to the (energy) economy outlined previously.

Its plans will primarily be realised though a competitive bidding process for 47-year-long concessions for individual tracts (blocks) of land determined by the Omani royal palace. In the (current) tendering phase A, six blocks will be at stake over two rounds. The first round comprises two blocks in Duqm (see figure) that will be awarded in April 2023. Subsequently, four blocks in Dhofar enter the bidding process, which is scheduled to start in May 2023.

The procurement conditions seek to simultaneously satisfy domestic interests – primarily, participation and local development – and create attractivity for (foreign) investors. The framework stipulates certain floor prices: Any consortium must offer at least approximately €0.04 per square metre for the land lease, 5 per cent of the hydrogen produced as a royalty in-kind, and profit royalties. Moreover, the Omani group OQ, represented by its Alternative Energy unit, must be made a shareholder of at least 20 per cent of the project. Furthermore, consortia will be subject to corporate tax. Projects must be vertically integrated and contain all elements from electricity generation to producing hydrogen derivatives. The bidding rules stipulate that electricity is to be produced with a cost-efficient and dynamically expandable solar-wind mix. The consortia are at liberty to choose electrolyser technology and the kind of hydrogen derivative. However, bidders are also expected to provide (preferably binding) buyers (so-called off-takers).

|

Based on sources found at https://bit.ly/SWP23C18Links |

Ahead of the tendering phases, Oman’s Ministry of Energy has already signed numerous declarations of intent with potential importing countries, including Germany, Belgium, the Netherlands, and Japan, as well as with strategic partners such as the energy giant Shell. Beyond the open tender, some consortia have already signed land use agreements. The Hyport-Duqm project, led by the Belgian company DEME, for example, is working on producing green ammonia from 1.3 GW of solar and wind energy in the Duqm region. Coordination and cooperation within the region have been limited so far. There are declarations of intent for Saudi and Emirati investments in Oman’s hydrogen sector as well, and Kuwait’s sovereign wealth fund has also expressed interest in the past.

A distinctive aspect of Oman’s plans is the deliberate inclusion of hydrogen and its derivatives for domestic use. Authorities plan to develop a local distribution network, through which the already existing demand from the petroleum and agriculture sectors will be decarbonised. The Sultanate is actively tapping into the potential of its ports as hydrogen hubs with export and production facilities. Most importantly, the plans also consider the production and export of green steel. For example, Jindal Shadeed – the local offshoot of the Indian giant Jindal Steel and Power – plans to invest about €2.8 billion in a plant that would produce five million tonnes of steel annually. OQ has also expressed interest in setting up green cement plants. Furthermore, there are purchase agreements with the Norwegian company Yara International for the use of green ammonia as ship fuel and exportable fertiliser.

Key players in Oman’s hydrogen economy

A national network of public companies and ministries is in charge of developing Oman’s hydrogen economy. The two most central actors are the Ministry of Energy and Minerals (MEM) and the state-owned company Hydrom (see figure). MEM, whose mandate includes both the energy sector and other portions of the economy, provides political, strategic, and regulatory leadership with respect to hydrogen. Hydrom, which was founded in 2022, orchestrates the sector. Its responsibilities include arranging land concessions, developing shared upstream infrastructure, organising the bidding process, distributing product, and coordinating the various actors involved. Hydrom reports to MEM and is a subsidiary of Energy Development Oman (EDO). Since a restructuring of the energy sector in 2021, EDO also controls the national oil company Petroleum Development Oman (PDO), which is not a hydrogen actor per se, but still has strong indirect impact on the sector due to its close ties to and role in hydrogen-related committees. The royal palace, which oversees all other actors, establishes the foundations of the hydrogen economy through royal decrees and the allocation of national resources (such as land).

Other public companies and authorities primarily occupy the mid- and downstream (see figure). For example, the OQ group – a vertically integrated conglomerate of Omani companies involved in the energy sector – not only supplies infrastructure, but also develops the production of hydrogen through its Alternative Energy division. The ASYAD group – Oman’s central logistics holding company – is responsible for the maritime transport of hydrogen and its derivatives as well as the management of several export ports. These ports are individual special economic zones with strong international ties, some of which operate as joint ventures with Belgian and Dutch firms. Oman seeks to develop these special economic zones into integrated hydrogen ecosystems in the spirit of the European “Hydrogen Valleys”. The ports’ locations along the Arabian Sea – which provides direct access to major international trade routes – extends their potential as international hubs, including for hydrogen-derived fuels. The Public Authority for Special Economic Zones and Free Zones is an overarching entity that exercises regulatory power over the special economic zones and, furthermore, coordinates all downstream hydrogen infrastructure. The Hy-Fly Alliance, established in 2021, brings together public and private as well as national and international hydrogen stakeholders in a comprehensive national coordination body.

Beyond these core actors, other players are also shaping the hydrogen economy. International oil companies hold shares in the national energy industry (see figure) and have thus been able to quickly gain a foothold in the hydrogen sector. Some have already realised renewable energy projects in Oman and signed declarations of intent for joint hydrogen projects. Applied research institutes, especially the Oman Hydrogen Centre, compliment these developments with their technical and project-related studies.

In summary, the hydrogen sector exhibits a diffuse institutional structure that features complex entanglements among key stakeholders (see figure). Among these institutions, one faction is primarily influenced by MEM while another is shaped by state-owned enterprises under the Oman Investment Authority. Established in 2020, the Oman Investment Authority is the nation’s sovereign wealth fund, holding most public companies and reporting to the Council of Ministers, which is the Sultanate’s highest executive body. On the other side of the coin, public companies are guided by board members who represent a wide array of parties and interests. In this environment, despite MEM’s dominance in the hydrogen sector and the monarch’s absolute power, the hydrogen sector is comprised of deeply intertwined actors who create a unique system of checks and balances. This high degree of institutionalisation may necessitate increased coordination on the part of international partners, but it also enhances the reliability of potential collaborations.

Reasons for cooperation

The geopolitical balance in the Gulf

Aside from energy concerns – particularly, the diversified and rapid supply of affordable clean energy – it is geopolitically prudent to import hydrogen from Oman and to collaborate with the country in the hydrogen sector.

Oman plays a significant role in regional conflict prevention and mediation efforts. Omani missions have helped stabilise the region since the first Gulf War all the way through to the Iranian nuclear deal. Oman is the only regional actor with constructive relations with all nations in the region. Its role is more fluid and nuanced than (active) neutrality and often aims at preserving the status quo. During the Qatar crisis of 2017 when Saudi Arabia, Bahrain, and the UAE suspended diplomatic relations and all movement of people and goods to Qatar within a single day, Oman officially remained impartial. However, it helped to bring Qatar missing food supplies, deepened its bilateral relations with the country, and later mediated the dispute alongside Kuwait. The Sultanate has also been indispensable when it comes to the war in Yemen. It played an essential role in brokering the 2022 ceasefire and has been a major humanitarian actor in the conflict, for example by providing health care to Yemenis and transit visas to Yemeni diaspora.

By all accounts, Sultan Haitham bin Tariq plans to maintain this approach and to continue using Omani diplomats as “brokers of peace and contributors to conflict resolution”. However, Oman’s economic situation limits its capacity for peace-making: Between 2015 and 2022, the foreign ministry’s budget fell by 24 per cent, as tackling domestic socio-economic and fiscal challenges will remain the primary concern for the foreseeable future. With Vision 2040 and the climate neutrality target, Oman is placing an all-in bet on industries of the future. Oman’s national hydrogen industry will thus need to be rapid and reliable if the Sultanate is to be able to continue its constructive foreign policy engagement.

Furthermore, a successful national hydrogen economy will lead to a strong Oman, which is in Europe’s geopolitical interest. The Arab Spring has prompted the traditionally inward-looking Gulf states to adopt more assertive foreign policies, contributing to heightened hegemonic rivalry between Saudi Arabia, the UAE, and, to a certain degree, Qatar. On one hand, the smaller Gulf states, particularly Oman, serve as a buffer and mitigate confrontation between larger powers (as occurred during the 2017 Qatar crisis, for example). On the other hand, the regional diversity that they foster helps to temper others’ application of power in interregional conflicts. Recent shifts in Bahrain’s foreign policy, for example, display the consequences of a relatively smaller actor’s loss of regional autonomy. Since it sought military help especially from Saudi Arabia to combat domestic protests in 2011, its foreign policy is increasingly catering to Riyadh, and it has since actively supported regional escalations, including those seen in the Qatar crisis and the war in Yemen. A further concentration and consolidation of power among the Gulf states could fuel regional conflicts including the Cold War with Iran and the war in Yemen. The impacts of this could bleed out to cross-regional military engagement in the Levant, North Africa, and the Horn of Africa.

Moreover, and perhaps most crucially, it is essential for Germany and the EU to forge new alliances in the region. The Gulf states are on the path to becoming significant players in the global order. However, Europe (as well as the US) has long overlooked its relations with the region, leading to a decline in influence. Firstly, Europe faces challenges in representing its interests in the Gulf, as exemplified by its helplessness in preventing OPEC’s decision to not increase oil production in 2022. Secondly, an emerging and steadily solidifying Gulf-China axis poses a threat to Europe’s position in the systemic conflict between the West and China. Cooperation with Oman in the hydrogen sector can provide a strong foundation for deepening diplomatic ties with the Sultanate, thereby countering the region’s accelerating decoupling from Europe.

Value-based trade, climate diplomacy, and political risk

Germany’s decoupling from Russia has revived debates over value-based approaches to trade, its risks, and its benefits – especially with regard to energy imports from the Gulf states.

Moving beyond its orientalist “monarchy” label, Oman stands out in the region for being inclusive and moderate. Societal groups and minorities are broadly represented, and public discourse is open to competing views. For instance, Arab Spring demonstrations in the country were not met with repression but with reform. Although the parliament’s role is limited, a largely functional system of checks and balances between Omani institutions does exist. In terms of value-based trade, is it also imperative to emphasise Oman’s essential role as a meditator and humanitarian actor in the war in Yemen.

A hydrogen partnership with Oman is also matter of climate diplomacy. The Gulf states do not just export carbon dioxide in the form of oil and gas exports, but they are also the world’s largest emitters per capita. With this in mind, climate diplomacy will have the crucial task of pragmatically involving oil and gas producers in global climate action. With the exception of Qatar, all Gulf states have recently announced plans to achieve climate neutrality. Among them, Oman stands out with the most ambitious target year of 2050 (shared with the UAE), the most mature strategy, and a direct link to the hydrogen economy. A rapid ramp-up of hydrogen production may foster a quick decarbonisation of Oman’s industry. The Sultanate could thus lead the way for its neighbours: Since environmental policy among the Gulf states is characterised by national(-istic) competition, Oman’s leadership could lead to a spill over effect on the other Gulf states and, thus, be an effective means to spurring global climate action.

Most importantly, Oman has proven to be extremely predictable in its policy-making over the past decade. This consistency stands in contrast to other regional actors whose foreign policies have become increasingly dynamic. The Qatar blockade, for instance, has shown that Saudi Arabia and the UAE no longer rule out foreign policy manoeuvres that put contractual business relations at risk. Aside from such exceptions, all Gulf states are expected to honour business agreements and to provide a secure source of supply. However, shifts in policy-making are now more relevant as similar scenarios for hydrogen may be unlikely but not altogether impossible. Heightened political risks in providing stable energy supplies could also result in a loss of Germany’s ability to assert its foreign policy goals. For instance, ahead of the chancellor’s trip to the Arab Gulf in 2022, the German government softened its arms embargo that it had imposed on certain actors because of the war in Yemen. In the case of Oman, the high degree of institutionalisation, including in its emerging hydrogen economy, mitigates the risk of erratic policy-making.

Oman’s tight fiscal situation and its resultant weak credit rating do spell financial risk, but they also point to the potential of Oman offering a valuable commitment. While the hydrogen ambitions of other Gulf states are rather peripheral, a ramping-up of the sector is an essential goal for Oman in the medium-term. This is a strong driver for the realisation of Oman’s plans and explains its earnest approach to developing a robust and competitive hydrogen economy.

Conclusion: Aligning foreign policy and fast-tracked hydrogen imports

As of July 2022, Germany and Oman have a declaration of intent to collaborate in the hydrogen sector. However, progress towards its implementation is slow. This needs to change, and not only as a matter of energy policy.

Germany’s approach appears to be driven by the belief that the hydrogen market will continue to favour buyers, even in the medium-term, allowing them to continue their careful search for exporters. However, the number of buyers is rapidly growing, with Japan and South Korea charging ahead. But also, other EU countries, such as Belgium and the Netherlands, are closing deals – partially anticipating the chance to someday resell hydrogen to Germany at a higher price. Exporters are also increasingly aware of their popularity, which could drive prices up instead of down. Critically, bottlenecks in electrolyser construction will initially make renewable hydrogen a scarce commodity.

With all of this in mind, Germany should coordinate public and private actors to acquire hydrogen imports as soon as possible if it wishes to prevent high prices and further deindustrialisation. In addition to its current approach, joint ventures with other EU member states could help, especially with the Netherlands, Belgium, and Italy. Such cooperative formats create synergies and prevent disparities in energy prices and competition within the EU. Furthermore, joint concession agreements involving the private sector could be formed within the framework of direct intergovernmental cooperation. This would support the expansion of German and European technological leadership in hydrogen and, at the same time, ensure hydrogen imports. The German government should also not shy away from taking a more proactive role in securing hydrogen, even in the form of a strategic reserve, for example.

At the same time, hydrogen imports can and should be linked to geopolitical, value-based, and climate diplomacy goals. Strengthening the national hydrogen economy of Oman also serves global efforts to fight climate change, promote regional stability, and establish key diplomatic partners for Germany. Moreover, Oman stands out as a regional conflict mediator with low political risk. It would also benefit Germany, as well as global climate efforts, to have Oman produce green goods, such as steel and maritime fuel, in the centre of the heavily travelled EU-China transport corridor. However, importing hydrogen from Oman would entail the same problem that befalls all potential imports from outside the EU neighbourhood: How far can the cost of maritime hydrogen transport truly fall, and how easy will it be to use hydrogen derivatives such as ammonia?

It would be advisable for Germany to establish a permanent hydrogen task force between its Federal Foreign Office and Federal Ministry for Economic Affairs and Climate Action. Such an instrument would facilitate successful collaboration and allow for the effective assessment of future partnerships against criteria of energy economics and foreign policy alike.

In addition to ramping up the sector, Germany’s hydrogen import strategy should pay close attention to long-term diversification, both internationally and regionally. Hydrogen from the Gulf states, especially Oman, would be a crucial enabler of this approach.

Dr Dawud Ansari is a researcher in the Global Issues Research Division at SWP. This SWP Comment was produced as part of the project “Geopolitics of the Energy Transition – Hydrogen”, which is funded by the German Federal Foreign Office.

© Stiftung Wissenschaft und Politik, 2023

All rights reserved

This Comment reflects the author’s views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

DOI: 10.18449/2023C18

(English version of SWP‑Aktuell 18/2023)