Connecting Ukraine to Europe’s Electricity Grid

Technical Details and Hard Geopolitics

SWP Comment 2021/C 57, 24.11.2021, 8 Pagesdoi:10.18449/2021C57

Research AreasConnecting Ukraine to the continental European power grid and the EU’s electricity market is on the political agenda. However, establishing the necessary grid connections is technically complicated and also requires profound reforms to the Ukrainian electricity sector. But it is not only Ukraine that has to deliver; the EU and its member states will also have to make far-reaching and hugely significant geopolitical decisions. The project needs a politically coordinated roadmap that defines clear criteria and conditions for a common electricity grid.

In the joint declaration with the USA on support for Ukraine, European energy security and climate goals, on 21 July 2021, Germany politically committed itself to supporting Ukraine in natural gas matters to cushion the impact of Nord Stream 2. Berlin also intends to promote and advance the restructuring of the Ukrainian energy system and its integration into a common energy area in the longer term.

The German-American declaration consequently puts Ukraine’s connection to the European energy market very high on the political agenda in Berlin (and indirectly also in Brussels). It explicitly states that there are issues in energy policy beyond the predominant subject of natural gas.

Electricity will thus play an increasingly important role in energy policy as well as in foreign and security policy. The energy transformation will require additional electrification. EU demand for electricity could increase by 40 percent by 2050. In absolute terms, this corresponds to an increase of approximately 1,100 terawatt hours (TWh), or about twice Germany’s electricity consumption. The European Commission’s goal of making Europe a climate-neutral continent by 2050 has a logical consequence: Europe’s neighbourhood must be integrated. The implementation of the Green Deal will involve the massive expansion of the use of renewable energies. In the EU, however, there is a lack of favourable locations and social acceptance for the expansion of, for example, onshore wind farms. The EU will therefore have to rely on imports of green and climate-neutral electrons and/or molecules. Connecting Ukraine’s electricity to the synchronous continental European grid should also be seen in this context.

Big Political Words, Small Concrete Steps

Synchronisation of electricity grids has been on the agenda for some time. Negotiations began with the first memorandum of understanding (MoU) between the EU and Ukraine on energy cooperation, signed in 2005 and reconfirmed in 2016. The MoU aims at “full integration” of the EU and Ukrainian energy markets.

Moreover, Ukraine has been a member of the European Energy Community since 2011. As such, it is obliged to gradually adopt the energy-relevant parts of the EU’s acquis communautaire. Harmonisation and convergence of the energy markets is driving the energy community process.

The process has implications for all neighbouring countries. Synchronisation with the European continental grid would require measures on the EU side; Ukraine would also have to decouple from the post-Soviet Integrated Power System/Unified Power System (IPS/UPS), specifically from Russia and Belarus. Last but not least, Moldova – along with Transnistria – would almost inevitably have to switch from the IPS/UPS to the continental grid as well due to its geographical location.

In June 2017, the grid operators of Ukraine (Ukrenergo) and Moldova (Moldelectrica) signed an agreement on their future connection to Europe’s grid with the European Network of Transmission System Operators for Electricity (ENTSO-E). The agreement sets out the technical steps that must be taken in order to complete their synchronisation with the continental grid. According to Ukrenergo, the synchronisation is planned for 2023.

However, even though the agreement has initiated a process at the technical level, this does not automatically lead to direct and immediate synchronisation and market integration.

Reasons for Connecting to the European Grid

The connection of the Ukrainian grid to ENTSO-E’s grid is also a topic for discussion at the highest political level. During German Chancellor Merkel’s last visit to Kyiv in August 2021, even Ukrainian Prime Minister Denys Shmyhal promoted the synchronisation of the Ukrainian with the continental European grid.

Synchronisation is the most far-reaching form of connection, since the networks are not only interconnected but operated as a common system with synchronous phase sequence (that is, frequency and voltage). While this increases the possibilities for mutual support, it also increases the potential for contagion in the event of problems.

Ukraine is pushing for a connection by 2023 and initially wanted to break away from the Russian IPS as early as winter 2021–2022. At first, the Ukrainian power grid will be operated in island mode, meaning that it will be isolated from all neighbours and controlled and balanced by itself. Only after several test runs will it be synchronised with the continental European grid.

There are four main reasons why Ukraine is striving for synchronisation. First, it would improve its energy security: its power grid is technically dependent on frequency maintenance, which is organised by the Russian grid operator. It thus depends on the Russian electricity system, even when there is no electricity trade between the two countries. In the short term, this dependence increases the cost of disconnecting from the Russian system, as the relevant capabilities would first need to be built up in Ukraine. In the long term, however, Ukraine’s connection to the continental European grid would deprive Moscow of the opportunity to use this dependence to exert political influence in Kyiv.

Second, Ukraine could benefit from lower electricity production costs. The connection to continental Europe would give foreign electricity suppliers access to the Ukrainian electricity market. The resulting competitive pressure would create the conditions for competitive pricing in the currently highly concentrated and over-regulated Ukrainian electricity market. A solvent East-Central European electricity market would not only break up the system of monopoly pricing, but also send market-based investment signals in the longer term. Moreover, connectivity would dampen electricity price effects associated with the Ukrainian coal phase-out. If cheaper imports from the EU replaced electricity from Ukrainian coal-fired power plants at certain times, the impact on electricity prices of the phase-out (which the EU is in favour of) could be reduced to a politically acceptable level, according to a study by Low Carbon Ukraine. However, electricity prices in neighbouring countries would also increase slightly at these times.

Third, the connection could also directly promote the reduction of greenhouse gas emissions – but only if Ukraine simultaneously introduces a significant CO2 tax. In that case, synchronisation could reduce CO2 emissions from coal- and gas-fired power plants in Eastern Europe (Poland, Romania, Slovakia, Hungary and Ukraine) by nearly one-fifth annually. This corresponds to about 14 megatons of CO2 or about 2 percent of Germany’s annual emissions. Among other things, the savings would come from countries being able to sell surplus electricity from renewables to their neighbours instead of shutting down renewable energy sources.

Fourth, Ukraine generally wishes for closer ties with the EU. The synchronisation of electricity systems and the resulting possible integration of electricity markets would entail additional economic, as well as institutional, interdependence between the EU and Ukraine, which would be difficult to sever. This would accompany regulatory integration into the Energy Community, which obliges Ukraine to implement energy-related EU directives.

The EU Commission’s ambition to make Europe the first climate-neutral continent by 2050 and the implementation of the Green Deal are also a strong argument from the EU’s perspective in favour of both synchronisation and extensive integration. Ukraine could become one of the key partners for the German economy as well, which is dependent on energy imports. Wind, solar, biomass, water and large areas of land are abundant, making Ukraine an attractive source of green electricity and hydrogen.

The theoretical potential is huge, but the Ukrainian electricity system is currently barely able to generate enough electricity for its own needs. The level of investment is low, and the electricity market is characterised by oligopolies and political influence. Consequently, the country can only be an electricity exporter and energy supplier for Germany if it rapidly expands its renewable capacity, and the Ukrainian market gains stability and competitiveness through European regulation and demand. In the course of this, Ukraine could also develop new energy sources for itself.

Major Challenges

Technical Obstacles

The technical obstacles to a connection are high; a complex set of regulations applies to readying the Ukrainian grid. The technical specifications and requirements are defined by ENTSO-E. Before Ukraine can synchronise with continental Europe, all 42 ENTSO-E members, meaning the member states’ transmission system operators or TSOs, must agree. ENTSO-E will take its decision based on technical parameters, whose overall purpose is to ensure a secure flow of electricity through well-maintained and well-managed power systems. The decision-makers will include well-known TSOs such as 50hertz from Germany and Réseau de Transport d’Electricité (RTE) from France, but also smaller ones such as Landsnet from Iceland.

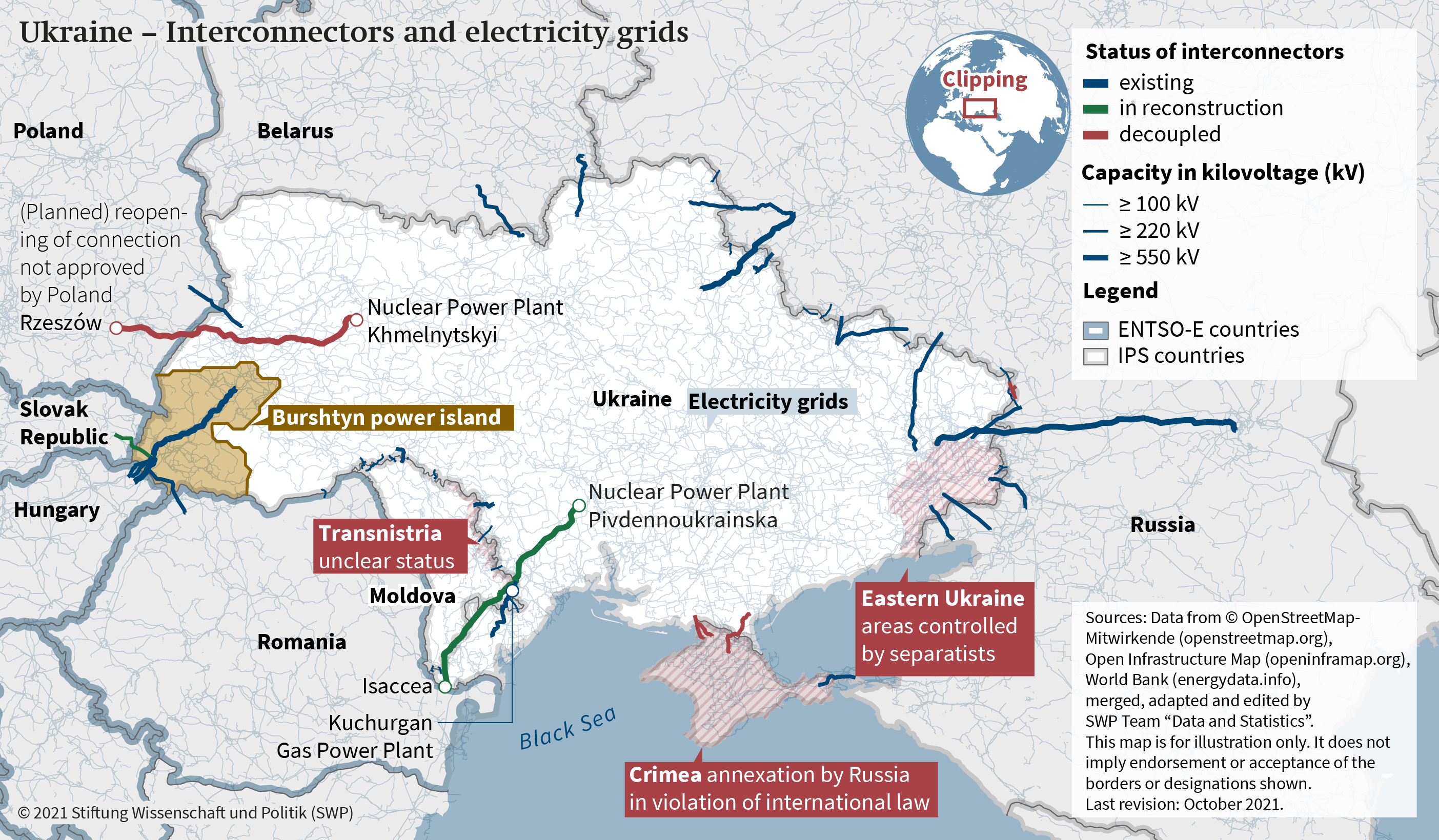

However, the TSOs of Ukraine’s immediate neighbours Slovakia, Hungary, Poland and Romania have a special role to play, as they will either have to make adjustments within their grids and/or will feel the effects directly in the flow of electricity. Burshtyn Island power plant in the west of Ukraine is already connected and synchronised with these countries (see Map 1, p. 6). This existing connection with ENTSO-E has given Ukraine some experience of what it means to synchronise with another grid. For synchronisation with the European grid to be successful, Ukraine will need sufficient transnational lines.

One project of the Ukrainian nuclear power plant operator Energoatom is Energomost, an energy bridge to connect the Khmelnytskyi 2 nuclear power plant with Poland via a 750 kilovolt line leading to Rzeszów. However, the Polish side objects to the Ukrainian plans. Other important lines are still under construction (to Romania) or could be extended to neighbouring countries via Burshtyn. Ukraine is also building new lines in the country itself to prepare for decoupling from Russia and Belarus.

Under ENTSO-E rules, Ukraine will have to implement a number of technical measures.

First and foremost is grid stability. One of the biggest practical challenges is the ability to balance electricity demand and supply. If there is too much or too little electricity in the grid, the system risks collapsing. If grids are linked, a blackout in Ukraine, for example, could theoretically spread to other parts of Europe. Ukraine is therefore renewing its transmission grid and its control system. In the long term, more decentralised systems can also provide a higher level of electricity security. But the transmission system will remain essential because Ukraine has sizeable cities, high industrial density and many large power stations.

For all the improvements Ukraine has already achieved on its own, the country would benefit greatly from international support. Germany in particular has experience with connecting new grids (such as the former East and West Germany, but also its eastern neighbours) and with integrating high shares of volatile wind and solar power into an electricity system dominated by old coal and nuclear power plants.

Theoretically, Ukraine could also be connected to the continental European grid via back-to-back connection using high-voltage direct current (B2B). This would allow electricity to flow across borders without the need for synchronisation. It would also significantly reduce the risk of problems in the Ukrainian power grid causing outages in Central Europe. Back-to-back coupling is also easier to manage. However, any future expansion of cross-border capacity would again require large investments in B2B connections, which are expensive. B2B is therefore unlikely to improve grid stability in Ukraine. Finally, it would be a minimalist solution and thus send a weak signal with regard to closer relations between Ukraine and the EU.

Regulations and Markets

The Ukrainian electricity market is not yet in a position to interact with the European market. The first obstacle to this is pricing and market monopolies. Ukraine’s electricity market is highly regulated: prices are capped. Network operators are also obliged to supply public institutions and private households with electricity. The costs associated with the concession are borne by the operators of the state electricity market, electricity grid and power plants. Yet individual oligarchs dominate the market. As a result, a few private companies prevent competition and make high profits. Public companies, on the other hand, are running up debts. In addition to the general risk premium on capital costs in Ukraine, fixed prices and market concentration make investment in new energy sources difficult. The tariffs of the state-owned Ukrainian grid operator Ukrenergo for the transmission of electricity are also too low; only government guarantees are saving Ukrenergo from bankruptcy. This, in turn, makes it difficult to renew power lines and transformer stations.

Second, there is a lack of institutions and legal framework. In part due to legal uncertainty, the Ukrainian electricity sector is not yet equipped for automatic, short-term, cross-border electricity trading (“market coupling”), as is being introduced in the EU to make optimal use of the existing systems. There is a lack of basic requirements, such as a trustworthy market operator, but above all, of institutional stability and legal certainty. The benefits of integration cannot be fully exploited if physical coupling is used for bilaterally negotiated supplies only. Moreover, supplies from Ukraine, which are not organised via a transparent market, could severely strain the liquidity and resilience of the comparatively small electricity markets in East-Central Europe. However, in cooperation with EU partners such as EEX or Nordpool, efforts could also be made to establish a marketplace. The necessary regulatory steps are being accompanied by the Energy Community and the EU Commission’s Ukraine Support Group in any case.

Ukraine also needs either its own carbon pricing system that can be linked to the EU ETS in the medium term, or at least a system of green certificates accepted in the EU. To ensure that truly carbon-neutral energy arrives in Germany, guarantees of origin and a monitoring, reporting and verification mechanism must be introduced.

The Ukrainian investment climate, which is characterised by uncertainty, will only benefit from a connection to continental Europe if foreign actors can operate in the country safely and with legal protection. This requires clear, fair and long-term rules that are consistently enforced. The EU can help remedy the lack of self-commitment in Ukraine’s energy policy by making certain (financial and regulatory) concessions conditional on Ukraine’s compliance with agreed electricity market rules.

(Geo)Political Hurdles

The list of challenges in terms of technical operation and legal regulation is rather long. Both sides must also assess and evaluate the implications of a technical connection of Ukraine to the European continental grid. This is because a synchronous connection would have non-negligible repercussions on the neighbouring states and thus also on the security of supply and the general security situation in the EU.

Disconnecting Ukraine from the IPS/UPS necessarily forces Russia and Belarus to take technical operational adjustment measures, which would incur financial costs. Moreover, synchronous connection to the ENTSO-E continental grid expands the EU’s sphere of influence and reduces that of Russia. In the recent dispute over gas supplies with Moldova, Moscow has clearly signalled that efforts to achieve greater integration with Europe could result in Russian countermeasures. This will make it necessary to pay attention to such repercussions.

Ukraine would be called upon to contain conflict potential at least through early technical coordination, namely by discussing the implications with its neighbouring countries and ideally negotiating a roadmap for parallel decoupling. Given the difficult and complex geopolitical situation that has arisen following the annexation of Crimea and the military destabilisation of eastern Ukraine, such a cooperative approach by Ukraine seems highly unrealistic. On the other hand, all parties should be interested in coordinating the decoupling so as not to trigger a new energy dispute.

An intensification of the conflict would become problematic for Ukraine, especially in winter. The country’s electricity and heat production is as dependent on Russian nuclear fuel rods as it is on regularly supplied coal and gas from Russia (see Map 1).

A particularly precarious situation had emerged by mid-November 2021. Low coal and gas storage levels could allow Russia to put Ukraine’s energy security to a serious test by supplying only small amounts of gas. This has already led to discussions in Ukraine about resuming electricity imports from Belarus.

In addition to these current and immediate energy security issues, there are hard security issues. In recent years, Ukraine has repeatedly been subjected to hybrid attacks on parts of its power grid. It is difficult to attribute the cyber attacks to a state perpetrator, but it can be assumed that Russian hackers have the appropriate skills and that Russia has detailed knowledge of the functioning of the Ukrainian power grid.

The same applies to Moldova. Here, the Kuchurgan gas-fired power plant in Transnistria was the subject of a dispute with Moscow. This large plant generates 80 percent of Moldova’s electricity needs. If it failed, or if the Ukrainian nuclear power plant in Zaporizhzhya with its total capacity of six gigawatts failed, stable base load would be lost, with a high potential for contagion throughout the entire synchronous network.

The fact that geopolitics and energy networks are part of the Kremlin’s strategic toolbox was illustrated by how swiftly electricity was supplied to Crimea after the annexation, using new power lines across the Kerch Bridge. The occupied territories in eastern Ukraine are likewise a de facto part of the Russian power grid and have already been disconnected from the Ukrainian grid.

Scope and Consequences

In return for the US restraint in not imposing sanctions on Nord Stream 2, Germany has expressed its willingness to Washington to support Ukraine. The US and Ukraine referred to Ukraine’s integration into the European network in their Charter on Strategic Partnership. The EU also considers it a priority.

While ENTSO-E will have to address the remaining technical operational challenges, because of their political implications they should not be left to a technical body alone. Synchronous electricity grids are “communities of solidarity and fate” in which all parties share benefits and risks. This requires a high degree of trust in both reliable technical operation and largely stable and dependable cooperation in the future. This is because electricity grids are managed at three levels: a) at the level of technical operation and infrastructure, b) at the level of political regulation, and c) at the trading and market level.

Unlike the Baltic States, with which a synchronisation process is also underway, Ukraine and Moldova are not members of the EU, nor will they become so in the foreseeable future. Owing to the EU’s strong and well-defined institutions, all EU member states have mostly equal control over the electricity system. As non-EU members, Ukraine and Moldova will be largely excluded from this.

However, in the case of synchronisation of the Ukrainian grid with the continental grid, the country would also need to be more involved at the non-technical governance levels. Electricity market integration means not only physical interconnectivity, but also interconnected trading. The regulatory framework underlying synchronisation does take into account the interoperability of systems and cross-border lines, as well as their technical integrity and security. Beyond this technical operational level, however, there are clear gradations between the EU and its neighbours in terms of interconnection and trade contacts, regulation and power projection. The Energy Community has been the instrument to advance physical and market integration. But the common body of law as well as network codes (i.e. the rules for network operation) have become increasingly sophisticated. As a result, the obstacles to integration are also getting higher. For the electricity system to be technically and operatively functional, the motto is “Rules before Joules”: first implement the rules, then put the power lines into operation. This also applies to the integration of the markets.

Conclusions

With the joint German-US declaration, Berlin has assumed a key role in connecting Ukraine. Because of the scope of this project, however, the new German government will have to act in consultation with Brussels and the other member states, and work towards a consensus.

Theoretically, there are three options for action for Berlin, Brussels and Kyiv:

-

Merely let the technical process run its course. If there is no clear political leadership, most likely the process will not be concluded, even if none of the parties openly opposes synchronisation. This would put Ukraine in a difficult position with regard to green energy investments. Not only would it contradict the German-American declaration, but it would also bring the EU no closer to its geopolitical goal of making the continent climate neutral.

-

Restrict the connection to a direct current close coupling (B2B). This would leave Ukraine in “quasi-island” mode and would probably also involve higher costs in the long term.

-

Define a clear roadmap that encompasses support for the technical and political processes. It would specify which rules apply, which power lines should be built and which investments should be made. In this way, technical risks could be managed and political costs calculated. This would be a prerequisite for a sustainable solution.

The EU has to make political decisions about the reforms that Ukraine should implement, in terms of regulation as well as trading and markets. Berlin will have to moderate and prepare the decision-making process. Depending on how the process is implemented, Ukraine will either create confidence that it wants to join the EU in the long term or expectations of future upheavals and disintegration tendencies (e.g. in the event of a change of government in Ukraine). In any case, synchronisation cannot simply be reversed.

Two controversial issues need to be kept in mind here. The EU’s carbon border adjustment mechanism will constrain free trade of electricity and increase the price of electricity imports. There is also the threat of tensions with Belarus and Russia. In the worst-case scenario, the competition over electricity integration could lead to a confrontation between electricity blocs. This is why Germany should act as a mediator between Russia and Ukraine.

The following points will require a political decision:

First, whether the connection is to be realised only via B2B or whether the EU wants to implement real synchronisation via alternating current (AC) lines.

Second, when – in 2023, 2026 or later – coupling or synchronisation should take place. A gradual sequencing in different phases could also be considered.

Third, which grid connections specifically are to be put into operation. For example, Ukraine’s neighbours might agree in principle to synchronisation but might not want a direct/powerful electricity connection to their national grids.

Fourth, the role of the existing and future electricity mix for cross-border trade with the EU. Currently, nuclear and coal-derived power dominate but Ukraine has great potential for renewable energy.

In each case, unequivocal decisions are needed to establish a transparent political process. A clear sequence would make it possible to identify milestones in the process (in terms of time and quality), for checking whether conditions have been met.

If synchronisation is poorly prepared technically, economically and politically, and if no-one takes political responsibility, this could lead to nasty surprises for both sides.

Lukas Feldhaus is an analyst in the “Low Carbon Ukraine” project, Berlin Economics. Dr Kirsten Westphal is Senior Associate in the Global Issues Research Division at SWP. Dr Georg Zachmann is Senior Fellow at Bruegel, Brussels.

© Stiftung Wissenschaft und Politik, 2021

All rights reserved

This Comment reflects the authors’ views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

doi: 10.18449/2021C57

Translation by Tom Genrich

(English version of SWP‑Aktuell 72/2021)