Ankara’s Economic Policy Dilemma

Europe’s Options for Economic and Security Cooperation with Turkey

SWP Comment 2024/C 02, 29.01.2024, 7 Seitendoi:10.18449/2024C02

ForschungsgebieteTurkish President Recep Tayyip Erdoğan began his third term in May 2023 with the appointment of Mehmet Şimşek as finance minister and the business executive Hafize Gaye Erkan as governor of the central bank. Both are widely acknowledged and experienced proponents of orthodox economics. The effect of their appointment was to return Ankara to an orthodox economic course. However, the shift in monetary policy was not backed up by structural reforms and the recovery has been meagre. Inflation remains rampant and the currency continues to fall; unresolved economic challenges create economic and political instability and could weaken the country’s security – in particular in light of Russia’s ambitions to expand its influence in the region. The consequences for the EU would be enormous. Turkey needs economic and security cooperation with Europe to secure stability without legitimising the regime’s autocratic course.

As the newly appointed Finance Minister Mehmet Şimşek declared on 4 June 2023, Turkey has no alternative to returning to a “rational economic policy”. He announced strict budgetary discipline, promised tough action to fight inflation, and called for sustainable economic development. Hopes of a course correction in Ankara were boosted when Erdoğan appointed the internationally respected financial expert Hafize Gaye Erkan as central bank governor. She stands for orthodox economic policy and sees sustainable development as the key to prosperity and economic growth.

The government’s policy shift has not resolved Turkey’s fragility problems, however. That would necessitate sweeping structural reforms – reaching beyond the sphere of monetary and budgetary policy – to improve the institutional and regulatory framework, boost productivity, investment and employment, and thus enable balanced growth. By July 2023 there were already growing signs that – despite the change in economic leadership – Erdoğan was actually clinging to his previous monetary and budgetary approach.

Eight months on, Turkey remains in a state of economic fragility, with a real risk of the debt burden spiking, the currency collapsing and the middle class facing decline. With no economic recovery in sight Turkey faces internal political destabilisation and external security weakness.

Inflation, currency depreciation and need for capital flows

The Turkish economy faces complex monetary and budget challenges. Annual inflation has been in double digits since late 2019, and is currently 64.8 per cent. The official unemployment rate is 10.2 per cent, youth unemployment 17.8 per cent; the actual rates are likely a good deal higher.

The Turkish currency collapsed again after Erdoğan won the second round of the presidential election on 28 May 2023, falling 18 per cent against the US dollar and 20 per cent against the euro within just two weeks. Despite the central bank’s interventions – six times in succession starting on 23 June – which cumulatively increased the base rate almost five-fold, the lira continued to slide. This increased the prices of many imported inputs and energy (oil and gas), exacerbating cost and demand inflation and imposing significant costs on private households.

Another imbalance demanding intervention by the economic leadership was exhaustion of the country’s foreign exchange reserves. By 12 May 2023 the Turkish central bank’s gross reserves had fallen by US$9 billion to US$105.13 billion, the lowest level since July 2022. Its net currency reserves shrank by US$4.45 billion to a 21-year low of US$2.33 billion, as demand jumped ahead of the elections. In order to stem the loss, the central bank ceased providing cheap money to commercial banks.

On 7 July 2023 the cost of Turkey’s credit default swaps (CDS) hit 503 base points (by comparison, Greece’s in 2010 was about 600 base points). This made state borrowing and refinancing immensely expensive, because the higher a country’s CDS price, the lower its creditworthiness and the more likely its default. The price of insuring loans through credit default swaps increases accordingly. Here, the orthodox monetary policy of the past seven months has borne fruit, with CDS rates falling back to 304 base points.

According to the central bank, Turkey’s current account deficit was US$7.9 billion in May 2023, and totalled US$59.96 billion for the preceding twelve months – the highest level since July 2012. Turkey’s trade deficit was US$10.5 billion in May, with only services recording a positive contribution of US$3.9 billion (of which US$3.1 billion were attributable to travel and tourism). Foreign direct investment was subdued in comparison to 2021 and 2022. Turkey increasingly attracts foreign direct investment in the form of real estate purchases; of the US$13.4 billion in FDI attracted in 2022, property accounted for US$6.3 billion.

The economic situation continues to force the Turkish government to scour the globe for investment, loans and above all capital. It was no coincidence that the first port of call for Finance Minister Mehmet Şimşek and Vice-President Cevdet Yılmaz was the wealthy United Arab Emirates. Media reports suggest that the sale of stakes in Turkish Airlines, Türk Telekom and the state gas supplier BOTAŞ were discussed.

Mollifying the financial markets

President Erdoğan advocates low interest rates and has called himself an “enemy of interest rates”. Rejecting the conventional economic teaching of raising interest rates to fight inflation, he attempted to boost the economy with cheap money, from September 2021 instructing the central bank to lower interest rates despite double-digit inflation rates.

Supporters of Erdoğan’s course believed that although falling rates would initially increase inflation and devalue the lira, this would also make Turkish goods more competitive internationally and boost exports. Imports, on the other hand, would decline as they became more expensive. Turkish manufacturers would reduce their reliance on expensive imported inputs and seek domestic suppliers instead. Import substitution, the theory went, would boost domestic manufacturing.

At the same time a weaker lira would incentivise foreign investment and tourism. Foreign currency inflows from increasing tourism, foreign direct investment and exports would compensate the negative current account and strengthen the lira – and ultimately bring down inflation.

That theory has failed to work out in practice. Inflation has remained high, the current account deficit has grown and the lira has fallen massively. The 23 June meeting of the Turkish central bank’s monetary policy committee was therefore eagerly awaited. Its decision on interest rates was expected to reveal the earnestness of Erdoğan’s economic policy turn. However, even before the meeting the president told the press that he was sticking to his theory of “low interest rates, low inflation”. The committee then decided to raise the base rate from 8.5 to 15 per cent. This was supposed to initiate a gradual tightening of the money supply to bring down inflation.

The step was welcomed as a moderate change of course, although falling short of expectations. Sceptics have rightly objected that the markets were probably not greatly influenced by the interest rate hike. The central bank continued to supply cheap funding to the commercial banks and meaningful change in interest rates for loans, deposits and bonds was not a realistic expectation.

It appears that the appointment of Şimşek and Erkan was conceived as a stop-gap, principally to create the impression that Turkey was returning to an orthodox economic course, in the sense of a policy based on conventional assumptions prioritising market mechanisms. The intention behind this was to stimulate capital inflows.

Another cause for concern was Erdoğan’s reiteration – speaking to the media on a flight back from Azerbaijan – that he was seeking loan deferments and new sources of funding. The monetary policy committee’s statement that the central bank would “continue to support strategic investment” did nothing to allay fears that it could be forced to pursue objectives above and beyond monetary stability. Apart from Erkan, all the committee’s other four members had approved past base rate reductions while inflation was rising. Their abrupt about turn on 23 June will have done nothing to restore confidence. Although President Erdoğan’s replacement of three deputy governors in July represented political backing for central bank governor Erkan, suspicions linger that he could still revoke the orthodox turn.

Socio-political dilemmas

It is worth considering the potential consequences if Turkey had reinstated the orthodox monetary policy more abruptly by increasing interest rates much more sharply. Firstly bond prices would have fallen significantly, devaluing the banks’ assets and placing them under massive pressure. Secondly the cost of borrowing would have increased immensely, raising consumer prices and reducing demand. Economic recession would have been a real possibility. Thirdly a sudden hike in interest rates would have caused a rapid exit from foreign exchange–protected accounts, increasing demand for foreign currency in an already dollarised economy and exacerbating the problem of foreign exchange liquidity. By mid May 2023 there was the equivalent of US$121.6 billion in foreign exchange-protected accounts. As of 1 January 2024 it is no longer possible to open a new foreign exchange-protected account and existing ones will not be renewed when they expire. Fourthly, a drastic interest rate hike would have greatly strengthened the lira, to the detriment of Turkey’s exports and tourism sector. Instead interest rates were increased gradually.

Three groups have profited from Erdoğan’s policy of keeping interest rates low. Cheap borrowing secured lucrative contracts for the construction sector, a weak lira made exporters more competitive, and low interest rates for credit cards, mortgages and car financing eased consumption for private households. The loss of purchasing power for low-income families was compensated by increasing the minimum wage.

All this places Erdoğan’s new government on the horns of an economic policy dilemma. If it continues to pursue strong growth it faces spiralling inflation, currency crisis and in the worst case sovereign default. If it returns to high interest rates, strict budget discipline and rigorous suppression of inflation – at the price of weaker growth – Erdoğan must expect to lose not only voters but also backers. The latter centre around businesses in the construction, tourism and defence sectors, all of which he has rewarded with cheap loans and state contracts. Minds are focussed by local elections scheduled for March 2024, where Erdoğan and the AKP hope in particular to regain control of Istanbul and the capital Ankara.

Preconditions for rebuilding confidence

Weak institutions and the reform backlog also represent impediments to restoring the health of the Turkish economy. Comprehensive structural reforms could restore confidence in Turkey and its economy. That would contribute to strengthening the lira and making the country attractive to foreign investors again.

Turkey needs inclusive institutions, democratic rules and an effective legal system. That means ensuring economic opportunities for all, free and equal access to resources, and their effective utilisation for the benefit of all. Determined action to combat corruption, proper transparency in state procurement and democratic renewal are needed too. It would also be important to improve the quality and reliability of the economic data provided by the Turkish Statistical Institute, to create a modern, inclusive and creativity-promoting education system, to improve the rights of women, and to promote their participation in society. As far as the latter two points are concerned, rejoining the Istanbul Convention would be a good first step and a positive message to the West.

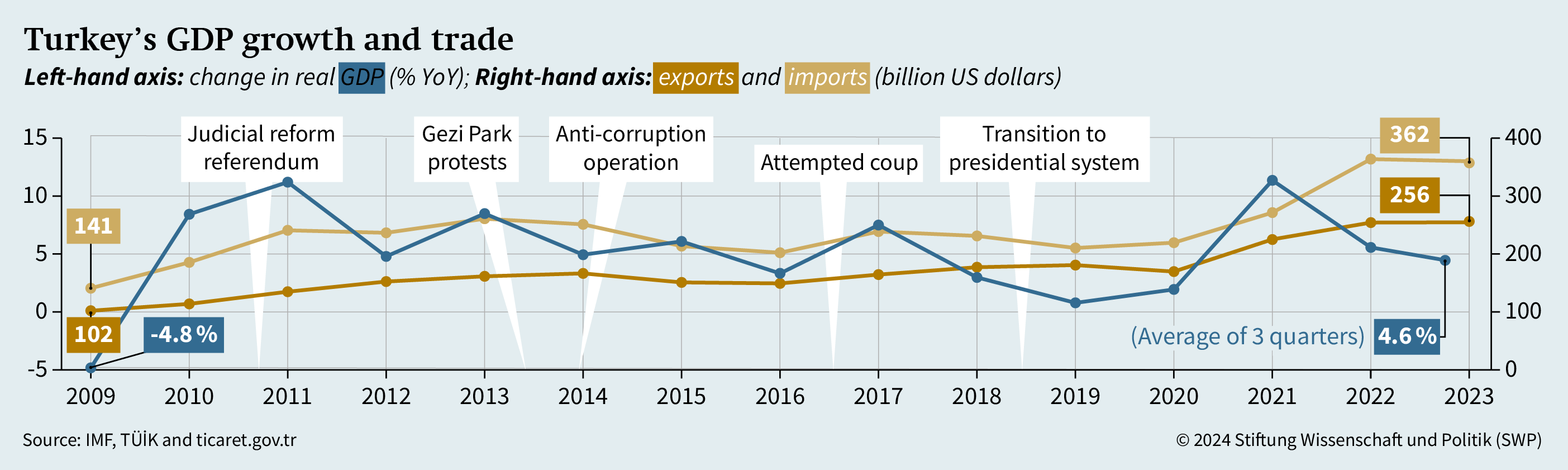

The Turkish economy stagnated over the past decade, measured in terms of growth in per capita GDP, which fell from US$12,582 in 2013 to US$10,655 in 2022. In the 2000s Turkey was still achieving average annual growth of 6 per cent, with per capita GDP tripling between 2002 and 2013. That period also saw comprehensive reforms, democratisation, adaptation to the EU acquis, and the establishment of integrative institutions and regulatory instances. The dilemma for Turkey’s leaders is political too: that kind of reform agenda conflicts with the objectives of the governing bloc and the alliance of parties on whose support Erdoğan currently depends.

Consequences of a Turkish economic crisis for the EU

As we have seen above, the Turkish economy is a long way from the road to rapid recovery. Yet any protracted crisis would have consequences for the EU’s own economy and security.

Risks to the EU’s exports and banking system

The European single market as a whole and most of the EU’s national economies are closely interconnected with Turkey. Any recession and significant loss of purchasing power in Turkey would certainly impact the German and European export sectors. The volume of EU-Turkey trade in 2022 amounted to US$207.9 billion, US$103.5 billion of which were Turkish exports to the EU. In 2023 the figure for 2022 was already exceeded by October, with a trade volume of US$210.28 billion. In 2022 trade between Germany and Turkey was worth about US$45.17 billion.

A collapse of the Turkish banking system would threaten the entire European economy. European banks – in particular Spanish, French and Italian – have accumulated exposure exceeding €100 billion. Spanish banks alone have invested €80 billion in the Turkish banking sector.

A wave of bankruptcies in Turkey’s manufacturing sector would have multiple impacts across the EU’s member states, affecting manufacturers as well as consumers. Germany is the biggest export destination for Turkish vehicles and components, for example. In 2023 the EU accounted for 68.3 per cent of the Turkish car industry’s exports (US$ 23.92 billion). Germany tops the list with US$4.85 billion, followed by France with US$4.31 billion, Italy with US$3.14 billion and Spain with US$2.43 billion. Moreover, Turkish vehicle component suppliers are crucial to European and German supply chains.

The migration issue

Turkey’s geographical location has made it a hub for migratory movements and a significant host and transit country for irregular migrants and refugees. The significant reduction in irregular entry into the EU through south-east Europe was a result of European-Turkish cooperation under the EU-Turkey Agreement of 2016. The numbers entering via the eastern Mediterranean route fell by almost 98 per cent between 2015 and 2020 (but rose again in 2021 and 2022). The agreement with Turkey also contributed to reducing the number of deaths at sea and combatting trafficking.

If economic turmoil were to plunge Turkey into political crisis – accompanied for example by anti-refugee protests and/or unrest – Ankara would be neither willing nor able to keep migration to the EU in check, nor to integrate refugees from the Syrian civil war into Turkish society. Today there are about four million Syrian refugees living in Turkey, who could potentially set off towards the EU. Another “wave” of irregular migration from or via Turkey would be politically explosive for many European governments and societies. It would also be conceivable for irregular migration to lead to escalations in Turkey’s conflicts with the Kurdish autonomous areas in northern Syria, with Greece and in the eastern Mediterranean.

If Turkey’s political and economic situation continues to worsen, increasing numbers of Turks could also plausibly flee to Germany. An increase in the numbers of refugees and traffickers of Turkish nationality apprehended at Germany’s borders has already been noted. In the first nine months of 2022 the German border police detained 5,362 Turkish citizens trying to enter Germany illegally – compared to 2,531 in 2021 and just 1,629 in 2020 (the first year of the Covid pandemic). The number of Turkish citizens seeking asylum in Germany increased again significantly in 2023. The factors driving increasing emigration include poverty, inflation and freedom of expression.

Eroding security?

Protracted economic stagnation in Turkey would also affect its security role on NATO’s southern flank, and its position as an energy hub. Here the country’s importance is predicated first on its geographical situation. Located where Europe meets Asia, Turkey controls maritime access to the Black Sea and functions as a transport corridor for gas and oil from the Caucasus and the Middle East to Europe. Its Mediterranean coast puts it geostrategically close to the sea routes between Asia and Europe. And as a member of NATO it guards the southern flank against Russia. As an important regional actor Turkey can also contribute to containing Moscow’s ambitions in the Black Sea region, the eastern Mediterranean, the Balkans and the Caucasus.

Turkey’s military capabilities also make it a significant security factor. It possesses an extensive defence industry, strong security forces and a corresponding security culture. The armed forces form a central pillar, with cross-border operations in northern Iraq and northern Syria, military interventions in Libya and the Caucasus, bases in Somalia and Qatar, and participation in multinational missions in Kosovo and Afghanistan. Any contraction in the Turkish economy would leave it lacking the resources required for ambitious military operations abroad.

NATO’s new Strategic Concept adopted in June 2022 in the aftermath of Russia’s invasion of Ukraine explicitly names Russia as the greatest threat to Euro-Atlantic Security. The Black Sea region acquires outstanding importance in this connection. Turkey’s strategy towards Russia here is largely congruent with NATO’s original approach to dealing with Moscow during the Cold War, relying on a combination of deterrence and dialogue.

While Ankara did not join the Western sanctions following Russia’s annexation of Crimea in 2014, it did not recognise the annexation either and in fact pursued military cooperation with Ukraine. Turkey’s objective here was not merely to close gaps in its own defence manufacturing capacity, but also to enhance Ukraine’s military capabilities. Upholding the strategy of deterrence and dialogue towards Russia allows Turkey to play a mediating role – for example contributing to the Russia-Ukraine Grain Agreement. Despite Turkey’s economic and energy dependency on Russia (for example for natural gas and tourism), the Turkish fleet matches Russia in the Black Sea, while the Turkish armed forces balance Moscow’s influence in Syria and Libya.

Turkey has also challenged Russia on several fronts, most recently in the Caucasus, where Moscow was forced to share ceasefire monitoring with Ankara following the 2020 war between Armenia and Azerbaijan. And the Zangezur Corridor connecting Turkey to Azerbaijan and Central Asia creates an alternative route to transport gas from the Caspian Sea to Europe, avoiding Russia. The EU can reduce its dependency on Russian raw materials to some extent by supporting Turkey’s development as an energy corridor.

Outlook and Recommendations

If Turkey ends up facing stagflation that would weaken its ability to deter and contain Russia. In that light, close cooperation between Brussels and Ankara is the order of the day. The EU’s relationship with Turkey had been complicated in recent years by developments including the Turkey’s own internal politics. Nevertheless, Turkey is a NATO member, and more important than ever for the EU’s security. As a direct neighbour and a regional power in the Black Sea and Mediterranean regions, Turkey plays an important role in managing migration routes, in counter-terrorism, in securing maritime trade routes, and in containing Russian ambitions.

Turkey’s rise to become a regional power challenging but also balancing with Russia – and also supporting Ukraine militarily – makes it a more vital partner than ever for Germany and the EU. It is therefore necessary to tie Turkey closer to the EU’s security architecture, in which NATO has an important role to play. There is also scope for cooperation on combatting irregular migration and human trafficking, for example in the scope of the European Border and Coast Guard Agency Frontex and the Standing Nato Maritime Group 2. Cooperation is also conceivable in the framework of the EU defence initiative PESCO, which permits third-country participation; Ankara has already indicated its interest.

Under these circumstances Berlin and Brussels would be advised to pursue a critical but pragmatic policy towards Turkey, taking account of the changing strategic situation and Ankara’s economic and security interests. One important step would be to modernise the EU’s customs union with Turkey. That could boost prosperity on both sides, if the agreement can be expanded to cover services and unprocessed agricultural goods, and if it were possible to improve terms for Turkish goods vehicles transiting to and through the EU member states. Turkey is also interested in being consulted on new EU customs agreements with third states. Negotiations to reform the customs union would contribute to overcoming the uncertainty among European economic actors about Turkey’s future relationship with the EU.

In the sphere of economic cooperation the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) also offer possibilities. They could provide funding for reconstruction of the regions affected by the February 2023 earthquake, making it conditional on effective action against corruption, for example in the construction sector, and transparency in state procurement. Conditionality of that nature would also address criticisms of Turkey within the EU.

In the case of Germany there are numerous state and civil society platforms for bilateral cooperation. To highlight just three of these:

-

The German-Turkish Chamber of Industry and Commerce has about one thousand members. It could play an important role in deepening cooperation in the vehicle and component, energy, machine-building and defence sectors.

-

The Joint Economic and Trade Commission (JETCO) was established in 2013 as a cross-sectoral platform aiming to improve bilateral cooperation above all in the fields of trade, industrial cooperation, tourism and infrastructure, and to develop concrete projects. It includes an annual meeting chaired by the two economy ministers.

-

The German-Turkish Energy Partnership was created in 2012 under an agreement between the Turkish Ministry of Energy and Natural Resources and the German Federal Ministry for Economic Affairs.

These three platforms could contribute to advancing the political and economic dialogue between the two countries, addressing bilateral differences and exploring further possibilities for cooperation.

Dr Yaşar Aydın is an Associate at the Centre for Applied Turkish Studies (CATS).

The Centre for Applied Turkey Studies (CATS) is funded by Stiftung Mercator and the German Federal Foreign Office.

© Stiftung Wissenschaft und Politik, 2024

All rights reserved

This Comment reflects the author’s views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

DOI: 10.18449/2024C02

Translation by Meredith Dale

(Updated English version of SWP‑Aktuell 48/2023)