One of the most serious economic and social consequences of the pandemic is the higher public debt of the Eurozone countries. The massive interventions of the Eurosystem have lowered borrowing costs to record lows. For some time to come, the sustainability of the public finances of the most indebted Eurozone countries will depend on expansionary monetary policy. However, this approach raises questions. It is uncertain how long monetary policy can support the debt market of the EU-19, whether there are effective alternatives, and what impacts the high debt levels and the interventions of the European Central Bank (ECB) will have on the foundations of the Eurozone.

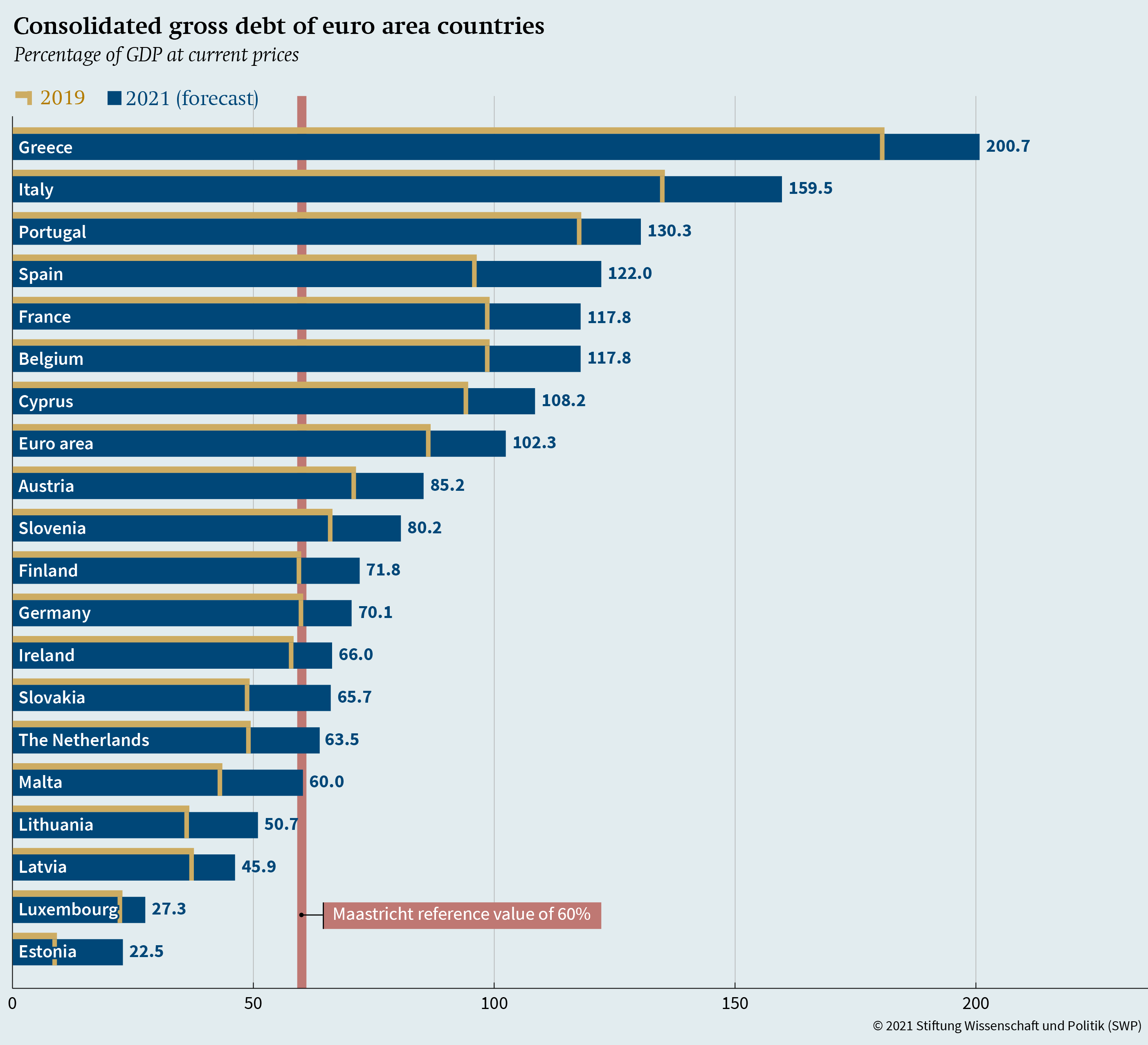

The Corona pandemic has hit Europe hard. In many states, public life was – and in some places continues to be – almost completely shut down. Businesses have had to close and curfews have been imposed. Consequently, the Corona crisis has also been a major shock to the European economy. The member states of the Eurozone had no choice but to massively counteract the collapse of some economies. With liquidity assistance, they have been trying to support the population groups and economic sectors most affected by the crisis. To make these state interventions possible, the European Commission activated the general escape clause of the Stability and Growth Pact. These support measures were necessary and continue to be so. Without them, unemployment in the Eurozone would have increased even more and many companies would have had to fear insolvency. All this would have had devastating social consequences, especially for the poorest. At the same time, the states would face a financing problem because the number of employees subject to social security contributions, and thus tax revenues, would fall and social spending would increase. In addition, there would be higher expenditures on health care. However, the states can, at best, try to mitigate the consequences of the crisis, but they cannot prevent an economic collapse as European economies have experienced the largest recessions in decades. Those euro area countries still struggling with the aftermath of the euro crisis, including high public debt levels, are at the same time particularly affected by the pandemic, as the vital tourism sector in southern Europe has largely come to a standstill. Falling economic growth, combined with higher government spending levels, has caused government debt to rise. According to European Commission forecasts, in 2021 the debt ratio in France will rise to around 118 per cent of gross domestic product (GDP) – compared to 98 per cent in 2019 – and in Italy even to 160 per cent. For Spain, the Eurozone country most affected by the Corona crisis, an increase of 26 percentage points to 122 per cent of GDP has been predicted. In Greece, the debt level will reach the 200 per cent mark. There, public finances are also under pressure from military spending. Not even Germany still meets the Maastricht criterion of 60 per cent of GDP, as its debt ratio is now 70.1 per cent (see Figure 1).

The negative fiscal impacts of the pandemic will be exacerbated in 2021 by the need to maintain restrictions on the economy, at least until the second quarter. On the other hand, the cost of servicing public debt in euro area countries is still at near record lows. The reasons for this are the interventions of the Eurosystem, which consists of the ECB and the 19 national central banks of the Eurozone. For this purpose, a special purchase programme was launched, mainly for government bonds (the pandemic emergency purchase programme, PEPP). Can rising government debt nevertheless become a pressing problem for the Eurozone?

Growing Public Debt and the Stability of the Eurozone

Already since the 1970s, public debt has been growing in the developed European economies. The introduction of the euro helped to lower interest rates on government bonds and put government debt on a sustainable path. However, the global financial crisis and the euro crisis caused the debt-to-GDP ratio to rise again significantly in most euro area countries. Now the current pandemic has caused debt to reach record levels. This raises questions about debt sustainability and the stability of the euro area. However, the view on government debt is also changing. Unlike in the previous Eurozone crisis, no actors can be blamed today for the excessive debt due to their misconduct. Rather, the increased public debt resulting from the Corona pandemic serves to mitigate its enormous negative economic and social impacts and to enable a quicker return to economic growth.

The question for the post-Corona period is whether the rapid growth of public debt will be a challenge for recovering economies. Previously, it was said that with debt ratios above 90 per cent of GDP, rising government debt would have particularly negative consequences for future economic growth, as private investment would be crowded out and public finances burdened by debt-servicing costs. Many Eurozone members, including Greece, Italy, France, Spain, and Portugal, have far exceeded this level. However, as debt-servicing costs are currently low, the problematic consequences of debt for public finances are also rather limited at the moment, as the pressure to cut other investment-enhancing government spending is weak.

To assess the risk of excessive public debt, it is not enough to calculate only the debt-to-GDP ratio. The main consideration should be whether the economy will be able to service higher levels of debt in the future, for example thanks to higher growth rates. What is important is whether its economic model is flexible enough to adapt to new challenges such as digitalisation and green transformation. Future debt sustainability also depends on the balance sheet of the public sector. This includes assets such as shares in state-controlled enterprises and financial assets, but also (especially long-term) liabilities. It should be noted that the negative consequences of the Corona crisis for public finances will only become apparent later. In many countries, they will manifest themselves, for example, in poorer demographic development, including sharp declines in birth rates. This may cause implicit debt to rise, for example costs for health care, social care, and the pension system. Unfavourable in this context are the prospects of highly indebted euro area countries such as Italy, Portugal, and Greece. There, the old-age dependency ratio – that is, the ratio of the over-65s to the 20 to 64‑year-olds – is rising in a worrying way.

The higher the public debt levels, the more sensitive public finances are to the increased servicing of their costs. In the event of a downturn, fiscal policy-makers would be faced with a dilemma between stabilising the business cycle and debt sustainability. Finally, if the government is no longer able to meet some or all of its debt obligations on time, it risks losing access to financial markets. Currently, the entire debt sustainability of the over-indebted Eurozone countries is based solely on the expansionary monetary policy of the Eurosystem.

ECB to the Rescue: Risks and Alternatives

With the announcement of the €1,850 billion PEPP, the ECB has implicitly committed itself to keeping government bond interest rates low. So far, the ECB’s strategy has been successful, as member states can currently finance their debt at record low levels. Even the recent political crisis in Italy has not led to an increased premium on Italian government bonds. The crucial question is how long the ECB can continue to stabilise the Eurozone debt market. The ECB’s Governing Council has announced that the purchase of government bonds will last until at least March 2022, when the Covid-19 crisis phase is over and the capital payments due from government bonds will be reinvested by the end of 2023. However, it is hard to imagine that the asset purchases will be stopped in the final phase of the presidential elections in France in 2022. Moreover, the economic consequences of the pandemic, such as higher debt and unemployment levels, will require monetary and fiscal policy support for much longer.

Inflation is the key factor in determining whether the ECB can support the Eurozone debt market for a longer period. As long as inflation remains well below the ECB’s target (below but close to 2 per cent), it can justify its accommodative monetary policy. Otherwise, it would have to choose between the monetary policy target and the stability of the monetary union. Currently, inflation in the euro area is at a low level. It is true that the five-year inflation swaps – an indicator of inflation expectations – have risen steadily in recent months. But whether inflation will really grow significantly and come close to the ECB target is disputed among economists.

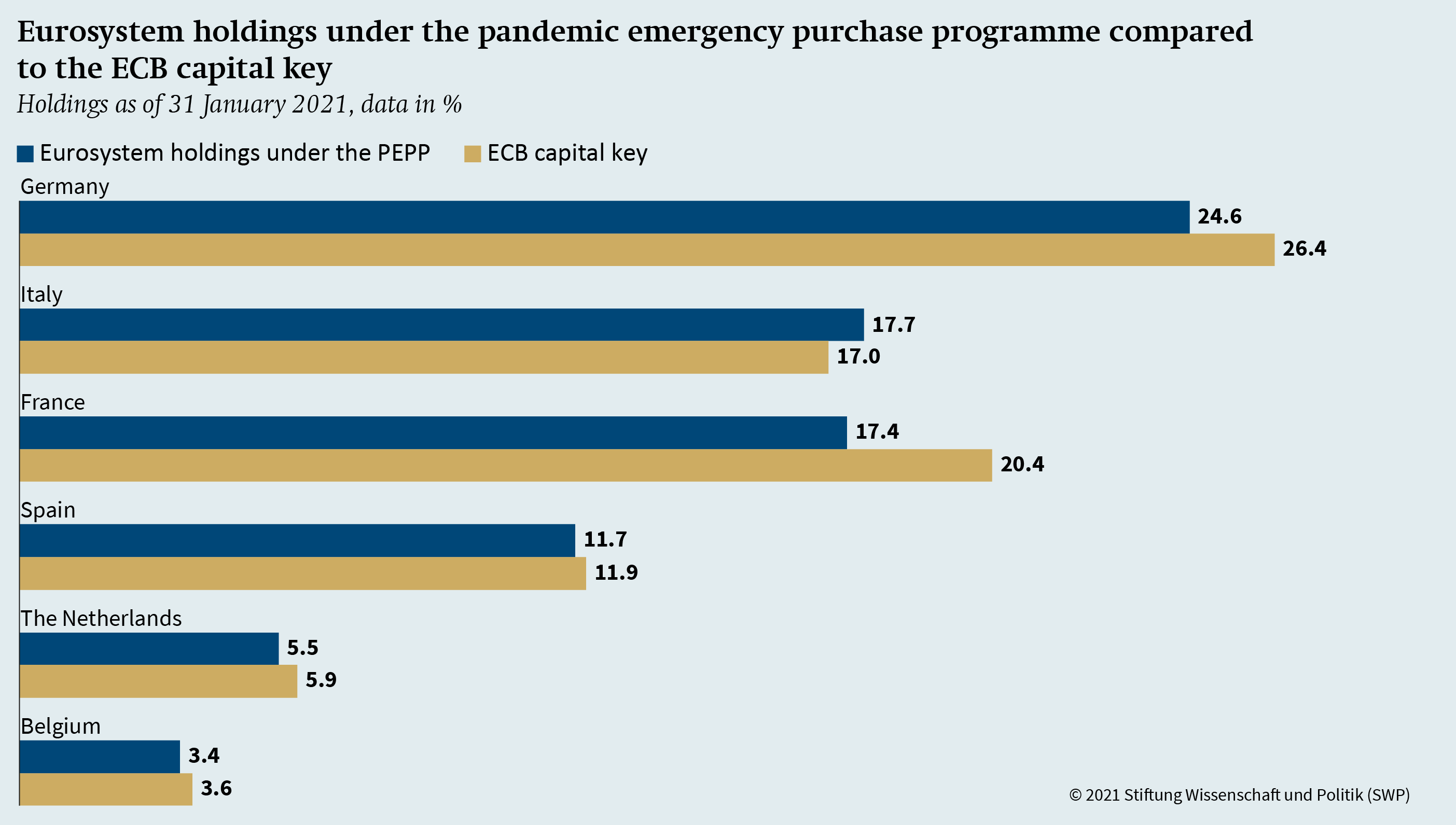

Another kind of challenge is the situation in the US market. The recent plans of the US government for a massive fiscal stimulus package caused the interest rates of US bonds to skyrocket. As a result, European bond rates also rose. This will force the ECB to buy more expeditiously and perhaps detach the purchases from the ECB’s capital key, which it officially abandoned with the PEPP but has been trying to adhere to (see Figure 2).

Risks of the ECB’s Involvement

However, the strategy of basing Eurozone debt stabilisation on monetary policy could also entail risks for the Eurozone. One major problem is the distribution of risk in the Eurosystem. This is highly decentralised, and part of the risk is the responsibility of the participating central banks. Similar to previous public-sector asset purchase programmes, the PEPP is characterised by limited risk sharing. This covers only 20 per cent of the purchases of government bonds under the PEPP. The bulk of the risks are borne by the national central banks. The Italian central bank, for example, has to buy mostly Italian securities on the secondary market, taking on the entire risk. If a central bank holding a large quantity of national sovereign debt had to accept losses, the continued participation of this bank in the Eurosystem would be in question.

Another, more significant problem is the danger that the ECB – if it owns a significant part of a state’s debt – intervenes as an actor in national politics. This could encourage reckless behaviour by national actors due to economic disincentives (moral hazard). Even if market pressure was not a decisive factor for long-term structural reforms, it was useful in keeping governments on the reform path. Once the ECB owns a large part of a country’s public debt, the government there could not only reverse structural reforms. In an extreme case, it could loosen public fiscal policy, knowing that the ECB will intervene in the debt market to avoid a possible destabilisation of the entire Eurozone. However, a massive show of financial support for the euro debt market would again raise legal questions – for example about the limitation of purchases per issuer or about the ECB’s capital key – as the ruling of the German Federal Constitutional Court in May 2020 showed. A similar legal problem, namely the need for the ECB to specify the concrete time horizon of its intervention, would arise if the bonds purchased under the PEPP were extended indefinitely by the Eurosystem, thus constituting a kind of “perpetual debt”.

Possible Alternatives

The question is whether there could be an alternative solution to stabilise the Eurozone debt market. It is hardly likely that the GDP of the most indebted states will grow fast enough to reduce their debt levels. Even before the pandemic, growth rates in the Eurozone were modest. Another way to reduce government debt is through restructuring. Bonds of euro area members are issued under national law, and the recent reform of the collective action clauses in bond covenants has made restructuring easier. However, in the case of Italy, where domestic investors buy the bulk of government bonds, this could destabilise the financial system, as investors such as banks would be forced to accept the losses. Another option would be to take advantage of the fact that the government bonds were issued under national law. This could be changed, for example, to extend the maturities of bonds (local law advantage). However, such a move would trigger very negative reactions in the financial markets and drive up the financing costs of other highly indebted Eurozone countries.

In recent months, the suggestion has often been made, especially in France, that the ECB should go further in supporting public finances, and that all Corona-related public debt bought by the ECB should be cancelled. Even though Article 123 of the Treaty on the Functioning of the European Union does not directly prohibit monetary financing, debt cancellation by the Eurosystem would be contrary to the spirit of the Treaty. Such a precedent could make investors who buy government bonds fear that the bonds they hold will one day also be cancelled. This would inevitably lead to higher interest rates on the debt. Such a solution is also likely to encourage the tendency towards moral hazard. Instead of initiating difficult structural reforms on their own, the highly indebted countries could continue to expect the ECB to cancel their debts. Therefore, this option should, at best, be considered as a last resort for possible extreme cases, for instance if the current pandemic proves to be permanent. This would require a profound restructuring of the sectors affected by the pandemic and would cause debt to rise dramatically once again.

Another proposal is to involve the European Stability Mechanism (ESM) in debt stabilisation. This instrument could take over the portion of the bonds bought by the Eurosystem, and thus enable an exit from expansionary monetary policy. However, such a solution would contradict the current model of ESM operations, which consists of granting financial aid to certain member states only under strict conditions. If the ESM is to be involved in debt stabilisation, the ESM Treaty, which lies outside the EU legal system, would have to be amended. Such a solution would have to be agreed by all members and ratified by all national parliaments. In order for this instrument to play a more important role in stabilising the debt market, it would first and foremost have to be removed from the direct control of the member states and made into an EU institution. At present, this is difficult to imagine.

Monetary and Fiscal Policy As the Core of the Stabilisation Strategy

The euro area will have to deal with high levels of debt among its member states for a long time. Current projected levels are likely to rise further in many of the EU-19 countries as the pandemic continues and vaccination progresses more slowly than expected. It is not only higher levels of spending and lower revenue streams that will put more pressure on public finances. The need for public support for the banking sector, among others, may also contribute to the increase in debt. The banking sector is likely to be hit hard by the pandemic because of problems in the real economy. The extent of such difficulties will be revealed by the stress test coordinated by the European Banking Authority. The results of the test are expected at the end of July 2021.

Currently, there is no effective alternative to debt stabilisation through monetary policy, which allows member states to focus on fighting the pandemic. Under current conditions, it is crucial to continue active fiscal policy at least until 2023 to support the post-pandemic recovery. It is also important that Germany maintains an active fiscal policy for as long as possible. A quick return of the largest economy in the Eurozone to normal growth rates could help other member states.

It is also essential to limit the use of monetary policy in the debt market as much as possible so as to encourage responsible economic policy-making of the member states. It is important to use public resources effectively to combat the effects of the pandemic in order to maintain labour force participation and create a broader basis for economic growth through productive investment. Above all, investments should be made in human resources, especially digital skills. Only faster economic growth offers the chance for stabilisation, and possibly debt reduction. Spending efficiency is important, especially in the case of the reconstruction fund. It is the net contributors who assess it. If the countries most affected by the pandemic fail to use EU funds effectively for growth-enhancing stimulus and structural reforms, they will face the same problems after the pandemic, but with much higher public debt levels. Particular attention should be paid to how Italy uses the reconstruction fund. The new government under former ECB chief Mario Draghi offers a good chance that these funds will be planned and used effectively. On the other hand, Italy’s medium-term political outlook is a cause for concern, especially as a right-wing populist coalition is expected in the next elections. All this is likely to have a negative impact on the country’s fiscal stability. It is also likely to dampen the willingness of other euro area countries to engage in further fiscal integration.

In terms of debt management, governments of the most indebted euro area countries should make the most of the current low interest rate environment to issue debt with the longest possible maturities. This would help ensure the sustainability of public finances in the face of short-term fluctuations in financial markets.

Prospects: Foundations of the Eurozone under Pressure

The stabilisation of public debt will be one of the most pressing issues on the euro area agenda in the coming years. It will influence two important debates on the foundations of the monetary union: the design of the current fiscal policy framework and the review of the ECB’s monetary policy strategy.

Rising debt levels challenge existing fiscal rules. In most of the cases, public debt levels will be far higher than the Maastricht reference value of 60 per cent of GDP. Therefore, it is in doubt whether this framework is tenable. Examples are the rule adopted in 2011, which requires an annual reduction of the debt ratio by one-twentieth of the difference between the actual debt ratio and the 60 per cent threshold, or the limitation of the budget deficit to 3 per cent. Although there is undoubtedly a need to make the fiscal rules in the Eurozone more realistic, it does not seem to be a good idea to start this discussion now. Due to the unfavourable political situation (elections will take place in Germany in 2021, in France in 2022) and very different positions, it would hardly lead to a constructive solution.

It would be best to extend the currently valid general escape clause of the Stability and Growth Pact at least until the end of 2022. However, sooner or later, Germany will also have to face a discussion on reforming the fiscal rules. In addition to the long-proposed simplification, the rules will have to be based less on specific benchmarks and be tailored more to the situations of specific economies, their business cycles, and their systemic importance for the stability of the euro area. However, this “individualisation” of fiscal rules risks further politicising them. The high level of debt and the need to relieve the Eurosystem of the task of stabilising it will necessitate a partial post-Corona debt mutualisation. The Eurozone – in its current form as a fiscally decentralised monetary union – is vulnerable to debt crises in its most indebted member countries. Such crises can quickly trigger a domino effect throughout the Eurozone. Before any joint issuance, however, plans for the post-Corona period must be accompanied by discussions on how sustainable the economic models of the southern euro countries are, and what conditions should apply to reforms.

Rising government debt will also largely determine the current debate on the ECB’s monetary policy strategy. The main elements of this strategy – such as the definition of the inflation target, the way inflation is measured, and the monetary policy horizon – will also have a major impact on the Eurosystem’s ability to stabilise debt. It would be beneficial if monetary policy were given more flexibility in supporting economic policy, as is the case worldwide today. Monetary policy alone, however, will not be able to permanently stabilise the euro area as long as the most glaring structural deficits persist in the largest euro area countries. In the short term, the ECB faces the challenge of stabilising interest rates on the sovereign debt of Eurozone members. Indeed, after the announcement of the US fiscal stimulus package, these interest rates were sharply increased due to rising US bond yields. In the longer term, the ECB will have to master an even more difficult task. It is a matter of intervening in debt stabilisation while keeping national fiscal policy from dominating supranational monetary policy.

Dr Paweł Tokarski is a Senior Associate in the EU / Europe Research Division. Alexander Wiedmann worked as an intern in the EU / Europe Research Division.

© Stiftung Wissenschaft und Politik, 2021

All rights reserved

This Comment reflects the authors’ views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

doi: 10.18449/2021C23

(English version of SWP‑Aktuell 24/2021)