The Hydrogen Ambitions of the Gulf States

Achieving Economic Diversification while Maintaining Power

SWP Comment 2022/C 44, 21.07.2022, 8 Pagesdoi:10.18449/2022C44

Research AreasThe countries of the Gulf Cooperation Council (GCC) are mapping out agendas to kickstart a hydrogen economy. Especially Saudi Arabia, Oman, and the United Arab Emirates (UAE) are pursuing ambitious plans to supply Europe and Asia-Pacific with the carbon-friendly fuel. Numerous declarations of intent have been signed, and the first large-scale projects are under way. For the Gulf countries, hydrogen is not only a means of diversification. Since the hydrogen economy blends into the institutional and fiscal framework of the petroleum industry, it is primarily a chance for the GCC economies to maintain current economic and political power structures. While hydrogen from the Gulf is an effective tool for climate change mitigation, Germany and Europe are faced with trade-offs and open questions.

Saudi Arabia, Kuwait, Bahrain, Qatar, the UAE, and Oman – the six countries of the GCC – are home to about one-third of the world’s oil reserves and about one-fifth of the planet’s natural gas reserves. Now, the Gulf states have unveiled ambitious plans for a hydrogen economy. High solar yields and abundant land provide excellent conditions to produce green hydrogen (from renewable electricity). Equally, natural gas reserves and geology offer opportunities for blue hydrogen (produced from natural gas with carbon capture). Abundant funding, direct decision-making, and existing infrastructure make the GCC economies excellent hydrogen first-movers. However, hydrogen offers more than mere diversification for the Gulf countries: It allows them to maintain economic and political power even in a decarbonised world.

Hydrogen policy in the Arab Gulf states

In October 2021, Saudi Arabia’s Minister of Energy, Abdulaziz bin Salman al-Saud, announced the goal of becoming the world’s largest hydrogen producer. A formalised hydrogen strategy does not exist; however, the country’s hydrogen policy is closely linked to Vision 2030, which was published in 2016. The vision assumes a holistic transformation of Saudi Arabia and is considered a key project of Crown Prince Mohammed bin Salman (MBS). Although Vision 2030 does not explicitly mention hydrogen, its strategic goals demand significant increases in domestic value creation, non-oil exports, renewable energy, and the natural gas industry. Also the Circular Carbon Economy – a concept co-developed by Saudi actors and adopted by the G20 during Saudi Arabia’s presidency – relates to (blue) hydrogen. The framework encompasses the four Rs (“reduce, reuse, recycle, remove”), which translate into energy efficiency, carbon-neutral power generation, natural carbon reduction, and – most importantly – extensive carbon capture. The captured CO2 can be used by the industry (if demand for CO2 as a raw material can be established) or by injection into oil reservoirs for tertiary oil production (so-called CO2 flooding).

Also Oman’s Vision 2040 does not explicitly mention hydrogen but calls for a general “diversification of energy sources”. A national hydrogen strategy was announced in February 2020 and is expected soon. EJAAD, a collaboration platform between the Ministry of Oil, the Ministry of Research, and the state-owned oil company, is leading this effort. In August 2021, Oman founded the “Hy-Fly Alliance”, which brings together government agencies, the oil and gas sector, education and research institutions, and the ports of Sohar and Duqm in a joint platform. At the same time, hydrogen divisions were set up in several ministries, as well as a state-owned hydrogen company named Hydrogen Development Oman.

The UAE announced at the COP26 summit in November 2021 that it was working on a “Hydrogen Roadmap”, which aims at establishing the country as a leader in hydrogen. The UAE intends to create new value chains for the export of low-carbon hydrogen and its derivatives, as well as the hydrogen-based production of steel and jet fuel. To this end, a clear regulatory framework with suitable policies, standards, and certifications is planned. The roadmap has not yet been published, but the UAE has already set a target of 25 per cent of the global hydrogen market. The hydrogen agenda is also linked to the Energy Strategy 2050, which was adopted in 2017 and aims to increase the share of clean energy in primary energy consumption to 25–50 per cent by 2050. The UAE’s Nationally Determined Contributions (NDCs), which were updated in December 2020, refer to hydrogen as the “energy carrier of the future”.

Qatar’s approach is the opposite. The gas-rich emirate has no plans for a policy framework or measures to increase domestic hydrogen production. Instead, Qatar relies on its position as the world’s leading exporter of liquefied natural gas (LNG); the country’s strategy is to export LNG and let importers produce blue hydrogen abroad. It continues to develop relationships with importers for this purpose. Hydrogen itself is also reflected in Qatar’s NDCs, which cite it as a means to fulfil the contributions.

Kuwait has not yet adopted a national hydrogen strategy, but the government-related think-tank KFAS presented a white paper for a strategy in January 2021. Its points overlap with the overarching Vision 2035 “New Kuwait”. The white paper suggests promoting carbon capture, renewable energy, and both green and blue hydrogen production. It also advocates for the domestic use of hydrogen and intensified cooperation with other GCC countries. Although the white paper focusses on blue hydrogen, green hydrogen is more realistic, as Kuwait is a net importer of natural gas.

Bahrain’s approach to hydrogen has been hesitant. Although feasibility studies for a domestic hydrogen economy were commissioned in November 2020, the government said it only wanted to observe developments. It was not until the Industrial Strategy 2022–2026 got published in January 2022 that the production of green and blue hydrogen was declared a goal.

Key players in the hydrogen development plans

National energy ministries are at the forefront of shaping the path towards a hydrogen economy. Under the umbrella of national strategies, the ministries take the lead in striking international agreements. In Saudi Arabia, Oman, and Qatar, the ministries (or the respective ministers) thus play the central role in national hydrogen policy. In the UAE, but also in Oman, numerous alliances and committees have been established to coordinate and develop strategies.

Other important players are the national oil companies, which are closely linked to the ministries: Saudi Aramco, the Kuwait Petroleum Corporation (KPC), the Bahrain Petroleum Company (BAPCO), QatarEnergy (QE), the Abu Dhabi National Oil Company (ADNOC) in the UAE, and Petroleum Development Oman (PDO). They are vertically integrated, publicly owned companies (apart from PDO, of which 40 per cent is owned by Royal Dutch Shell, Total, and Partex, as well as a small number of Aramco shares in private hands). In addition to operating the petroleum business, their tasks also include developing and executing petroleum policy. Within this framework, they also have a mandate to design and implement hydrogen policies.

Moreover, utility companies – predominantly power and water suppliers – have a stake in hydrogen, for example to supply desalinated water or renewable electricity. Saudi Arabia’s ACWA Power, which is responsible for power and water grid investments, is a regional player in this regard.

Another key actor in the Gulf states are sovereign wealth funds (SWFs). They manage public assets developed from petroleum revenue through profit-oriented investments, but they also finance national development projects. These are the Saudi Arabian Public Investment Fund (PIF, approx. 500 bn. US$ in volume), the Kuwait Investment Authority (approx. 700 bn. US$), the Qatar Investment Authority (approx. 450 bn. US$), the Oman Petroleum Reserve Fund (approx. 1.3 bn. US$), the Oman Investment Authority (approx. 17 bn. US$), and Mumtalakat for Bahrain (approx. 17.5 bn. US$). In the UAE, the federal and complex ruling structure gives rise to several SWFs. The most relevant one for hydrogen is Mubadala, which includes sustainability and economic diversification among its goals.

Despite these favourable financial conditions, the Gulf states do not necessarily have a competitive advantage in terms of financing, because at the same time they need larger sums elsewhere: Although energy and land are abundant, water is scarce. Freshwater – a central component for hydrogen production – requires desalination plants. The additional energy for water desalination is marginal when compared to the overall cost of hydrogen production; it accounts for only around 1 per cent. However, desalination plants need billions in investments and considerably increase the capital required for developing hydrogen supply in the GCC.

Another key actor, especially in Oman, are special economic zones (SEZs). They have allocated land, infrastructure, and export-related know-how. Hydrogen plants are to be built partly in these SEZs, which is why they are involved in project design and future operations. In Oman, these are Sohar, Duqm, and Salalah. Saudi Arabia’s Neom – a controversial sci-fi utopia on the Red Sea coast, envisaged as part of Vision 2030 – will host a large-scale facility for green ammonia (a downstream fuel or transit medium for hydrogen).

Finally, selected national research institutions engage in developing the Gulf’s hydrogen economy. Examples are the Saudi University KAUST and the influential think tank KAPSARC, Khalifah University (UAE), and Sultan Qaboos University (Oman). Last but not least, international networks provide important collaboration platforms.

First initiatives for a hydrogen economy

Ambitious plans

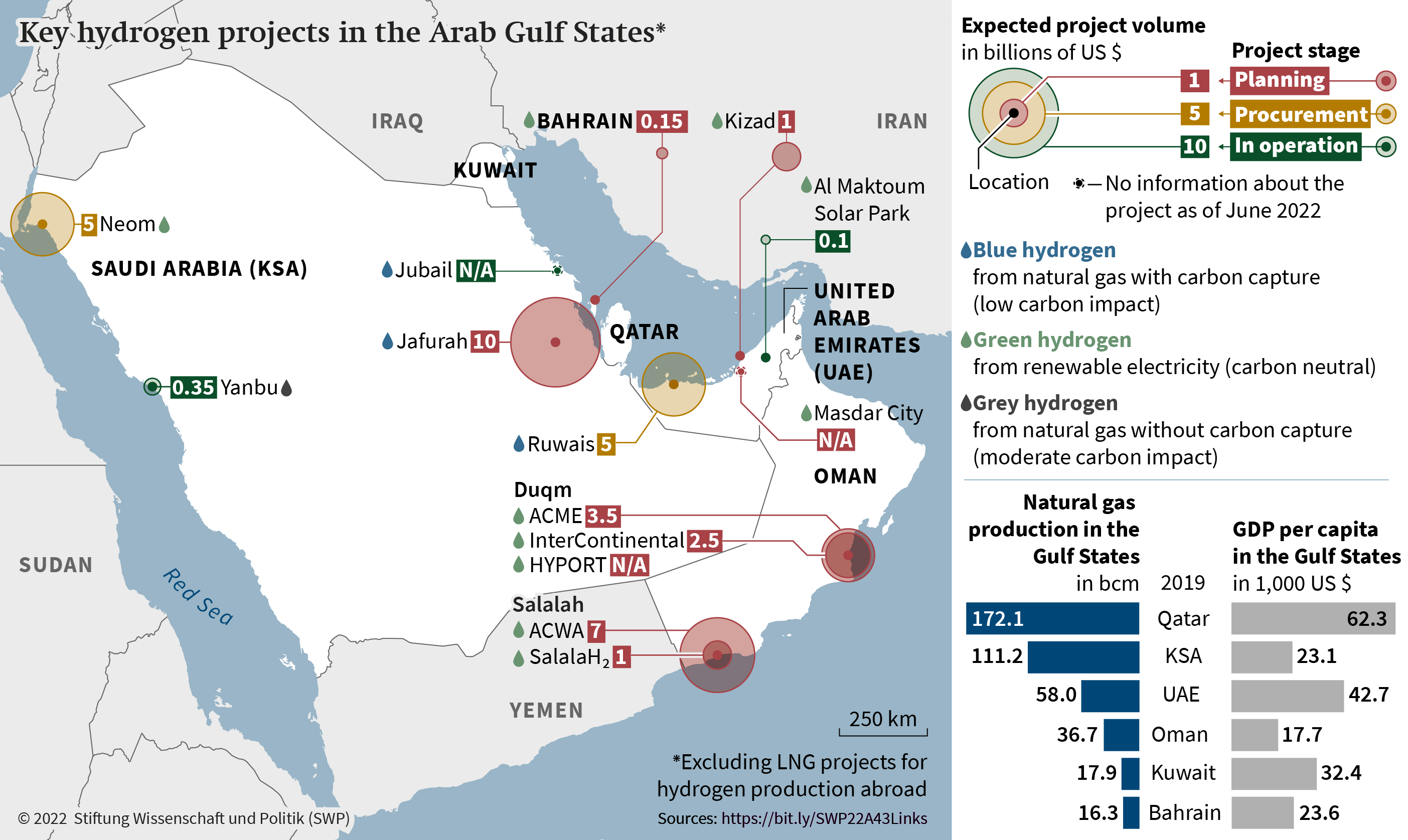

Saudi Arabia has announced several large-scale hydrogen projects, some of which have already been implemented. The Red Sea coast is of crucial importance: Saudi Arabia’s flagship project is planned for the future city of Neom (see Figure, p. 4). In collaboration with ACWA Power and US producer Air Products (which will be the exclusive distributor), the project is expected to use 4 gigawatts (GW) of renewables to produce green ammonia. German Thyssenkrupp will provide the plant’s electrolyser, which will utilise wastewater from the city.

|

Figure The sources on which the graph is based are listed under https://bit.ly/SWP22A43Links. |

Moreover, Saudi Arabia plans on producing blue hydrogen from shale gas in the country’s Eastern Province. In October 2021, officials announced that major parts of the Jafurah field, worth 110 bn. US$, will be allocated for this purpose. An existing hydrogen plant in Jubail Industrial City was upgraded to produce blue hydrogen. In January 2022 alone, the kingdom launched eight further agreements for hydrogen plants in addition to projects for hydrogen-powered vehicles to be used domestically. The energy minister even mentioned the prospective production of pink hydrogen from nuclear energy.

Oman, on the other hand, is focussing on green hydrogen. A cornerstone of its ambitions is a collaboration between the Omani oil investment company OQ, a subsidiary of the Kuwaiti SWF, and Hong Kong-based InterContinental Energy: Construction of a wind-and-solar plant with 25 GW of power and an electrolyser is expected to start in 2028. Planners envision that the plant supplies Europe and Asia via the port of Duqm (see Figure), a Hydrogen Valley of the European Union’s (EU) “Mission Innovation Hydrogen Valley Platform”.

The UAE hosts the first green hydrogen plant in the Middle East. The facility, a collaboration with Siemens Energy and local DEWA, has been in operation since 2021 and is connected to the Al Maktoum Solar Park (see Figure). Plans for a facility for hydrogen derivatives for land and air transport are underway and feature a consortium of the Mubadala subsidiary Masdar, Siemens Energy, Lufthansa, and other UAE partners. In August 2021, Emirati company Helios (a special purpose vehicle for the expansion of renewables) contracted Thyssenkrupp for a feasibility study for the production of green ammonia in Kizad. In December 2021, the French utility supplier Engie and Masdar formed an alliance to develop a green hydrogen hub in the UAE.

As far as sales are concerned, most projects have targeted Asia-Pacific so far: After Saudi Aramco and the Japanese Institute of Energy Economics made the world’s first maritime delivery of blue hydrogen in September 2020, further agreements were signed with Japan’s largest refinery company, Eneos Corporation, and South Korea’s Hyundai Heavy Industries. The latter entered a deal to import LNG, from which blue hydrogen is to be produced in South Korea. This model is also Qatar’s apparent strategy. The gas-rich emirate continues to focus on LNG exports and has already been able to broker agreements with South Korea and the United Kingdom.

Further agreements have been reached between the Saudi PIF and the South Korean companies Posco and Samsung C&T on the production of green hydrogen. South Korean companies are also planning to build a green ammonia plant in the UAE. Already in 2018, Emirati ADNOC concluded an agreement with the Japanese Ministry of Economy and South Korea’s GS Energy on ammonia as a transport fuel and on blue ammonia. Saudi Arabia also wants to cooperate more intensively with China on blue hydrogen.

Regional coordination on hydrogen policy remains questionable

The GCC states are also considering hydrogen collaborations within the region. Such ventures could help raise the necessary capital, utilise synergies, and foster much-needed specialisation. Some examples: The Saudi city of Neom is collaborating with the Emirati company Helios to expand solar energy in the kingdom. When Saudi Crown Prince MBS visited Oman in December 2021, several agreements for collaborations in the hydrogen sector were signed. Oman’s Duqm-based project is also receiving financial support from the region – from a subsidiary of the Kuwaiti SWF.

However, cooperation and coordination among the Gulf states have been notoriously unreliable and inconsistent in the past. Instead of identifying and using comparative advantages, the countries have set a course for direct competition in the development of non-petroleum sectors. A major reason is that national decision-making in the GCC is highly dependent on international consultancy companies, whose often-myopic recommendations lack regional differentiation and originality. Moreover, joint large-scale projects in the past were only of limited success. The diplomatic escalation between Saudi Arabia, the UAE, and Qatar in 2017 highlighted the deep political gulf in the region. Similar incidents occurred with other nations; given the current leadership in Riyadh and Abu Dhabi, future disruptions cannot be ruled out.

Reasons and perspectives for cooperation with Germany

Diversification and climate policy

Economic diversification is often presented as a new challenge for the Gulf states, although it has been on their agendas for half a century. For example, already Saudi Arabia’s first development plan for 1970–75 listed “diversifying sources of national income and reducing dependence on oil” as a goal. However, progress to this end has been slow – even in the UAE, which is typically perceived as a diversified economy. This stagnation stands in contrast to international climate goals: According to model estimates, containing global warming to 2°C requires that about half of the regional oil and gas reserves remain underground. Yet, so far, the Gulf states have had hardly any incentive to go beyond oil and gas.

First, petroleum accounts for 60 to 95 per cent of the national budget, depending on the country. Thus, oil and gas revenue provides a massive cash flow under direct government control. GCC nationals receive a share of that wealth in the form of income transfers, public-sector jobs, and public services. The monarchies thus consolidate their positions by maintaining (economic) stability and security. A move away from petroleum and towards other sectors and a tax-based fiscal state would disrupt this model – and the governments’ access to cash flows. The prevailing system creates a strong inertia that prevents diversification and decarbonisation.

However, the GCC’s political economy also explains why the Gulf monarchies are so keen on developing their hydrogen sectors: A publicly owned hydrogen economy can keep the status quo in power – and, hence, weaken the inertia.

Second, there is a lack of market incentives. At prices of 80 US$ per oil barrel and 0.60 US$ per cubic metre of gas, about 130 trillion US$ are stored below the Gulf. The export of oil and gas products will remain an extremely lucrative business for the foreseeable future. To put this in perspective: The production cost of a barrel of crude oil from the region averages 10 US$, and in some cases less. This places the region at the lower end of the global supply curve. Even if world demand were to decline, the GCC economies can still expect profits for decades.

Hydrogen exports can create a direct alternative to fossil-fuel exports. They can build on existing infrastructure and know-how while simultaneously advancing the decarbonisation of exports. Green hydrogen allows the GCC economies to hedge their positions against the economic and political ramifications of tightening global climate policies in the long run. However, green hydrogen will scarcely supplant fossil-fuel exports in the short term or midterm. Blue hydrogen instead creates alternative demand for natural gas reserves. Thus, and even in the short run, it prevents CO2 emissions that would arise if the gas was burnt instead. The global climate could thus benefit from exports of (especially blue) hydrogen from the Gulf.

So far, German and European climate policy has made the mistake of declaring domestic fossil fuel consumption (and unilateral reductions in it) as the central indicator of climate change mitigation; moreover, blue hydrogen has largely been ignored so far. Although the EU is a significant energy importer, other markets are open to fossil fuel exporters as well. Effective climate policy requires finding a common denominator, which means that also the interests of exporters must be considered. The current European approach of unilateralism fails to recognise that exporters are pragmatic and sometimes have the upper hand: If alternatives to the petroleum sector – such as the hydrogen economy – fail to take off, the GCC countries will sell off fossil fuel reserves at home and abroad. Ultimately, the local discourse has always considered diversification primarily as a means to an end to secure long-term prosperity.

This calculus is no secret. Saudi Arabia, for example, communicates it almost literally: In November 2021, Energy Minister al‑Saud made his country’s pledge for climate neutrality by 2060 dependent on the success of economic diversification and wealth generation. According to the minister, if necessary, declining exports due to climate policy would be compensated by increasing domestic consumption – with corresponding growth in national emissions. A similar mechanism transpired in Iran, where domestic oil consumption soared after the US introduced export sanctions.

New partnerships

In 2021, the German-Saudi Energy Dialogue yielded a memorandum of understanding that envisages the use of German technology in Saudi hydrogen projects as well as green hydrogen exports to Germany. Also, a German-Saudi hydrogen diplomacy office has been opened. A similar – albeit vaguer and less far-reaching – agreement was reached with the UAE. It includes establishing a joint task force for identifying projects and removing barriers.

In terms of industrial policy, the Gulf states, for their part, are mainly interested in specialised partnerships for individual elements of the value chain, and less in awarding contracts for entire projects. German companies are using their expertise and contributing individual components (e.g. electrolysers), but it will be difficult to compete in other branches of the value chain against specialised companies, such as US hydrogen supplier Air Products.

German efforts to reduce Russian energy imports are creating a new role for the Gulf. Germany’s Minister for Economic Affairs and Climate Action, Robert Habeck, visited the region in March 2022. In Qatar, the visit led “only” to a declaration of intent, but four cooperation projects were agreed in the UAE with the aim of producing hydrogen and transporting it to Germany. These four projects each use different technologies and are important test runs to clarify open issues. Surprisingly, and contradicting the ministry’s previous stance, the agreements explicitly include blue hydrogen; the Federal Ministry for Economic Affairs and Climate Action thus showcases an objective and value-free approach to low-carbon technology.

Conclusion and recommendations

The GCC countries are keen on hydrogen – though not all to the same extent. While Saudi Arabia initiates major undertakings with no formal framework, Oman is creating new structures and introducing various projects. The UAE has announced a policy framework and successfully realised its first ventures. Qatar continues to focus on LNG and blue hydrogen production abroad. Kuwait and Bahrain remain cautious and are sticking to investments and feasibility studies. Regarding the hydrogen colour spectrum, the Gulf states are agnostic: Oman is focussing on green, Qatar is staying with blue, and the UAE and Saudi Arabia are planning a balance between both.

However, the eventual implementation of those projects remains to be seen – big announcements without follow-ups are not unusual in the region. Also, the topic of transport is still open: ammonia, hydrogen, or continuing with LNG? For LNG-exporter Qatar, existing infrastructure may already determine the answer, but other countries are still struggling with the right strategy. Germany and the EU should adopt a unified approach to transport and, if necessary, participate instead in smaller but fully thought-out pilot projects.

The GCC governments’ strong interest in hydrogen is hardly intrinsic. Instead, it follows the goal of securing prosperity and the promise of foreign demand. Hydrogen provides the Gulf states with an opportunity to largely maintain economic and political power structures despite a global energy transition. Green hydrogen complements existing (fossil) energy exports and hedges against long-term risks. Blue hydrogen offers medium-to-long-term prospects for natural gas reserves and is therefore of great interest mainly to Qatar, the UAE, and Saudi Arabia. European hydrogen imports from the region can thus contribute to climate change mitigation on both sides of the deal.

This, however, creates two central dilemmas for Germany and the EU as prospective importers.

First, hydrogen’s ability to improve the Gulf countries’ climate compliance stems largely from its ability to secure existing power-political structures. However, this also means that hydrogen may hinder social development. The struggles of labour migrants, human rights violations, and the lack of political participation can hardly improve if the hydrogen economy stabilises current power structures. In general, citing the Ukraine war for cutting trade with Russia while simultaneously turning to autocracies that are waging war in Yemen is an inconsistent and unpleasant move. On the one hand, Germany and Europe will have to re-negotiate within their societies on where to draw the line between pragmatism and principles. On the other hand, it will be all the more important to emphasise nuances between the individual states. In terms of political monopolisation, involvement in the Yemen war, the human rights situation, and foreseeable reliability as trading partners, there are major differences between the individual Gulf states that need to be evaluated and considered.

Second, the example of the Gulf states illustrates the increasingly relevant trade-off between national and global climate action. Germany and Europe have so far restricted their focus to (carbon-neutral) green hydrogen. Low-carbon blue hydrogen may not meet European ambitions, but it can reduce the global supply of carbon-intensive fuels, and thus prevent emissions that would otherwise simply occur elsewhere. Climate change mitigation must be understood as a global cross-cutting issue and take individual perspectives into account. It cannot be established unilaterally or by brute force. Among the many problems, such an approach fails to recognise that the Gulf states, which are highly efficient oil and gas producers, can massively impede global climate action – also unilaterally. Therefore, climate policy and foreign policy need to converge and factor in the diplomatic, geopolitical, and trade-related interdependencies of global climate issues. Along these lines, Germany and the EU should question their ideological fixation with green hydrogen – an objective approach to low-carbon tech is an essential step towards feasible and effective energy and climate policy.

Dr Dawud Ansari is a researcher in the Global Issues Research Group. This SWP Comment was produced as part of the project “Geopolitics of the Energy Transition – Hydrogen”, which is funded by the German Federal Foreign Office.

© Stiftung Wissenschaft und Politik, 2022

All rights reserved

This Comment reflects the author’s views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

DOI: 10.18449/2022C44

(English version of SWP‑Aktuell 43/2022)